Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 Additional information: ( i ) The fixed deposits will mature after one - year period. ( ii ) The following information relates to

Question Additional information:

i The fixed deposits will mature after oneyear period.

ii The following information relates to the property, plant and equipment: On February Blyss acquired mining equipment. According to the purchase

agreement, Blyss must dismantle the equipment at the end of its year useful life and

restore the mining site to its original condition. The estimated cost for dismantling and

restoration using traditional methods is RM However, a new technology has

emerged that can reduce these costs by The Blysss cost of capital is

An equipment costing RM was sold during the year for RM earning a profit

of RM This profit has been included in the administrative expenses.

iii There was an issue of shares during the year ended June partly to fund the

acquisition of the investment property during the year and the balance of the issue was

issued for cash.

iv All the acquisition of investment properties is through issue of shares. The company is

applying the fair value model under IAS MFRS Investment Property for all its

properties.

v A mining licence with a carrying value of RM was sold at a loss.

vi The allowance for receivables as at June was RM

vii The salaries paid during the year are included in the following costs:

viii Both the other receivables and other payables are related to the operating expenses. The

depreciation of property, plant and equipment is included in the administrative expenses.

Required:

Based on the information provided,

a prepare the statement of cash flows of Blyss Bhd for the year ended June based

on the indirect method.

marks

b prepare the net cash flow from operating activities for the year ended June under

the direct method.

marks

Note:

You are required to show all your workings. All figures are to be rounded to the last digit do not

show any decimal point

Total: marks

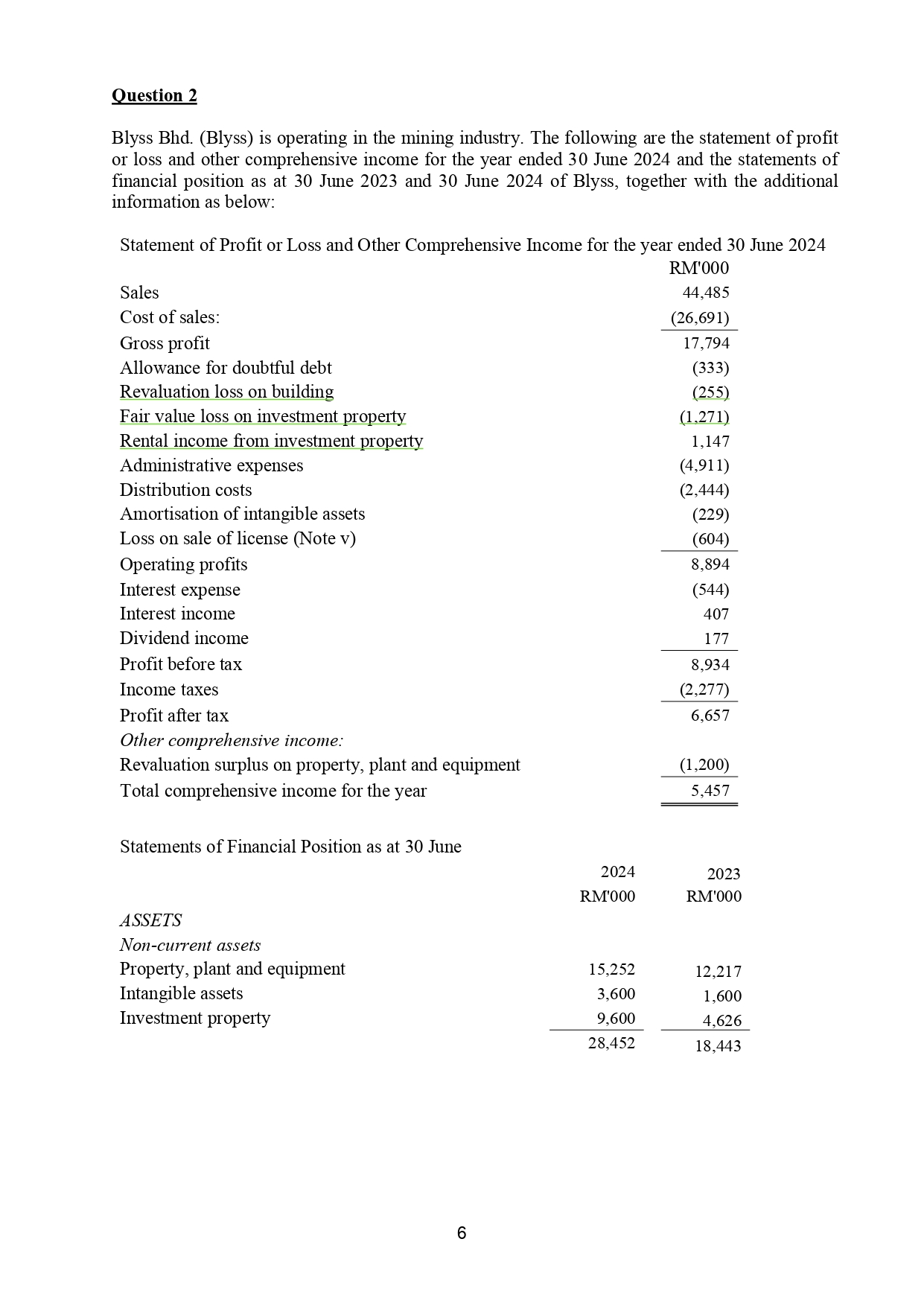

Blyss BhdBlyss is operating in the mining industry. The following are the statement of profit

or loss and other comprehensive income for the year ended June and the statements of

financial position as at June and June of Blyss together with the additional

information as below:

Statement of Profit or Loss and Other Comprehensive Income for the year ended June

Sales

Cost of sales:

Gross profit

Allowance for doubtful debt

Revaluation loss on building

Fair value loss on investment property

Rental income from investment property

Administrative expenses

Distribution costs

Amortisation of intangible assets

Loss on sale of license Note v

Operating profits

Interest expense

Interest income

Dividend income

Profit before tax

Income taxes

Profit after tax

Other comprehensive income:

Revaluation surplus on property, plant and equipment

Total comprehensive income for the year

Statements of Financial Position as at June

ASSETS

Noncurrent assets

Property, plant and equipment

Intangible assets

Investment property

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started