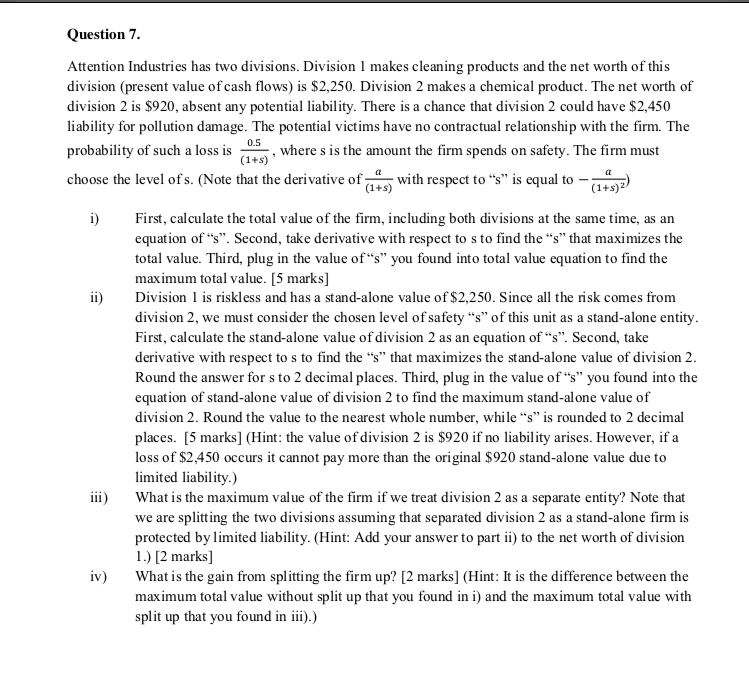

Question '2. Attention Industries has two divisions. Division 1 makes cleaning products and the net worth of this division {present value of cash flows} is $2,250. Division 2 makes a chemical product. The net worth of division 2 is $920, absent any potential liability. There is a chance that division 2 could have $2,450 liability for pollution damage. The potential victims have no contractual relationship with the firm. The probability of such a loss is '15 {1+3} ' choose the level of s. {Note that the derivative of where s is the amount the firm spends on safety. The firm must 4: {1+3} 4: {inll} with respect to \"s" is equal to i} First, calculate the total value of the firm, including both divisions at the same time, as an equation of \"s\". Second, take derivative with respect to s to fmd the \"s" that maximizes the total value. Third, plug in the value of \"s" you found into total value equation to fmd the maximum total value. [5 marks] ii} Division 1 is riskless and has a standalone value of $2,250. Since all the risk comes from division 2, we must consider the chosen level of safety \"s" of this unit as a standalone entity. First, calculate the standalone value of division 2 as an equation of \"s". Second, take derivative with respect to s to fqu the \"s" that maximizes the standalone value of division 2. 1-1on the answer for s to 2 decimal places. Third, plug in the value of \"s" you found into the equation of standalone value of division 2 to fmd the maximum standalone value of division 2. Round the value to the nearest whole number, while \"s" is rounded to 2 decimal places. [5 marks] {Hint: the value of division 2 is $920 if no liability arises. However, if a loss of $2,450 occurs it cannot pay more than the original $920 standalone value due to limited liability.} iii} What is the maxinqu value of the firm if we treat division 2 as a separate entity'?I Note that we are splitting the two divisions assuming that separated division 2 as a standalone firm is protected by limited liability. {Hint: Add your answer to part ii} to the net worth of division 1.} [2 marks] iv} What is the gain from splitting the firm up?I [2 marks] {Hint: It is the difference between the maximum total value without split up that you found in i} and the maximum total value with split up that you found in iii}.}