Answered step by step

Verified Expert Solution

Question

1 Approved Answer

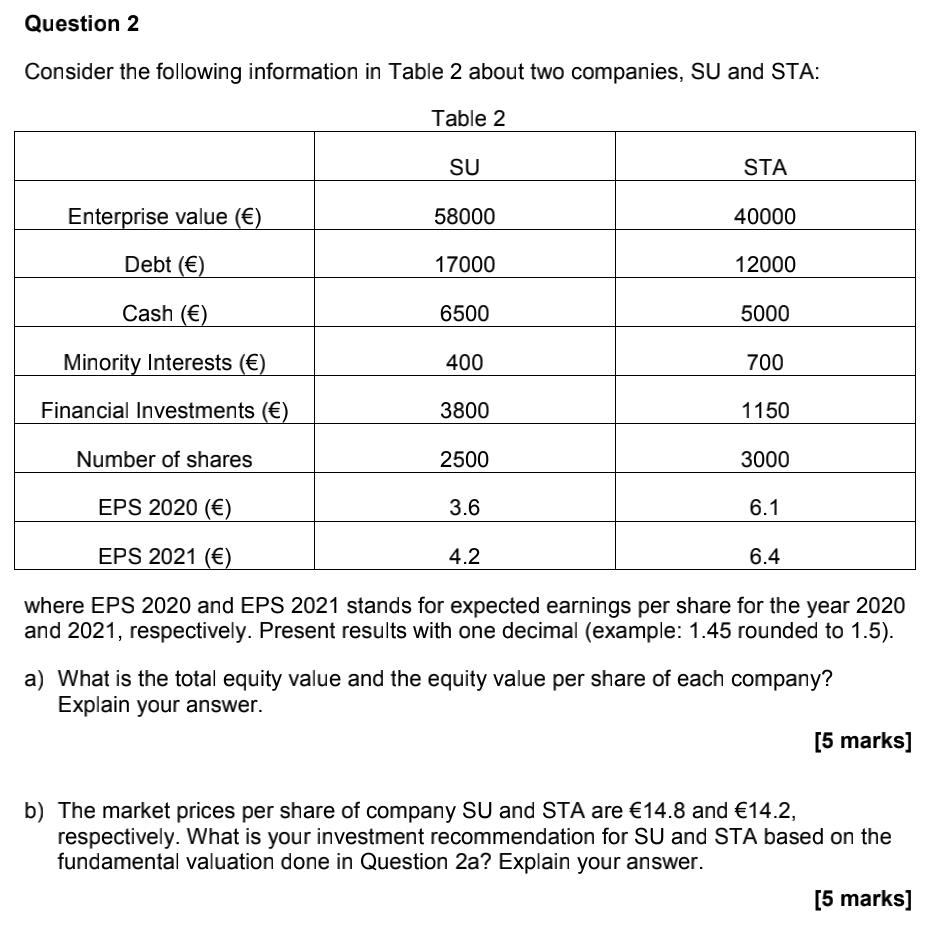

Question 2 Consider the following information in Table 2 about two companies, SU and STA: Table 2 SU STA Enterprise value () 58000 40000

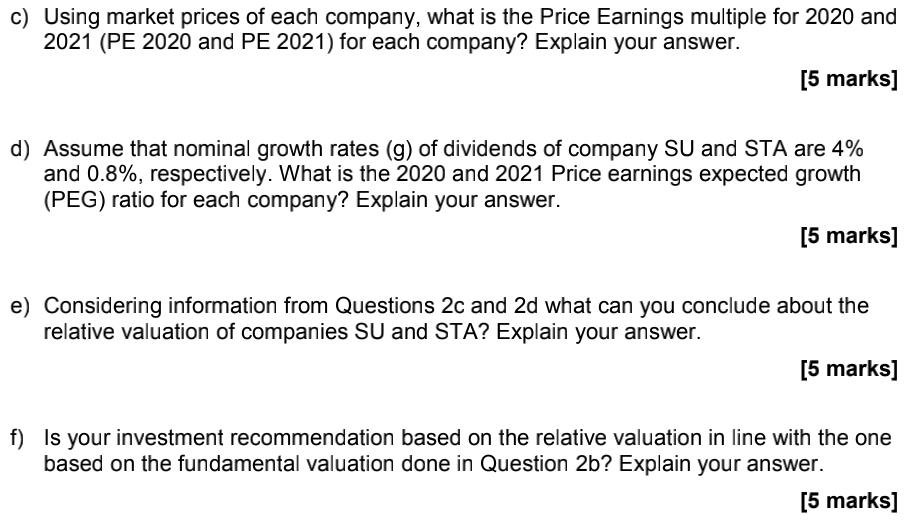

Question 2 Consider the following information in Table 2 about two companies, SU and STA: Table 2 SU STA Enterprise value () 58000 40000 Debt () 17000 12000 Cash () 6500 5000 Minority Interests () 400 700 Financial Investments () 3800 1150 Number of shares 2500 3000 EPS 2020 () 3.6 6.1 EPS 2021 () 4.2 6.4 where EPS 2020 and EPS 2021 stands for expected earnings per share for the year 2020 and 2021, respectively. Present results with one decimal (example: 1.45 rounded to 1.5). a) What is the total equity value and the equity value per share of each company? Explain your answer. [5 marks] b) The market prices per share of company SU and STA are 14.8 and 14.2, respectively. What is your investment recommendation for SU and STA based on the fundamental valuation done in Question 2a? Explain your answer. [5 marks] c) Using market prices of each company, what is the Price Earnings multiple for 2020 and 2021 (PE 2020 and PE 2021) for each company? Explain your answer. [5 marks] d) Assume that nominal growth rates (g) of dividends of company SU and STA are 4% and 0.8%, respectively. What is the 2020 and 2021 Price earnings expected growth (PEG) ratio for each company? Explain your answer. [5 marks] e) Considering information from Questions 2c and 2d what can you conclude about the relative valuation of companies SU and STA? Explain your answer. [5 marks] f) Is your investment recommendation based on the relative valuation in line with the one based on the fundamental valuation done in Question 2b? Explain your answer. [5 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a To calculate the total equity value and equity value per share for each company 1 SU Enterprise Value EV 58000 Debt 17000 Cash 6500 Minority Interes...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started