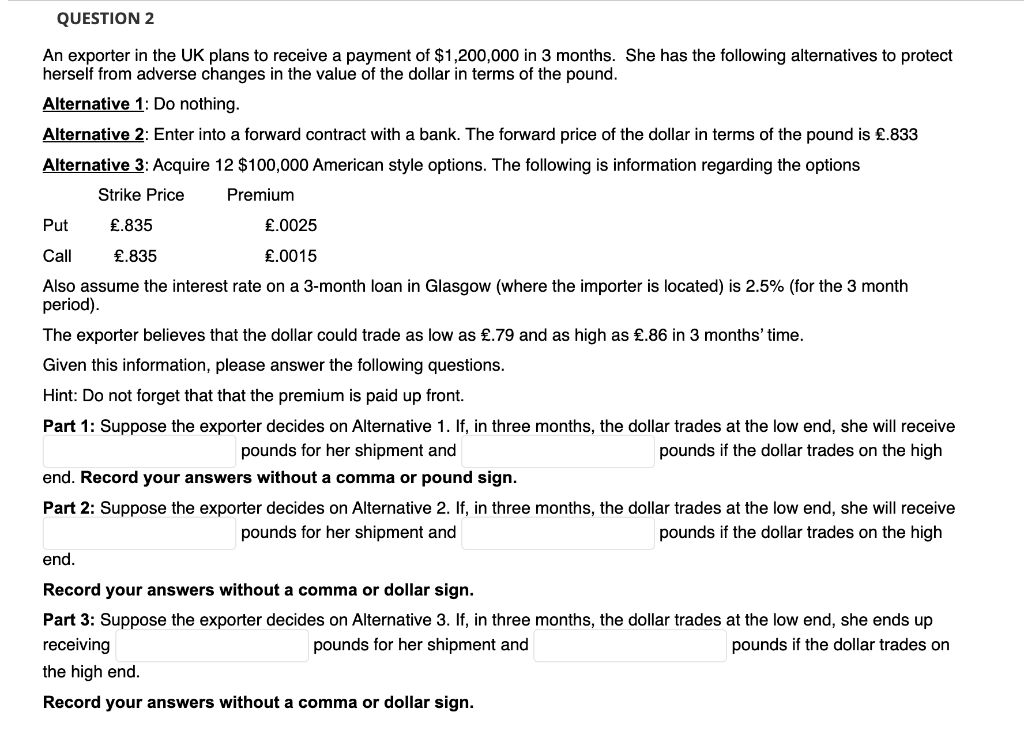

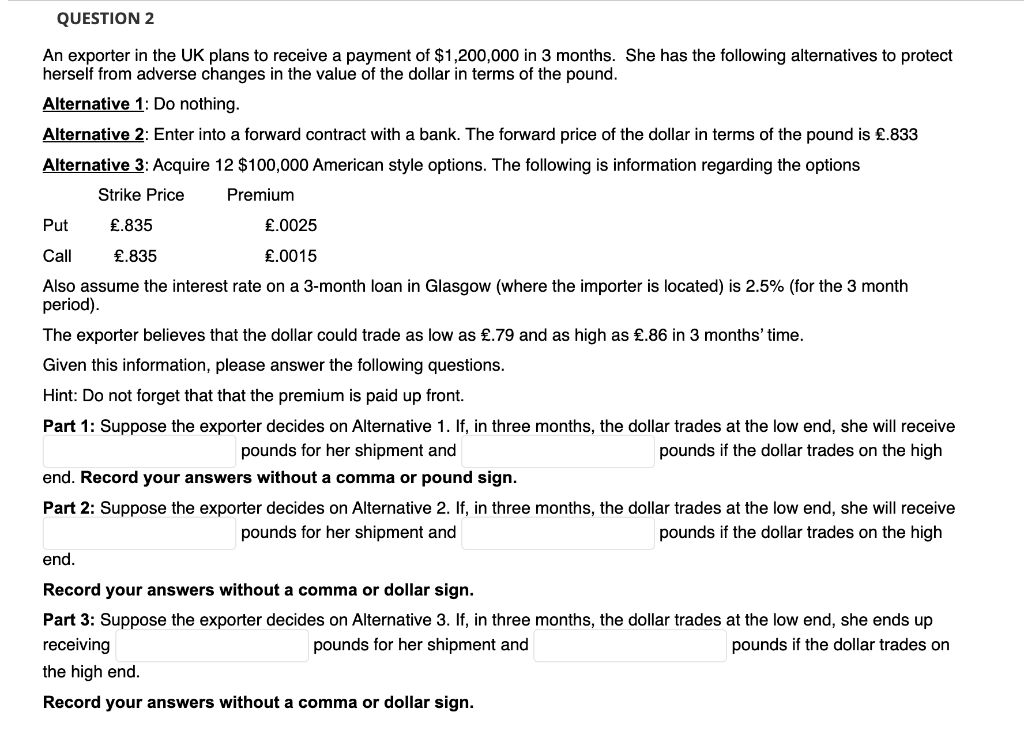

QUESTION 2 An exporter in the UK plans to receive a payment of $1,200,000 in 3 months. She has the following alternatives to protect herself from adverse changes in the value of the dollar in terms of the pound. Alternative 1: Do nothing. Alternative 2: Enter into a forward contract with a bank. The forward price of the dollar in terms of the pound is .833 Alternative 3: Acquire 12$100,000 American style options. The following is information regarding the options Also assume the interest rate on a 3-month loan in Glasgow (where the importer is located) is 2.5% (for the 3 month period). The exporter believes that the dollar could trade as low as .79 and as high as .86 in 3 months' time. Given this information, please answer the following questions. Hint: Do not forget that that the premium is paid up front. Part 1: Suppose the exporter decides on Alternative 1. If, in three months, the dollar trades at the low end, she will receive pounds for her shipment and pounds if the dollar trades on the high end. Record your answers without a comma or pound sign. Part 2: Suppose the exporter decides on Alternative 2. If, in three months, the dollar trades at the low end, she will receive pounds for her shipment and pounds if the dollar trades on the high end. Record your answers without a comma or dollar sign. Part 3: Suppose the exporter decides on Alternative 3. If, in three months, the dollar trades at the low end, she ends up receiving pounds for her shipment and pounds if the dollar trades on the high end. Record your answers without a comma or dollar sign. QUESTION 2 An exporter in the UK plans to receive a payment of $1,200,000 in 3 months. She has the following alternatives to protect herself from adverse changes in the value of the dollar in terms of the pound. Alternative 1: Do nothing. Alternative 2: Enter into a forward contract with a bank. The forward price of the dollar in terms of the pound is .833 Alternative 3: Acquire 12$100,000 American style options. The following is information regarding the options Also assume the interest rate on a 3-month loan in Glasgow (where the importer is located) is 2.5% (for the 3 month period). The exporter believes that the dollar could trade as low as .79 and as high as .86 in 3 months' time. Given this information, please answer the following questions. Hint: Do not forget that that the premium is paid up front. Part 1: Suppose the exporter decides on Alternative 1. If, in three months, the dollar trades at the low end, she will receive pounds for her shipment and pounds if the dollar trades on the high end. Record your answers without a comma or pound sign. Part 2: Suppose the exporter decides on Alternative 2. If, in three months, the dollar trades at the low end, she will receive pounds for her shipment and pounds if the dollar trades on the high end. Record your answers without a comma or dollar sign. Part 3: Suppose the exporter decides on Alternative 3. If, in three months, the dollar trades at the low end, she ends up receiving pounds for her shipment and pounds if the dollar trades on the high end. Record your answers without a comma or dollar sign