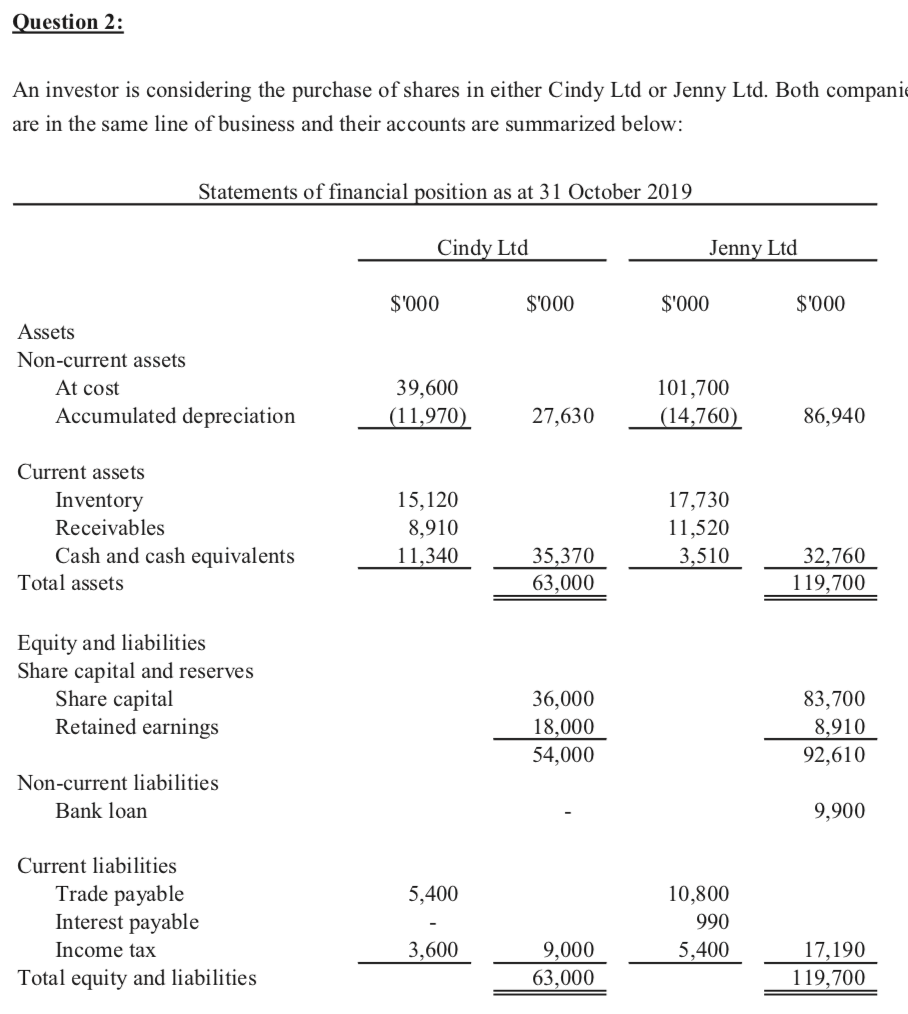

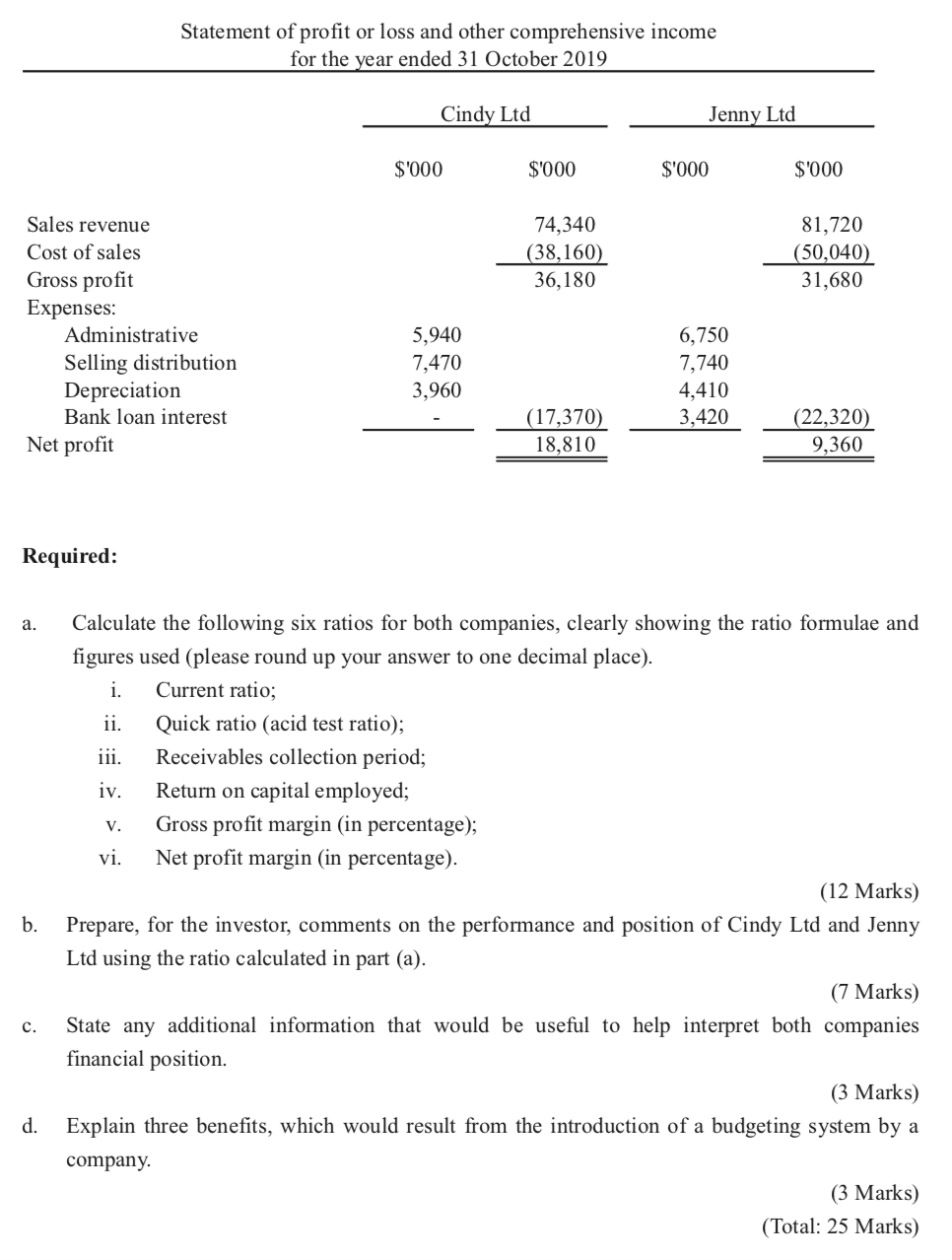

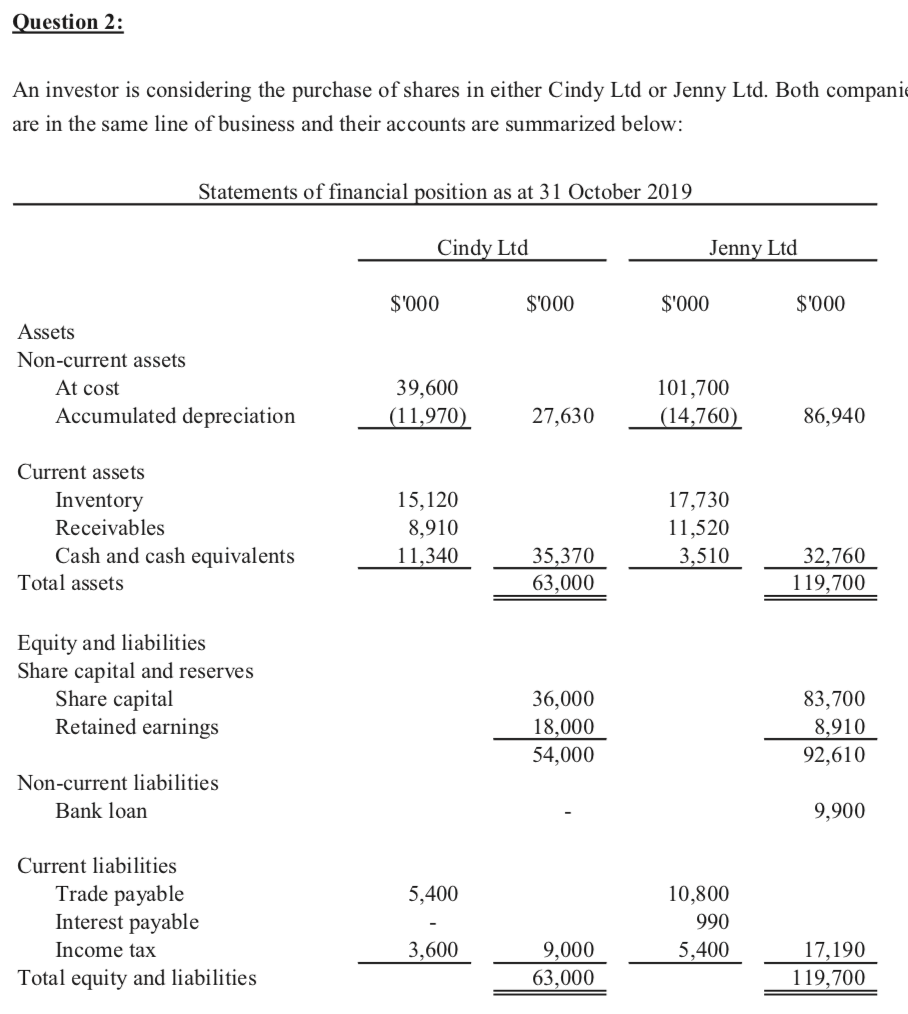

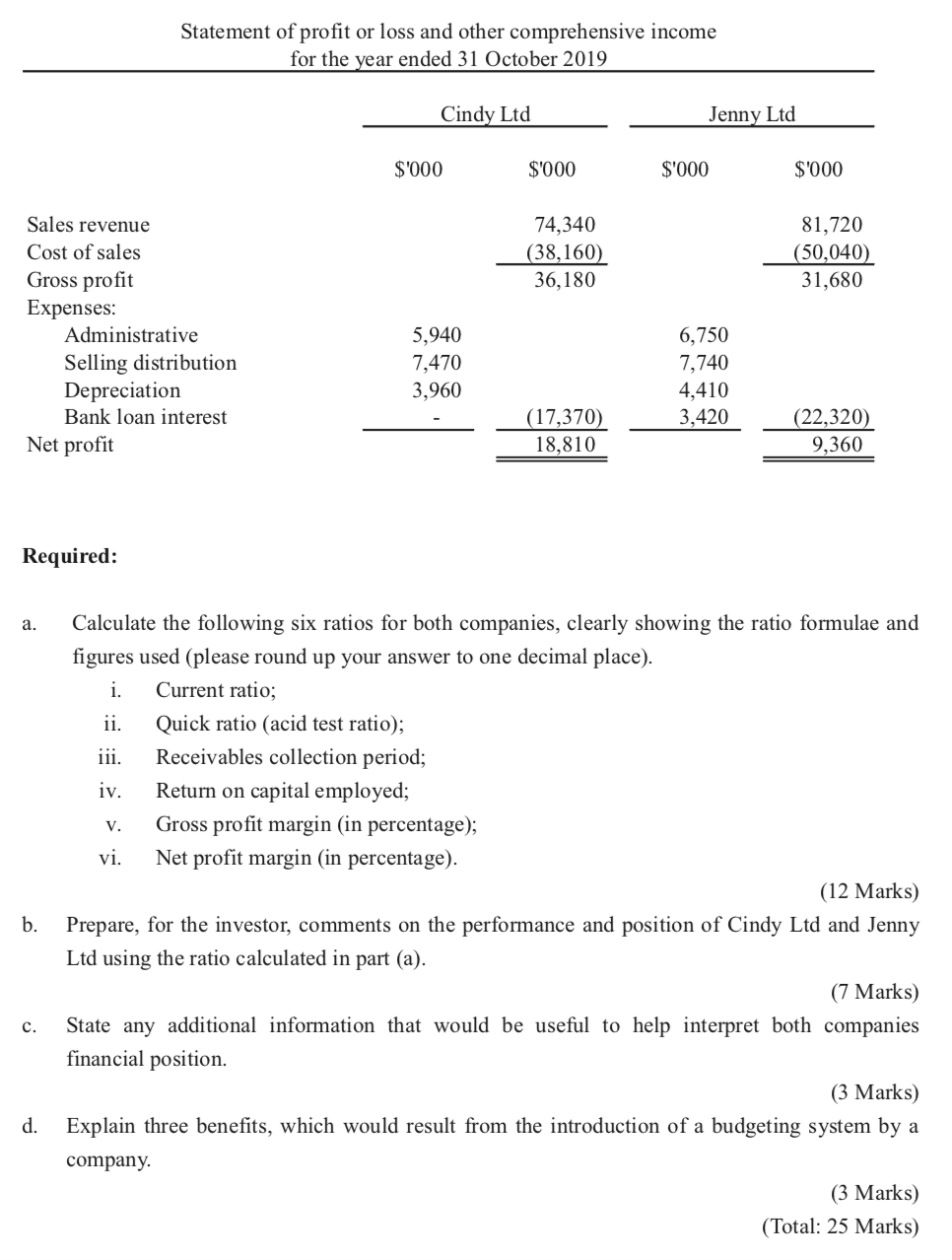

Question 2: An investor is considering the purchase of shares in either Cindy Ltd or Jenny Ltd. Both compani are in the same line of business and their accounts are summarized below: Statements of financial position as at 31 October 2019 Cindy Ltd Jenny Ltd $'000 $'000 $'000 $'000 Assets Non-current assets At cost Accumulated depreciation 39,600 (11,970) 101,700 (14,760 27,630 86,940 Current assets Inventory Receivables Cash and cash equivalents Total assets 15,120 8,910 11,340 17,730 11,520 3,510 35,370 63,000 32,760 119,700 Equity and liabilities Share capital and reserves Share capital Retained earnings 36,000 18,000 54,000 83,700 8,910 92,610 Non-current liabilities Bank loan 9,900 5,400 Current liabilities Trade payable Interest payable Income tax Total equity and liabilities 10,800 990 5,400 3,600 9,000 63,000 17,190 119,700 Statement of profit or loss and other comprehensive income for the year ended 31 October 2019 Cindy Ltd Jenny Ltd $'000 $'000 $'000 $'000 74,340 (38,160) 36,180 81,720 (50,040) 31,680 Sales revenue Cost of sales Gross profit Expenses: Administrative Selling distribution Depreciation Bank loan interest Net profit 5,940 7,470 3,960 6,750 7,740 4,410 3,420 (17,370) 18,810 (22,320) 9,360 Required: a. V. b. Calculate the following six ratios for both companies, clearly showing the ratio formulae and figures used (please round up your answer to one decimal place). i. Current ratio; ii. Quick ratio (acid test ratio); iii. Receivables collection period; iv. Return on capital employed; Gross profit margin (in percentage); vi. Net profit margin (in percentage). (12 Marks) Prepare, for the investor, comments on the performance and position of Cindy Ltd and Jenny Ltd using the ratio calculated in part (a). (7 Marks) State any additional information that would be useful to help interpret both companies financial position. (3 Marks) Explain three benefits, which would result from the introduction of a budgeting system by a company. (3 Marks) (Total: 25 Marks) c. d. Question 2: An investor is considering the purchase of shares in either Cindy Ltd or Jenny Ltd. Both compani are in the same line of business and their accounts are summarized below: Statements of financial position as at 31 October 2019 Cindy Ltd Jenny Ltd $'000 $'000 $'000 $'000 Assets Non-current assets At cost Accumulated depreciation 39,600 (11,970) 101,700 (14,760 27,630 86,940 Current assets Inventory Receivables Cash and cash equivalents Total assets 15,120 8,910 11,340 17,730 11,520 3,510 35,370 63,000 32,760 119,700 Equity and liabilities Share capital and reserves Share capital Retained earnings 36,000 18,000 54,000 83,700 8,910 92,610 Non-current liabilities Bank loan 9,900 5,400 Current liabilities Trade payable Interest payable Income tax Total equity and liabilities 10,800 990 5,400 3,600 9,000 63,000 17,190 119,700 Statement of profit or loss and other comprehensive income for the year ended 31 October 2019 Cindy Ltd Jenny Ltd $'000 $'000 $'000 $'000 74,340 (38,160) 36,180 81,720 (50,040) 31,680 Sales revenue Cost of sales Gross profit Expenses: Administrative Selling distribution Depreciation Bank loan interest Net profit 5,940 7,470 3,960 6,750 7,740 4,410 3,420 (17,370) 18,810 (22,320) 9,360 Required: a. V. b. Calculate the following six ratios for both companies, clearly showing the ratio formulae and figures used (please round up your answer to one decimal place). i. Current ratio; ii. Quick ratio (acid test ratio); iii. Receivables collection period; iv. Return on capital employed; Gross profit margin (in percentage); vi. Net profit margin (in percentage). (12 Marks) Prepare, for the investor, comments on the performance and position of Cindy Ltd and Jenny Ltd using the ratio calculated in part (a). (7 Marks) State any additional information that would be useful to help interpret both companies financial position. (3 Marks) Explain three benefits, which would result from the introduction of a budgeting system by a company. (3 Marks) (Total: 25 Marks) c. d