Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 c) The net profit originally calculated at N$25 370. Show your calculation of the correct figure. (5 marks) Question 4 (37 marks) 4.1

Question 2

c) The net profit originally calculated at N$25 370. Show your calculation of the correct

figure. (5 marks)

Question 4 (37 marks)

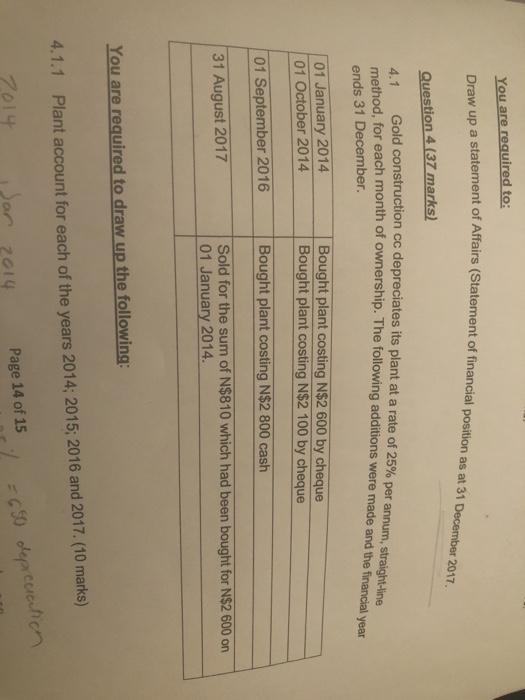

4.1 Gold construction cc depreciates its plant at a rate of 25% per annum, straight-line method, for each month of ownership. The following additions were made and the financial year ends 31 December.

01 January 2014

Bought plant costing N$2 600 by cheque

01 October 2014

Bought plant costing N$2 100 by cheque

01 September 2016

Bought plant costing N$2 800 cash

31 August 2017

Sold for the sum of N$810 which had been bought for N$2 600 on 01 January 2014.

You are required to draw up the following:

4.1.1 Plant account for each of the years 2014; 2015; 2016 and 2017. (10 marks)

4.1.2 The provision for depreciation account for each of the years 2014; 2015; 2016 and 2017 (14 marks)

4.1.3 Plant disposal account for the year. (4 marks)

4.2 As a manager of a business, you have to choose a method for stock valuation. The business you work for uses the perpetual inventory stock system. On 31 May 2016, there were 350 units at N$18 per unit in stock.

The inventory movement for June are shown below.

Dates

Received

Issued

Unit purchase price

June 1

300

20

12

800

25

24

900

30

150

You are required to:

4.2.1 Calculate the value of closing stock using the LIFO (Last in first out) method of stock valuation (9 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started