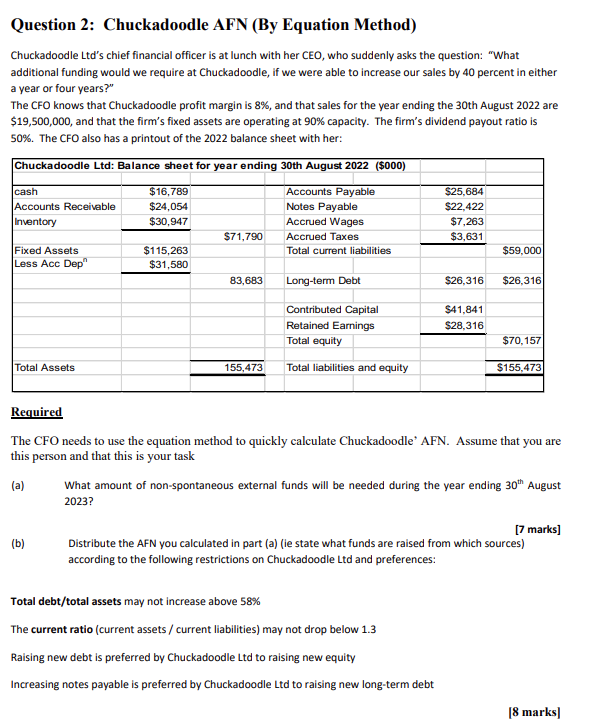

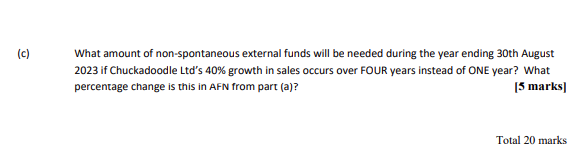

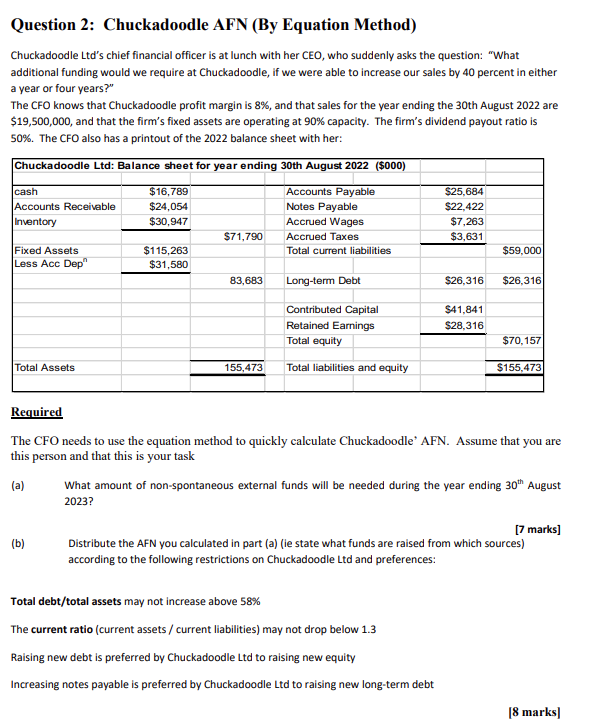

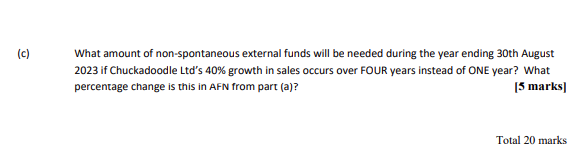

Question 2: Chuckadoodle AFN (By Equation Method) Chuckadoodle Ltd's chief financial officer is at lunch with her CEO, who suddenly asks the question: "What additional funding would we require at Chuckadoodle, if we were able to increase our sales by 40 percent in either a year or four years?" The CFO knows that Chuckadoodle profit margin is 8%, and that sales for the year ending the 30 th August 2022 are $19,500,000, and that the firm's fixed assets are operating at 90% capacity. The firm's dividend payout ratio is 50%. The CFO also has a printout of the 2022 balance sheet with her: Required The CFO needs to use the equation method to quickly calculate Chuckadoodle' AFN. Assume that you are this person and that this is your task (a) What amount of non-spontaneous external funds will be needed during the year ending 30th August 2023? [7 marks] (b) Distribute the AFN you calculated in part (a) (ie state what funds are raised from which sources) according to the following restrictions on Chuckadoodle Ltd and preferences: Total debt/total assets may not increase above 58% The current ratio (current assets / current liabilities) may not drop below 1.3 Raising new debt is preferred by Chuckadoodle Ltd to raising new equity Increasing notes payable is preferred by Chuckadoodle Ltd to raising new long-term debt What amount of non-spontaneous external funds will be needed during the year ending 30 th August 2023 if Chuckadoodle Ltd's 40% growth in sales occurs over FOUR years instead of ONE year? What percentage change is this in AFN from part (a)? [5 marks] Question 2: Chuckadoodle AFN (By Equation Method) Chuckadoodle Ltd's chief financial officer is at lunch with her CEO, who suddenly asks the question: "What additional funding would we require at Chuckadoodle, if we were able to increase our sales by 40 percent in either a year or four years?" The CFO knows that Chuckadoodle profit margin is 8%, and that sales for the year ending the 30 th August 2022 are $19,500,000, and that the firm's fixed assets are operating at 90% capacity. The firm's dividend payout ratio is 50%. The CFO also has a printout of the 2022 balance sheet with her: Required The CFO needs to use the equation method to quickly calculate Chuckadoodle' AFN. Assume that you are this person and that this is your task (a) What amount of non-spontaneous external funds will be needed during the year ending 30th August 2023? [7 marks] (b) Distribute the AFN you calculated in part (a) (ie state what funds are raised from which sources) according to the following restrictions on Chuckadoodle Ltd and preferences: Total debt/total assets may not increase above 58% The current ratio (current assets / current liabilities) may not drop below 1.3 Raising new debt is preferred by Chuckadoodle Ltd to raising new equity Increasing notes payable is preferred by Chuckadoodle Ltd to raising new long-term debt What amount of non-spontaneous external funds will be needed during the year ending 30 th August 2023 if Chuckadoodle Ltd's 40% growth in sales occurs over FOUR years instead of ONE year? What percentage change is this in AFN from part (a)? [5 marks]