Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 Answer all parts of this question. a) Suppose a firm announces positive earnings growth in the latest quarter and its price does

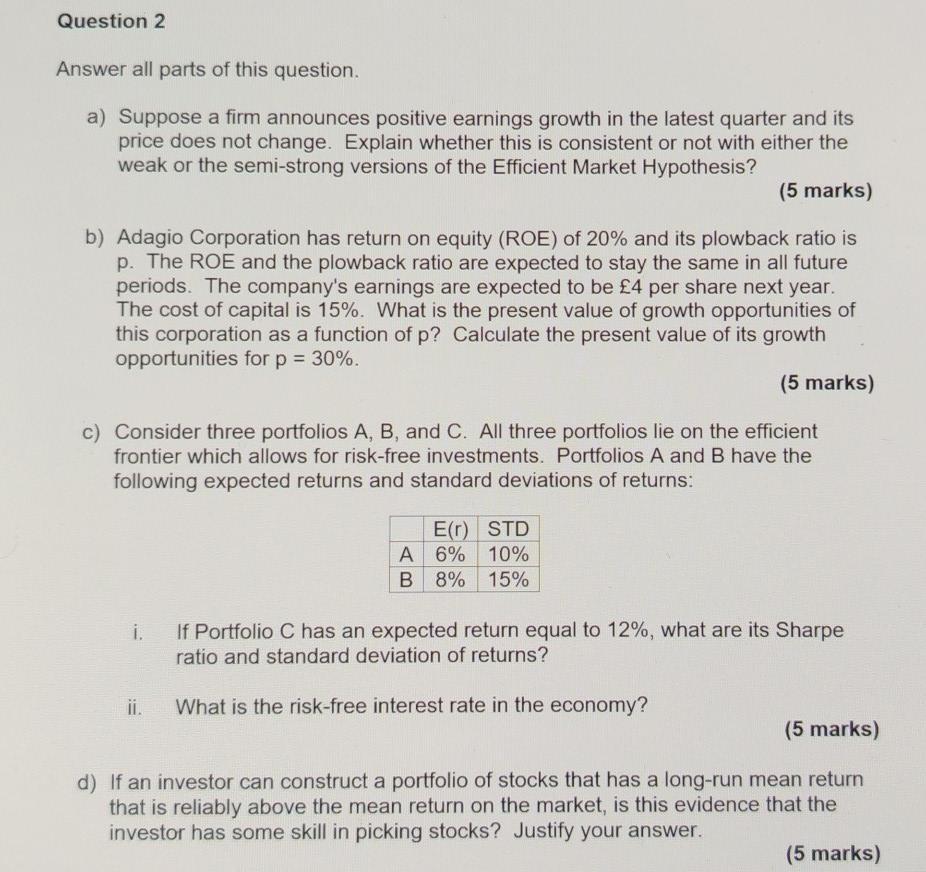

Question 2 Answer all parts of this question. a) Suppose a firm announces positive earnings growth in the latest quarter and its price does not change. Explain whether this is consistent or not with either the weak or the semi-strong versions of the Efficient Market Hypothesis? (5 marks) b) Adagio Corporation has return on equity (ROE) of 20% and its plowback ratio is p. The ROE and the plowback ratio are expected to stay the same in all future periods. The company's earnings are expected to be 4 per share next year. The cost of capital is 15%. What is the present value of growth opportunities of this corporation as a function of p? Calculate the present value of its growth opportunities for p = 30%. (5 marks) c) Consider three portfolios A, B, and C. All three portfolios lie on the efficient frontier which allows for risk-free investments. Portfolios A and B have the following expected returns and standard deviations of returns: E(r) STD 10% A 6% B 8% 15% i. If Portfolio C has an expected return equal to 12%, what are its Sharpe ratio and standard deviation of returns? What is the risk-free interest rate in the economy? ii. (5 marks) d) If an investor can construct a portfolio of stocks that has a long-run mean return that is reliably above the mean return on the market, is this evidence that the investor has some skill in picking stocks? Justify your answer. (5 marks)

Step by Step Solution

★★★★★

3.39 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Answers a Consistency with EMH Weak EMH Consistent The weak EMH only states that past publicly available information is reflected in prices Positive e...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started