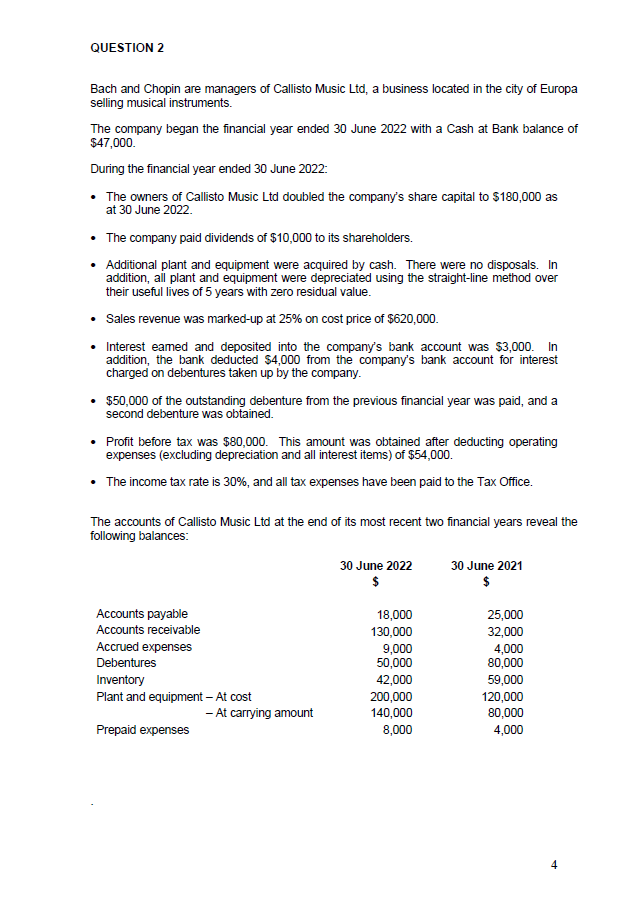

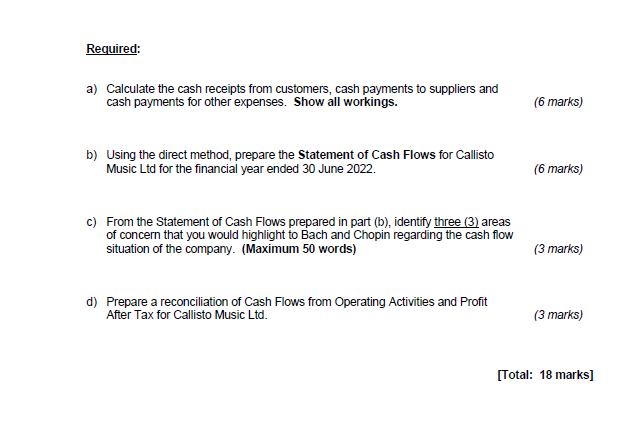

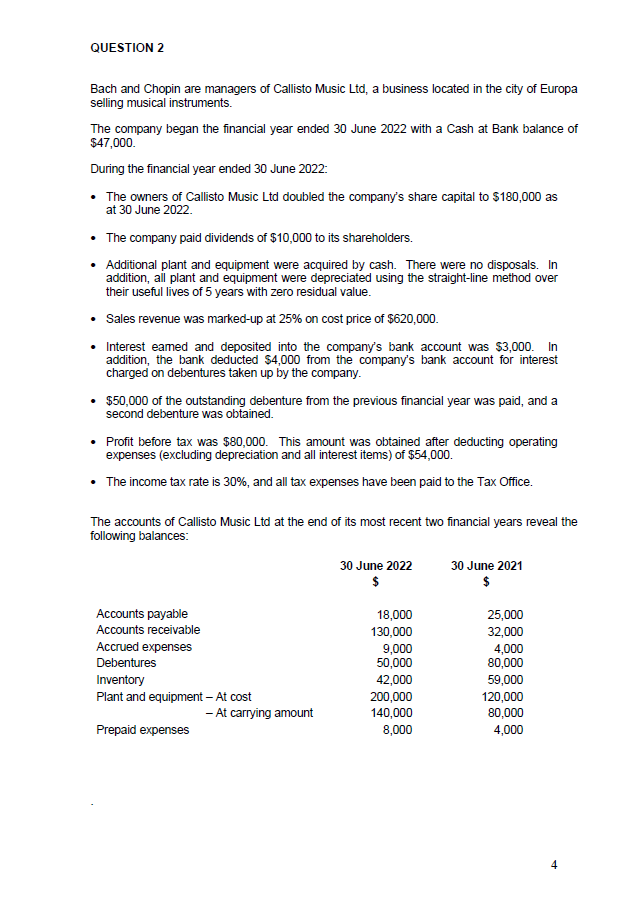

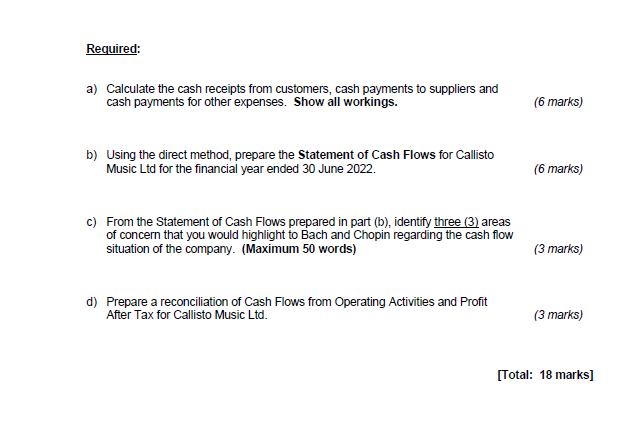

QUESTION 2 Bach and Chopin are managers of Callisto Music Ltd, a business located in the city of Europa selling musical instruments. The company began the financial year ended 30 June 2022 with a Cash at Bank balance of $47,000. During the financial year ended 30 June 2022: The owners of Callisto Music Ltd doubled the company's share capital to $180,000 as at 30 June 2022. The company paid dividends of $10,000 to its shareholders. Additional plant and equipment were acquired by cash. There were no disposals. In addition, all plant and equipment were depreciated using the straight-line method over their useful lives of 5 years with zero residual value. Sales revenue was marked-up at 25% on cost price of $620,000. Interest eamed and deposited into the company's bank account was $3,000. In addition, the bank deducted $4,000 from the company's bank account for interest charged on debentures taken up by the company. $50,000 of the outstanding debenture from the previous financial year was paid, and a second debenture was obtained. Profit before tax was $80,000. This amount was obtained after deducting operating expenses (excluding depreciation and all interest items) of $54,000. The income tax rate is 30%, and all tax expenses have been paid to the Tax Office. The accounts of Callisto Music Ltd at the end of its most recent two financial years reveal the following balances: 30 June 2022 $ 30 June 2021 $ Accounts payable 18,000 25,000 Accounts receivable 130,000 32,000 Accrued expenses 9,000 4,000 Debentures 50,000 80,000 Inventory 42,000 59,000 Plant and equipment - At cost 200,000 120,000 140,000 80,000 Prepaid expenses 8,000 4,000 - At carrying amount 4 Required: a) Calculate the cash receipts from customers, cash payments to suppliers and cash payments for other expenses. Show all workings. b) Using the direct method, prepare the Statement of Cash Flows for Callisto Music Ltd for the financial year ended 30 June 2022. c) From the Statement of Cash Flows prepared in part (b), identify three (3) areas of concern that you would highlight to Bach and Chopin regarding the cash flow situation of the company. (Maximum 50 words) d) Prepare a reconciliation of Cash Flows from Operating Activities and Profit After Tax for Callisto Music Ltd. (6 marks) (6 marks) (3 marks) (3 marks) [Total: 18 marks] QUESTION 2 Bach and Chopin are managers of Callisto Music Ltd, a business located in the city of Europa selling musical instruments. The company began the financial year ended 30 June 2022 with a Cash at Bank balance of $47,000. During the financial year ended 30 June 2022: The owners of Callisto Music Ltd doubled the company's share capital to $180,000 as at 30 June 2022. The company paid dividends of $10,000 to its shareholders. Additional plant and equipment were acquired by cash. There were no disposals. In addition, all plant and equipment were depreciated using the straight-line method over their useful lives of 5 years with zero residual value. Sales revenue was marked-up at 25% on cost price of $620,000. Interest eamed and deposited into the company's bank account was $3,000. In addition, the bank deducted $4,000 from the company's bank account for interest charged on debentures taken up by the company. $50,000 of the outstanding debenture from the previous financial year was paid, and a second debenture was obtained. Profit before tax was $80,000. This amount was obtained after deducting operating expenses (excluding depreciation and all interest items) of $54,000. The income tax rate is 30%, and all tax expenses have been paid to the Tax Office. The accounts of Callisto Music Ltd at the end of its most recent two financial years reveal the following balances: 30 June 2022 $ 30 June 2021 $ Accounts payable 18,000 25,000 Accounts receivable 130,000 32,000 Accrued expenses 9,000 4,000 Debentures 50,000 80,000 Inventory 42,000 59,000 Plant and equipment - At cost 200,000 120,000 140,000 80,000 Prepaid expenses 8,000 4,000 - At carrying amount 4 Required: a) Calculate the cash receipts from customers, cash payments to suppliers and cash payments for other expenses. Show all workings. b) Using the direct method, prepare the Statement of Cash Flows for Callisto Music Ltd for the financial year ended 30 June 2022. c) From the Statement of Cash Flows prepared in part (b), identify three (3) areas of concern that you would highlight to Bach and Chopin regarding the cash flow situation of the company. (Maximum 50 words) d) Prepare a reconciliation of Cash Flows from Operating Activities and Profit After Tax for Callisto Music Ltd. (6 marks) (6 marks) (3 marks) (3 marks) [Total: 18 marks]