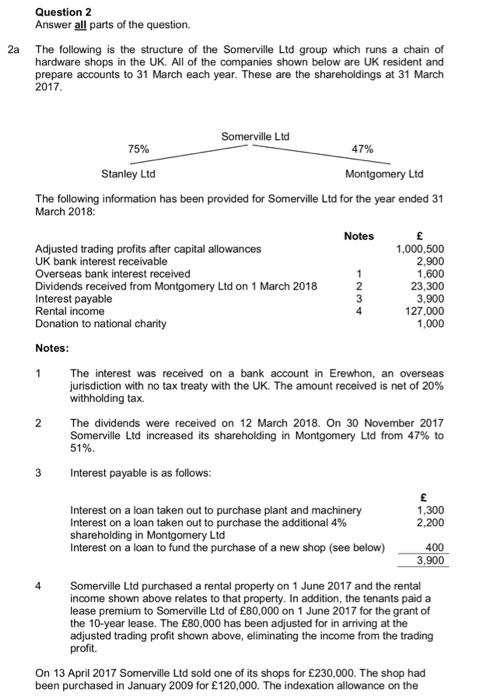

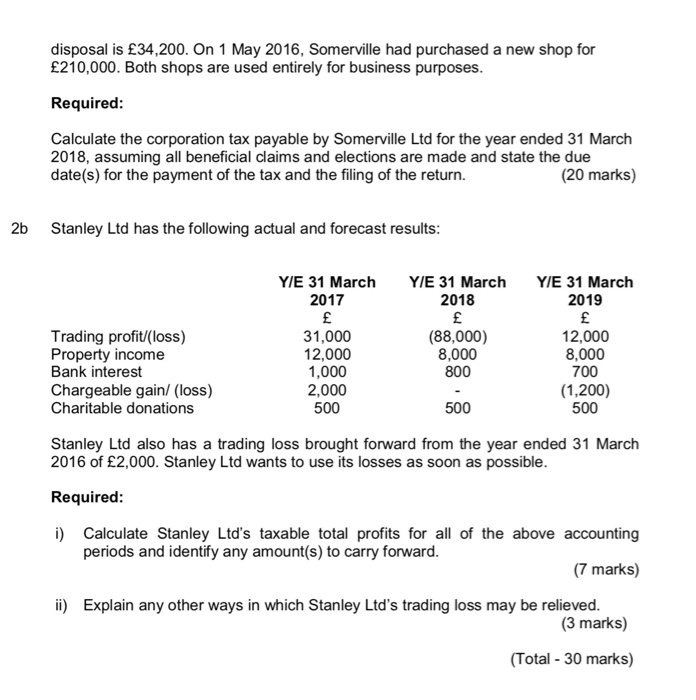

Question 2 Answer all parts of the question. 2a The following is the structure of the Somerville Ltd group which runs a chain of hardware shops in the UK. All of the companies shown below are UK resident and prepare accounts to 31 March each year. These are the shareholdings at 31 March 2017 Somerville Ltd 75% 47% Stanley Ltd Montgomery Ltd The following information has been provided for Somerville Ltd for the year ended 31 March 2018: Notes Adjusted trading profits after capital allowances UK bank interest receivable Overseas bank interest received Dividends received from Montgomery Ltd on 1 March 2018 Interest payable Rental income Donation to national charity 1,000,500 2,900 1,600 23,300 3,900 127,000 1,000 Notes: 1 The interest was received on a bank account in Erewhon, an overseas jurisdiction with no tax treaty with the UK. The amount received is net of 20% withholding tax. 2 The dividends were received on 12 March 2018. On 30 November 2017 Somerville Ltd increased its shareholding in Montgomery Ltd from 47% to 51%. 3 Interest payable is as follows: 1,300 2,200 Interest on a loan taken out to purchase plant and machinery Interest on a loan taken out to purchase the additional 4% shareholding in Montgomery Ltd Interest on a loan to fund the purchase of a new shop (see below) 400 3,900 4Somerville Ltd purchased a rental property on 1 June 2017 and the rental income shown above relates to that property. In addition, the tenants paid a lease premium to Somerville Ltd of 80,000 on 1 June 2017 for the grant of the 10-year lease. The 80,000 has been adjusted for in arriving at the adjusted trading profit shown above, eliminating the income from the trading profit. On 13 April 2017 Somerville Ltd sold one of its shops for 230,000. The shop had been purchased in January 2009 for 120,000. The indexation allowance on the disposal is 34,200. On 1 May 2016, Somerville had purchased a new shop for 210,000. Both shops are used entirely for business purposes Required Calculate the corporation tax payable by Somerville Ltd for the year ended 31 March 2018, assuming all beneficial claims and elections are made and state the due date(s) for the payment of the tax and the filing of the return. (20 marks) 2b Stanley Ltd has the following actual and forecast results YIE 31 March 2017 YIE 31 March 2018 YIE 31 March 2019 12,000 8,000 700 (1,200) 500 Trading profit/(loss) Property income Bank interest Chargeable gain/ (loss) Charitable donations 31,000 12,000 1,000 2,000 500 (88,000) 8,000 800 500 Stanley Ltd also has a trading loss brought forward from the year ended 31 March 2016 of 2,000. Stanley Ltd wants to use its losses as soon as possible Required i) Calculate Stanley Ltd's taxable total profits for all of the above accounting periods and identify any amount(s) to carry forward (7 marks) i) Explain any other ways in which Stanley Ltd's trading loss may be relieved (3 marks) Total 30 marks) Question 2 Answer all parts of the question. 2a The following is the structure of the Somerville Ltd group which runs a chain of hardware shops in the UK. All of the companies shown below are UK resident and prepare accounts to 31 March each year. These are the shareholdings at 31 March 2017 Somerville Ltd 75% 47% Stanley Ltd Montgomery Ltd The following information has been provided for Somerville Ltd for the year ended 31 March 2018: Notes Adjusted trading profits after capital allowances UK bank interest receivable Overseas bank interest received Dividends received from Montgomery Ltd on 1 March 2018 Interest payable Rental income Donation to national charity 1,000,500 2,900 1,600 23,300 3,900 127,000 1,000 Notes: 1 The interest was received on a bank account in Erewhon, an overseas jurisdiction with no tax treaty with the UK. The amount received is net of 20% withholding tax. 2 The dividends were received on 12 March 2018. On 30 November 2017 Somerville Ltd increased its shareholding in Montgomery Ltd from 47% to 51%. 3 Interest payable is as follows: 1,300 2,200 Interest on a loan taken out to purchase plant and machinery Interest on a loan taken out to purchase the additional 4% shareholding in Montgomery Ltd Interest on a loan to fund the purchase of a new shop (see below) 400 3,900 4Somerville Ltd purchased a rental property on 1 June 2017 and the rental income shown above relates to that property. In addition, the tenants paid a lease premium to Somerville Ltd of 80,000 on 1 June 2017 for the grant of the 10-year lease. The 80,000 has been adjusted for in arriving at the adjusted trading profit shown above, eliminating the income from the trading profit. On 13 April 2017 Somerville Ltd sold one of its shops for 230,000. The shop had been purchased in January 2009 for 120,000. The indexation allowance on the disposal is 34,200. On 1 May 2016, Somerville had purchased a new shop for 210,000. Both shops are used entirely for business purposes Required Calculate the corporation tax payable by Somerville Ltd for the year ended 31 March 2018, assuming all beneficial claims and elections are made and state the due date(s) for the payment of the tax and the filing of the return. (20 marks) 2b Stanley Ltd has the following actual and forecast results YIE 31 March 2017 YIE 31 March 2018 YIE 31 March 2019 12,000 8,000 700 (1,200) 500 Trading profit/(loss) Property income Bank interest Chargeable gain/ (loss) Charitable donations 31,000 12,000 1,000 2,000 500 (88,000) 8,000 800 500 Stanley Ltd also has a trading loss brought forward from the year ended 31 March 2016 of 2,000. Stanley Ltd wants to use its losses as soon as possible Required i) Calculate Stanley Ltd's taxable total profits for all of the above accounting periods and identify any amount(s) to carry forward (7 marks) i) Explain any other ways in which Stanley Ltd's trading loss may be relieved (3 marks) Total 30 marks)