Answered step by step

Verified Expert Solution

Question

1 Approved Answer

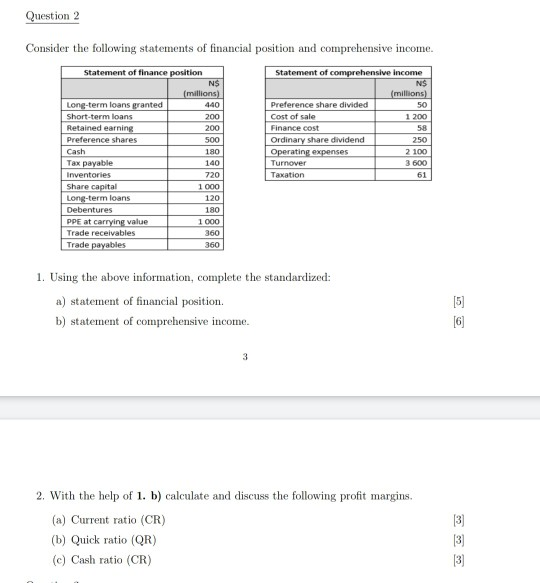

Question 2 Consider the following statements of financial position and comprehensive income. 440 200 Statement of finance position N$ (millions) Long-term loans granted Short-term loans

Question 2 Consider the following statements of financial position and comprehensive income. 440 200 Statement of finance position N$ (millions) Long-term loans granted Short-term loans 200 Retained earning Preference shares 500 Cash 180 Tax payable 140 Inventories 720 Share capital 1 000 Long-term loans 120 Debentures 180 PPE at carrying value 1 000 Trade receivables 360 Trade payables 360 Statement of comprehensive income NS (millions) Preference share divided 50 Cost of sale 1 200 Finance cost 58 Ordinary share dividend 250 Operating expenses 2100 Turnover 3.600 Taxation 61 1. Using the above information, complete the standardized: a) statement of financial position. b) statement of comprehensive income. [5] [6] 3 2. With the help of 1. b) calculate and discuss the following profit margins. (a) Current ratio (CR) (b) Quick ratio (QR) (c) Cash ratio (CR) 3 3 [3]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started