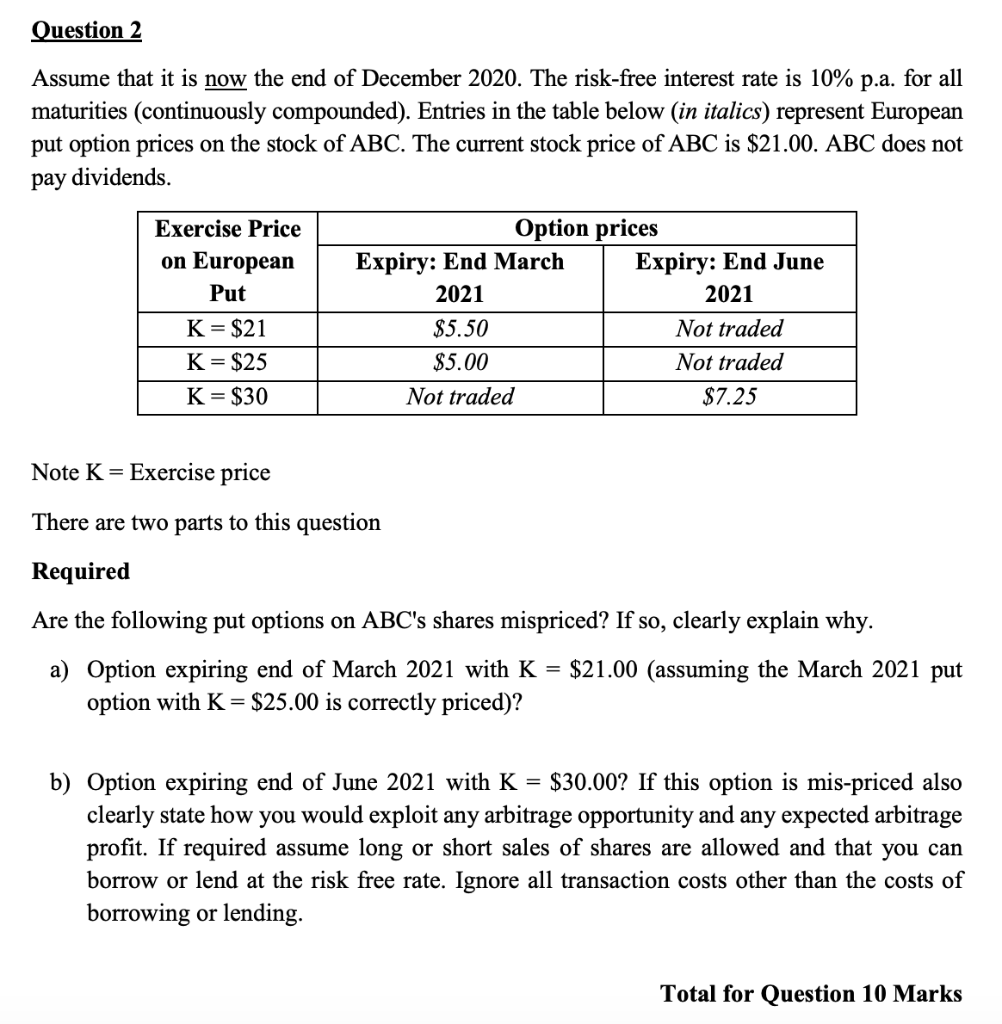

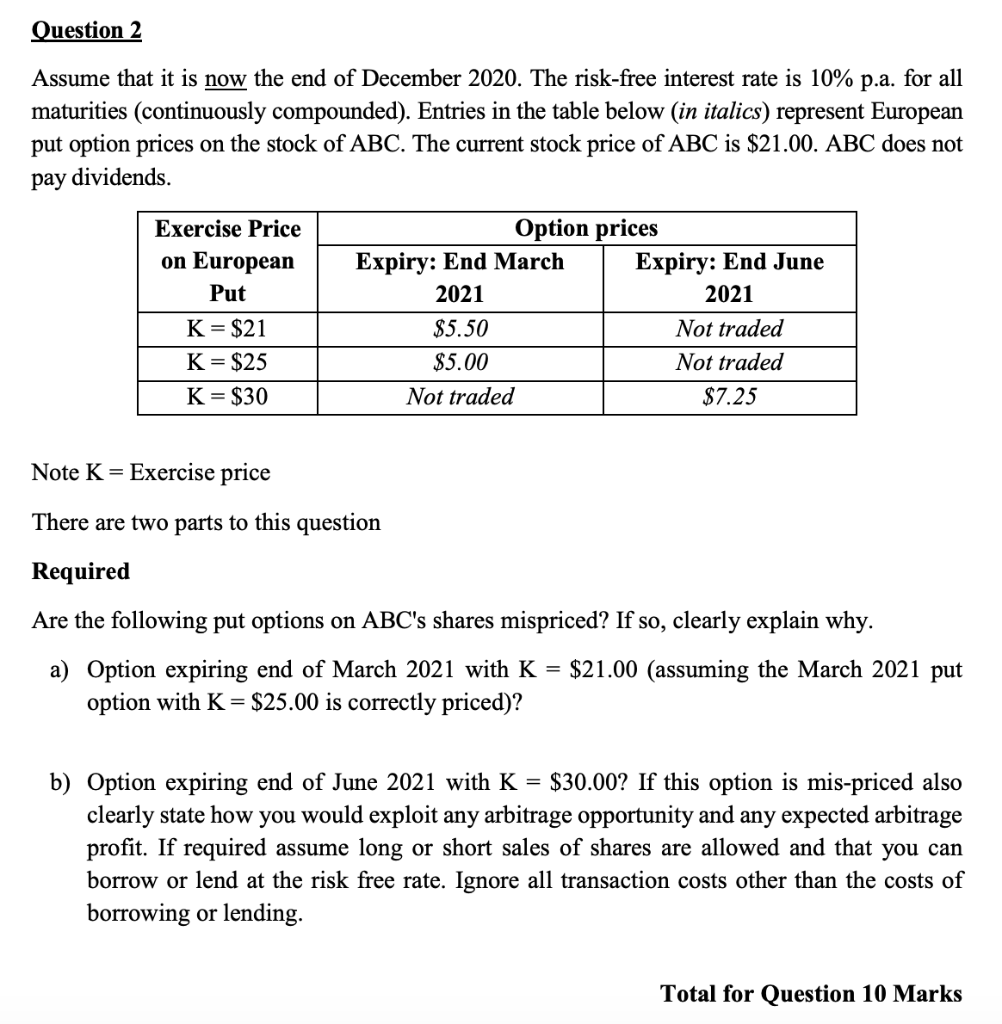

Question 2 Assume that it is now the end of December 2020. The risk-free interest rate is 10% p.a. for all maturities (continuously compounded). Entries in the table below (in italics) represent European put option prices on the stock of ABC. The current stock price of ABC is $21.00. ABC does not pay dividends. Exercise Price on European Put K= $21 K= $25 K=$30 Option prices Expiry: End March Expiry: End June 2021 2021 $5.50 Not traded $5.00 Not traded Not traded $7.25 Note K = Exercise price There are two parts to this question Required Are the following put options on ABC's shares mispriced? If so, clearly explain why. a) Option expiring end of March 2021 with K = $21.00 (assuming the March 2021 put option with K = $25.00 is correctly priced)? b) Option expiring end of June 2021 with K = $30.00? If this option is mis-priced also clearly state how you would exploit any arbitrage opportunity and any expected arbitrage profit. If required assume long or short sales of shares are allowed and that you can borrow or lend at the risk free rate. Ignore all transaction costs other than the costs of borrowing or lending. Total for Question 10 Marks Question 2 Assume that it is now the end of December 2020. The risk-free interest rate is 10% p.a. for all maturities (continuously compounded). Entries in the table below (in italics) represent European put option prices on the stock of ABC. The current stock price of ABC is $21.00. ABC does not pay dividends. Exercise Price on European Put K= $21 K= $25 K=$30 Option prices Expiry: End March Expiry: End June 2021 2021 $5.50 Not traded $5.00 Not traded Not traded $7.25 Note K = Exercise price There are two parts to this question Required Are the following put options on ABC's shares mispriced? If so, clearly explain why. a) Option expiring end of March 2021 with K = $21.00 (assuming the March 2021 put option with K = $25.00 is correctly priced)? b) Option expiring end of June 2021 with K = $30.00? If this option is mis-priced also clearly state how you would exploit any arbitrage opportunity and any expected arbitrage profit. If required assume long or short sales of shares are allowed and that you can borrow or lend at the risk free rate. Ignore all transaction costs other than the costs of borrowing or lending. Total for Question 10 Marks