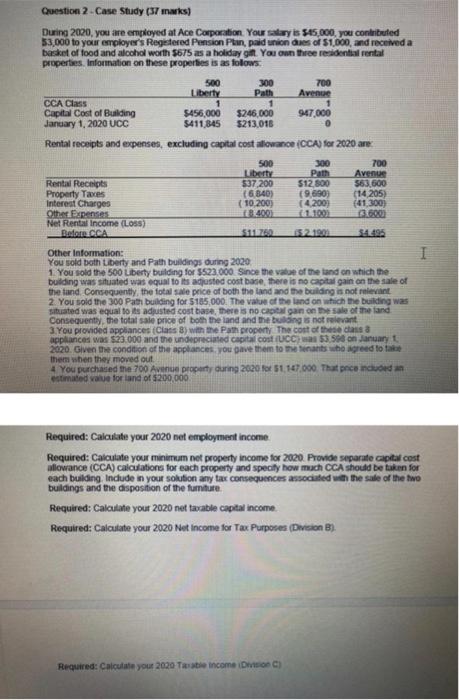

Question 2 Case Study (57 mwks) During 2020, you are employed at Ace Corporation. Your salary is $45.000, you contributed $3,000 to your employer's Registered Pension Plan, paid union des of $1,000, and received a basket of food and alcohol worth $675 as a holiday gift. You own the residential rental properties. Information on these properties is as follows 500 300 700 Liberty Path Avenue CCA Class 1 1 Capital Cost of Building 5456,000 $246,000 947.000 January 1, 2020 UCC 5411 845 $213.016 Rental receipts and expenses, excluding capital cost allowance (CCA) for 2020 are 500 300 700 Liberty Path Avenue Rental Receipts 537,200 $12.800 $63.600 Property Taxes (6 840) (9.690) (14,205) Interest Charges (10.2003 (4200) (41.300) Other Expenses B4001 16 Net Rental Income (LOSS) BOCCA 54495 Other Information: You sold both Liberty and Path buildings during 2020 1. You sold the 500 Liberty building for $523.000 Since the value of the land on which the building was situated was equal to its adjusted cost base, there is no capital gain on the sale of the tand Consequently, the total sale price of both the land and the building is not relevant 2. You sold the 300 Path building for $185,000. The value of the land on which the building was situated was equal to adjusted cost base, there is no capital gain on the sale of the land Consequently, the total sale price of both the land and the building is not relevant 3. You provided appliances (Class B) with the Path property The cost of these casa appliances was $23.000 and the undeprecated capital cost UCC) 53.5 on January 2020. Given the condition of the appliances, you gave them to the ants who agreed to take them when they moved out 4 You purchased the 700 Avenue property during 2020 x 51 147.000 That pece included an estimated value for land of $200.000 Required: Calculate your 2020 net employment income Required: Calculate your minimum net property income for 2020. Provide separate capital cost allowance (CCA) calculations for each property and specify how much CCA should be taken for each building Indude in your solution any tax consequences associated with the sale of the two buildings and the disposition of the furniture Required: Calculate your 2020 net table capital income Required: Calculate your 2020 Net Income for Tax Purposes (Division B). Required: Calculate your 2020 e income DC) Question 2 Case Study (57 mwks) During 2020, you are employed at Ace Corporation. Your salary is $45.000, you contributed $3,000 to your employer's Registered Pension Plan, paid union des of $1,000, and received a basket of food and alcohol worth $675 as a holiday gift. You own the residential rental properties. Information on these properties is as follows 500 300 700 Liberty Path Avenue CCA Class 1 1 Capital Cost of Building 5456,000 $246,000 947.000 January 1, 2020 UCC 5411 845 $213.016 Rental receipts and expenses, excluding capital cost allowance (CCA) for 2020 are 500 300 700 Liberty Path Avenue Rental Receipts 537,200 $12.800 $63.600 Property Taxes (6 840) (9.690) (14,205) Interest Charges (10.2003 (4200) (41.300) Other Expenses B4001 16 Net Rental Income (LOSS) BOCCA 54495 Other Information: You sold both Liberty and Path buildings during 2020 1. You sold the 500 Liberty building for $523.000 Since the value of the land on which the building was situated was equal to its adjusted cost base, there is no capital gain on the sale of the tand Consequently, the total sale price of both the land and the building is not relevant 2. You sold the 300 Path building for $185,000. The value of the land on which the building was situated was equal to adjusted cost base, there is no capital gain on the sale of the land Consequently, the total sale price of both the land and the building is not relevant 3. You provided appliances (Class B) with the Path property The cost of these casa appliances was $23.000 and the undeprecated capital cost UCC) 53.5 on January 2020. Given the condition of the appliances, you gave them to the ants who agreed to take them when they moved out 4 You purchased the 700 Avenue property during 2020 x 51 147.000 That pece included an estimated value for land of $200.000 Required: Calculate your 2020 net employment income Required: Calculate your minimum net property income for 2020. Provide separate capital cost allowance (CCA) calculations for each property and specify how much CCA should be taken for each building Indude in your solution any tax consequences associated with the sale of the two buildings and the disposition of the furniture Required: Calculate your 2020 net table capital income Required: Calculate your 2020 Net Income for Tax Purposes (Division B). Required: Calculate your 2020 e income DC)