Answered step by step

Verified Expert Solution

Question

1 Approved Answer

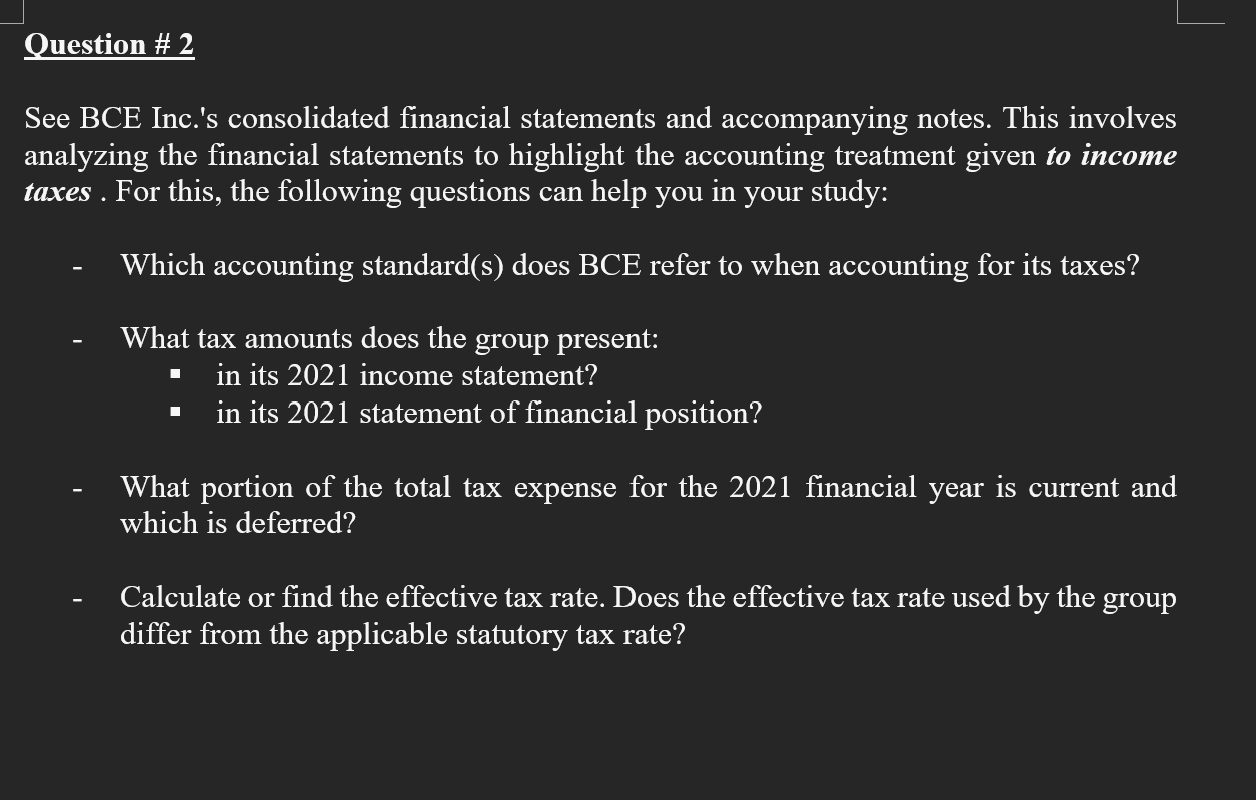

Question # 2 Based on 2 0 2 1 annual report See BCE Inc. ' s consolidated financial statements and accompanying notes. This involves analyzing

Question # Based on annual report

See BCE Inc.s consolidated financial statements and accompanying notes. This involves

analyzing the financial statements to highlight the accounting treatment given to income

taxes For this, the following questions can help you in your study:

Which accounting standards does BCE refer to when accounting for its taxes?

What tax amounts does the group present:

in its income statement?

in its statement of financial position?

What portion of the total tax expense for the financial year is current and

which is deferred?

Calculate or find the effective tax rate. Does the effective tax rate used by the group

differ from the applicable statutory tax rate?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started