Answered step by step

Verified Expert Solution

Question

1 Approved Answer

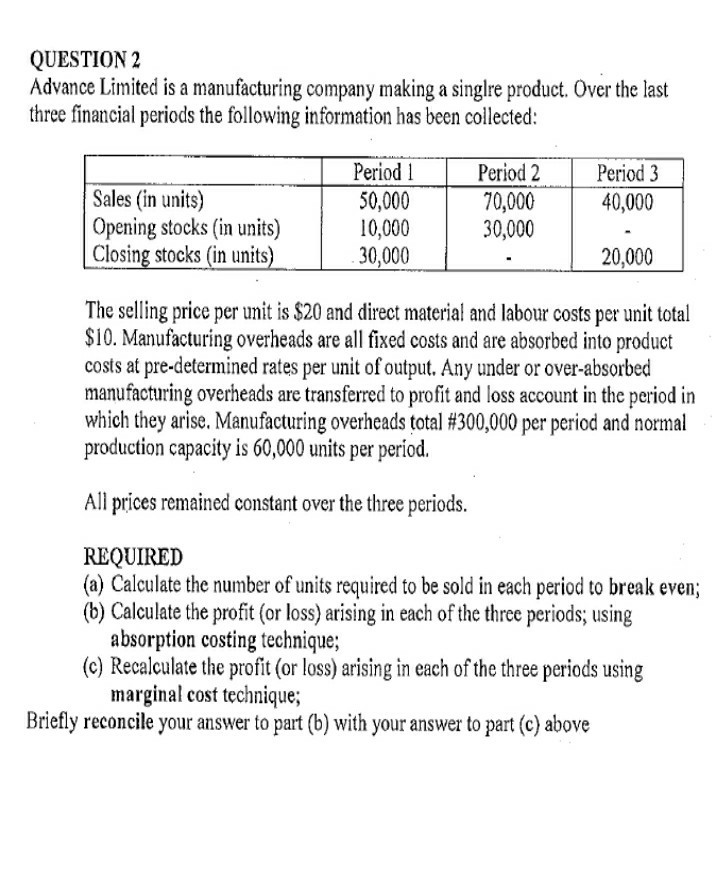

QUESTION 2 Advance Limited is a manufacturing company making a singlre product. Over the last three financial periods the following information has been collected: Period

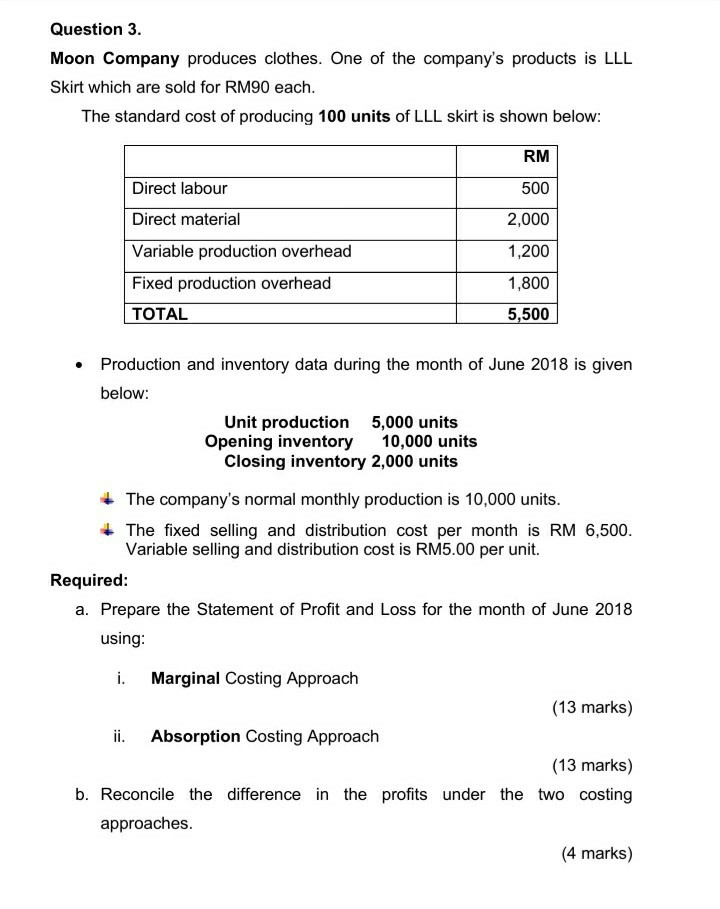

QUESTION 2 Advance Limited is a manufacturing company making a singlre product. Over the last three financial periods the following information has been collected: Period 3 40,000 Sales (in units) Opening stocks (in units) Closing stocks (in units) Period 1 50,000 10,000 30,000 Period 2 70,000 30,000 20,000 The selling price per unit is $20 and direct material and labour costs per unit total $10. Manufacturing overheads are all fixed costs and are absorbed into product costs at pre-determined rates per unit of output. Any under or over-absorbed manufacturing overheads are transferred to profit and loss account in the period in which they arise. Manufacturing overheads total #300,000 per period and normal production capacity is 60,000 units per period. All prices remained constant over the three periods. REQUIRED (a) Calculate the number of units required to be sold in each period to break even; (b) Calculate the profit (or loss) arising in each of the three periods; using absorption costing technique; (c) Recalculate the profit (or loss) arising in each of the three periods using marginal cost technique; Briefly reconcile your answer to part (b) with your answer to part (c) above Question 3. Moon Company produces clothes. One of the company's products is LLL Skirt which are sold for RM90 each. The standard cost of producing 100 units of LLL skirt is shown below: RM Direct labour Direct material Variable production overhead Fixed production overhead TOTAL 500 2,000 1,200 1,800 5,500 Production and inventory data during the month of June 2018 is given below: Unit production 5,000 units Opening inventory 10,000 units Closing inventory 2,000 units The company's normal monthly production is 10,000 units. + The fixed selling and distribution cost per month is RM 6,500. Variable selling and distribution cost is RM5.00 per unit. Required: a. Prepare the Statement of Profit and Loss for the month of June 2018 using: i. Marginal Costing Approach (13 marks) Absorption Costing Approach (13 marks) b. Reconcile the difference in the profits under the two costing approaches. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started