Question 2 and 3 in the case study

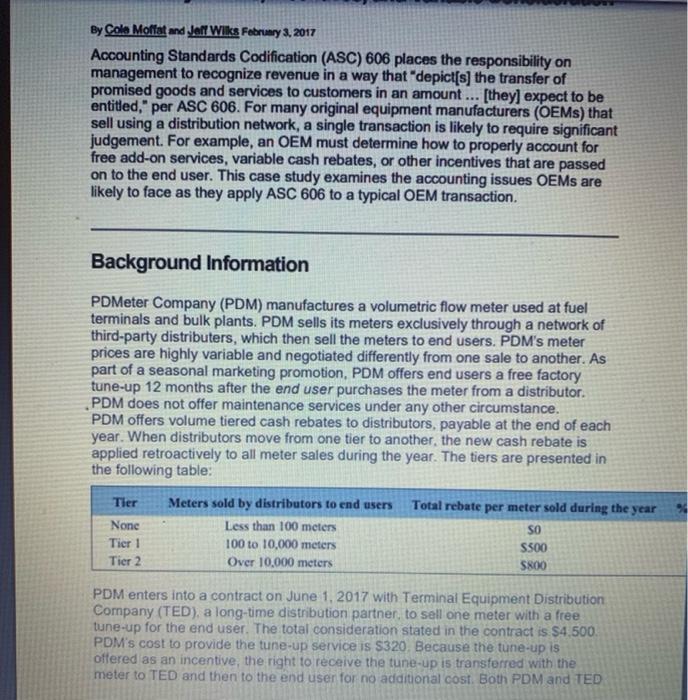

By Cole Moffat and Jell Wilks February 3, 2017 Accounting Standards Codification (ASC) 606 places the responsibility on management to recognize revenue in a way that "depict(s) the transfer of promised goods and services to customers in an amount ... [they] expect to be entitled," per ASC 606. For many original equipment manufacturers (OEMs) that sell using a distribution network, a single transaction is likely to require significant judgement. For example, an OEM must determine how to properly account for free add-on services, variable cash rebates, or other incentives that are passed on to the end user. This case study examines the accounting issues OEMs are likely to face as they apply ASC 606 to a typical OEM transaction Background Information PDMeter Company (PDM) manufactures a volumetric flow meter used at fuel terminals and bulk plants. PDM sells its meters exclusively through a network of third-party distributers, which then sell the meters to end users. PDM's meter prices are highly variable and negotiated differently from one sale to another. As part of a seasonal marketing promotion, PDM offers end users a free factory tune-up 12 months after the end user purchases the meter from a distributor. PDM does not offer maintenance services under any other circumstance. PDM offers volume tiered cash rebates to distributors, payable at the end of each year. When distributors move from one tier to another, the new cash rebate is applied retroactively to all meter sales during the year. The tiers are presented in the following table: Tier Meters sold by distributors to end users Total rebate per meter sold during the year None Less than 100 meters SO Tier 1 100 to 10,000 meters S500 Tier 2 Over 10.000 meters 5800 PDM enters into a contract on June 1, 2017 with Terminal Equipment Distribution Company (TED) a long-time distribution partner to sell one meter with a free tune-up for the end user. The total consideration stated in the contract is $4,500 PDM's cost to provide the tune-up service is $320. Because the tune-up is offered as an incentive, the right to receive the tune-up is transferred with the meter to TED and then to the end user for no additional cost. Both PDM and TED 718626/mod_resource/content/16/PDMeter%20Case.pdf view the free tune-up as an incentive for end users to purchase meters. The direct costs incurred by PDM to manufacture this meter are $1,950. TED sells the meter to an end user, Bulk Plant Owners LLP, on September 1, 2017. PDM performs the free tune-up for Bulk Plant Owners LLP 12 months later, on September 1, 2018. At the time of the initial transaction, PDM expects TED to reach Tier 1 by the end of the year. However, on November 15, 2017, TED sells its 10,001st meter for the year and is eligible for the $800 rebate on every meter sold in 2017. A summary of case facts are as follows: . . . . . Goods and services in transaction: (A) Meter and (B) tune-up for end user Transaction/Sale date to Distributor: June 1, 2017 Stated contract price: $4,500 Tune-up cost to PDM: $320 Meter cost to PDM: $1,950 Expected rebate to TED: $500 as of June 1, 2017 Actual rebate to TED: $800 as of November 15, 2017 Meter sold to end user: September 1, 2017 Tune-up Performed: September 1, 2018 . . . . Analysis 1. Apply the 5 step recognition model to the sale by PDMeter to Bulk Plant Owners; describe how you applied each step. a. Step One: Identify the Contract b. Step Two: Identify the Performance Obligations C. Step Three Determine the Transaction Price d. Step Four: Allocate the Transaction Price e. Step Five: Recognize Revenue 2. Prepare the transactions to properly account for the sale under ASC 606 using the format below. Beginning balances as of May 30 2017 have been provided 3. Provide any additional comments regarding revenue recognition for sale of the meter to Bulk Plant Owners By Cole Moffat and Jell Wilks February 3, 2017 Accounting Standards Codification (ASC) 606 places the responsibility on management to recognize revenue in a way that "depict(s) the transfer of promised goods and services to customers in an amount ... [they] expect to be entitled," per ASC 606. For many original equipment manufacturers (OEMs) that sell using a distribution network, a single transaction is likely to require significant judgement. For example, an OEM must determine how to properly account for free add-on services, variable cash rebates, or other incentives that are passed on to the end user. This case study examines the accounting issues OEMs are likely to face as they apply ASC 606 to a typical OEM transaction Background Information PDMeter Company (PDM) manufactures a volumetric flow meter used at fuel terminals and bulk plants. PDM sells its meters exclusively through a network of third-party distributers, which then sell the meters to end users. PDM's meter prices are highly variable and negotiated differently from one sale to another. As part of a seasonal marketing promotion, PDM offers end users a free factory tune-up 12 months after the end user purchases the meter from a distributor. PDM does not offer maintenance services under any other circumstance. PDM offers volume tiered cash rebates to distributors, payable at the end of each year. When distributors move from one tier to another, the new cash rebate is applied retroactively to all meter sales during the year. The tiers are presented in the following table: Tier Meters sold by distributors to end users Total rebate per meter sold during the year None Less than 100 meters SO Tier 1 100 to 10,000 meters S500 Tier 2 Over 10.000 meters 5800 PDM enters into a contract on June 1, 2017 with Terminal Equipment Distribution Company (TED) a long-time distribution partner to sell one meter with a free tune-up for the end user. The total consideration stated in the contract is $4,500 PDM's cost to provide the tune-up service is $320. Because the tune-up is offered as an incentive, the right to receive the tune-up is transferred with the meter to TED and then to the end user for no additional cost. Both PDM and TED 718626/mod_resource/content/16/PDMeter%20Case.pdf view the free tune-up as an incentive for end users to purchase meters. The direct costs incurred by PDM to manufacture this meter are $1,950. TED sells the meter to an end user, Bulk Plant Owners LLP, on September 1, 2017. PDM performs the free tune-up for Bulk Plant Owners LLP 12 months later, on September 1, 2018. At the time of the initial transaction, PDM expects TED to reach Tier 1 by the end of the year. However, on November 15, 2017, TED sells its 10,001st meter for the year and is eligible for the $800 rebate on every meter sold in 2017. A summary of case facts are as follows: . . . . . Goods and services in transaction: (A) Meter and (B) tune-up for end user Transaction/Sale date to Distributor: June 1, 2017 Stated contract price: $4,500 Tune-up cost to PDM: $320 Meter cost to PDM: $1,950 Expected rebate to TED: $500 as of June 1, 2017 Actual rebate to TED: $800 as of November 15, 2017 Meter sold to end user: September 1, 2017 Tune-up Performed: September 1, 2018 . . . . Analysis 1. Apply the 5 step recognition model to the sale by PDMeter to Bulk Plant Owners; describe how you applied each step. a. Step One: Identify the Contract b. Step Two: Identify the Performance Obligations C. Step Three Determine the Transaction Price d. Step Four: Allocate the Transaction Price e. Step Five: Recognize Revenue 2. Prepare the transactions to properly account for the sale under ASC 606 using the format below. Beginning balances as of May 30 2017 have been provided 3. Provide any additional comments regarding revenue recognition for sale of the meter to Bulk Plant Owners