Answered step by step

Verified Expert Solution

Question

1 Approved Answer

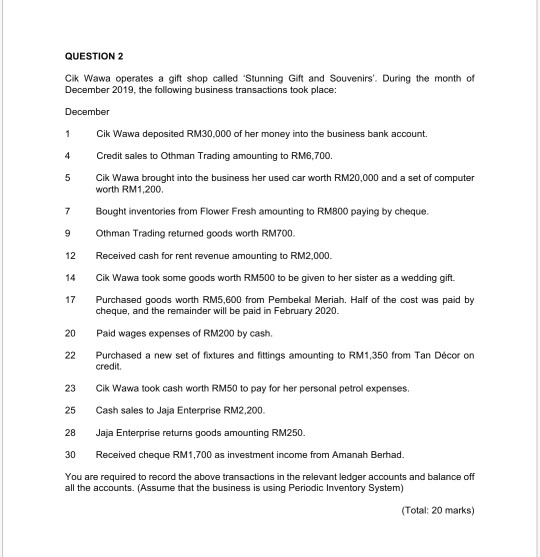

QUESTION 2 Cik Wawa operates a gift shop called Stunning Gift and Souvenirs. During the month of December 2019, the following business transactions took place:

QUESTION 2 Cik Wawa operates a gift shop called Stunning Gift and Souvenirs. During the month of December 2019, the following business transactions took place: December Cik Wawa deposited RM30,000 of her money into the business bank account. Credit sales to Othman Trading amounting to RM6,700. Cik Wawa brought into the business her used car worth RM20,000 and a set of computer worth RM1,200 Bought inventories from Flower Fresh amounting to RM800 paying by cheque Othman Trading returned goods worth RM700. Received cash for rent revenue amounting to RM2,000. Cik Wawa took some goods worth RM500 to be given to her sister as a wedding gift. Purchased goods worth RM5,600 from Pembekal Meriah. Half of the cost was paid by cheque, and the remainder will be paid in February 2020. Paid wages expenses of RM200 by cash. Purchased a new set of fixtures and fittings amounting to RM1,350 from Tan Dcor on credit. Cik Wawa took cash worth RM50 to pay for her personal petrol expenses 25 Cash sales to Jaja Enterprise RM2,200 Jaja Enterprise returns goods amounting RM250. 30 Received cheque RM1,700 as investment income from Amanah Berhad. You are required to record the above transactions in the relevant ledger accounts and balance off all the accounts. (Assume that the business is using Periodic Inventory System) (Total: 20 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started