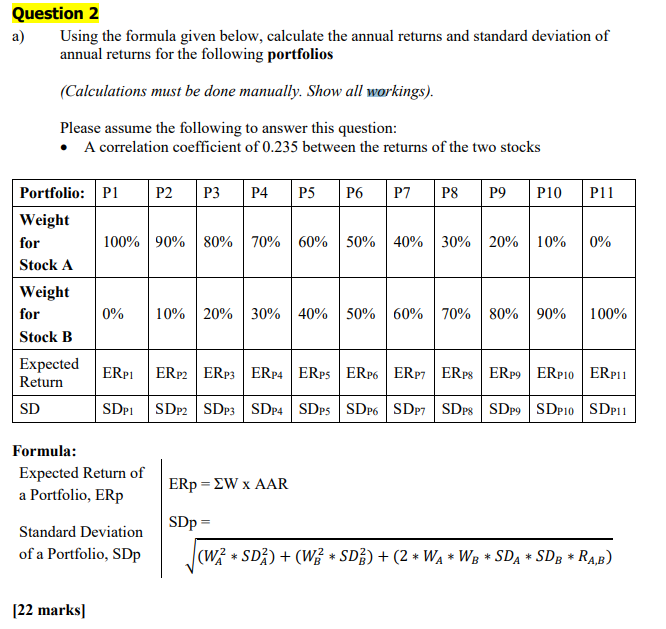

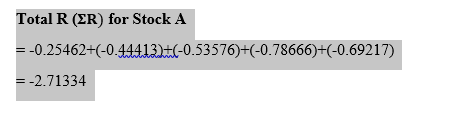

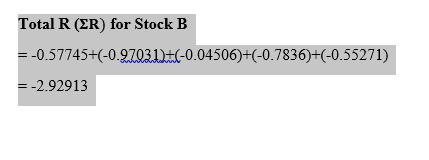

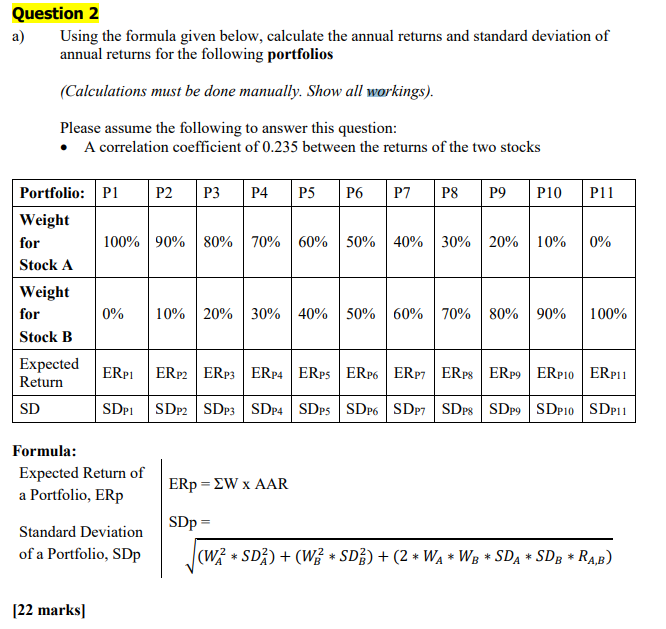

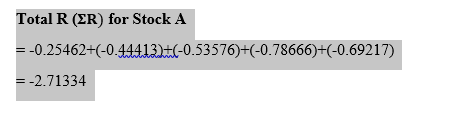

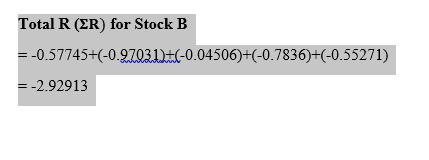

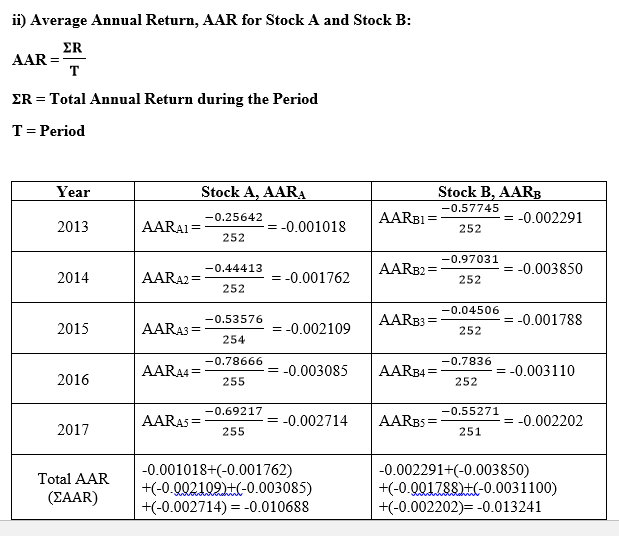

Question 2 a)Using the formula given below, calculate the annual returns and standard deviation of annual returns for the following portfolios (Calculations must be done manually. Show all workings) Please assume the following to answer this question: A correlation coefficient of 0.235 between the returns of the two stocks P2 P3 P4 P5 P6 P7P8 P9 P10 P11 Portfolio: P1 Weight for Stock A Weight for Stock B Expected 100% | 90% | 80% | 70% | 60% | 50% | 40% | 30% | 20% | 10% 10% 0% | 10% | 20% | 30% | 40% | 50% | 60% | 70% | 80% | 90% | 100% Return SD Formula: Expected Return of 1 ERp = ZW x AAR a Portfolio, ERp Standard Deviation of a Portfolio, SDp 122 marks] Total R (ER) for StockA 0.25462 (-0.44413)-0.53576)+(-0.78666)+(-0.69217) -2.71334 Total R (ER) for Stock B -0.57745+(-097031-0.04506)+(-0.7836)+(-0.55271) -2.92913 ii) Average Annual Return, AAR for Stock A and Stock B AAR = R-Total Annual Return during the Period T Period Year Stock A, AAR Stock B, AARB 252 0.001018AARBI0.57745 -0.44413 =-0.001762 2013 AARAI = 0.25642 252 -0.97031 =-0.003850 AARB2 2014 AARA2252 252 004506-0.001788 -0.53576 2015 AARA3- 252 2540.002109AARB3-0.04506 -0.78666 -0.7836 AARA4255 -0.003085 AARB4- 252-=-0003110 = 2016 AARA5=-0.69217 -0.001018+(-0.001762) +-0.002714)0.010688 -0002714 |AARs,- =-0.552-=-0.002202 2017 255 251 Total AAR (ZAAR) -0.002291+(-0.003850) +(-0.21Z8&tl-0.0031100) +-0.002202)--0.013241 D+(-0.002109-0.003085) Question 2 a)Using the formula given below, calculate the annual returns and standard deviation of annual returns for the following portfolios (Calculations must be done manually. Show all workings) Please assume the following to answer this question: A correlation coefficient of 0.235 between the returns of the two stocks P2 P3 P4 P5 P6 P7P8 P9 P10 P11 Portfolio: P1 Weight for Stock A Weight for Stock B Expected 100% | 90% | 80% | 70% | 60% | 50% | 40% | 30% | 20% | 10% 10% 0% | 10% | 20% | 30% | 40% | 50% | 60% | 70% | 80% | 90% | 100% Return SD Formula: Expected Return of 1 ERp = ZW x AAR a Portfolio, ERp Standard Deviation of a Portfolio, SDp 122 marks] Total R (ER) for StockA 0.25462 (-0.44413)-0.53576)+(-0.78666)+(-0.69217) -2.71334 Total R (ER) for Stock B -0.57745+(-097031-0.04506)+(-0.7836)+(-0.55271) -2.92913 ii) Average Annual Return, AAR for Stock A and Stock B AAR = R-Total Annual Return during the Period T Period Year Stock A, AAR Stock B, AARB 252 0.001018AARBI0.57745 -0.44413 =-0.001762 2013 AARAI = 0.25642 252 -0.97031 =-0.003850 AARB2 2014 AARA2252 252 004506-0.001788 -0.53576 2015 AARA3- 252 2540.002109AARB3-0.04506 -0.78666 -0.7836 AARA4255 -0.003085 AARB4- 252-=-0003110 = 2016 AARA5=-0.69217 -0.001018+(-0.001762) +-0.002714)0.010688 -0002714 |AARs,- =-0.552-=-0.002202 2017 255 251 Total AAR (ZAAR) -0.002291+(-0.003850) +(-0.21Z8&tl-0.0031100) +-0.002202)--0.013241 D+(-0.002109-0.003085)