Answered step by step

Verified Expert Solution

Question

1 Approved Answer

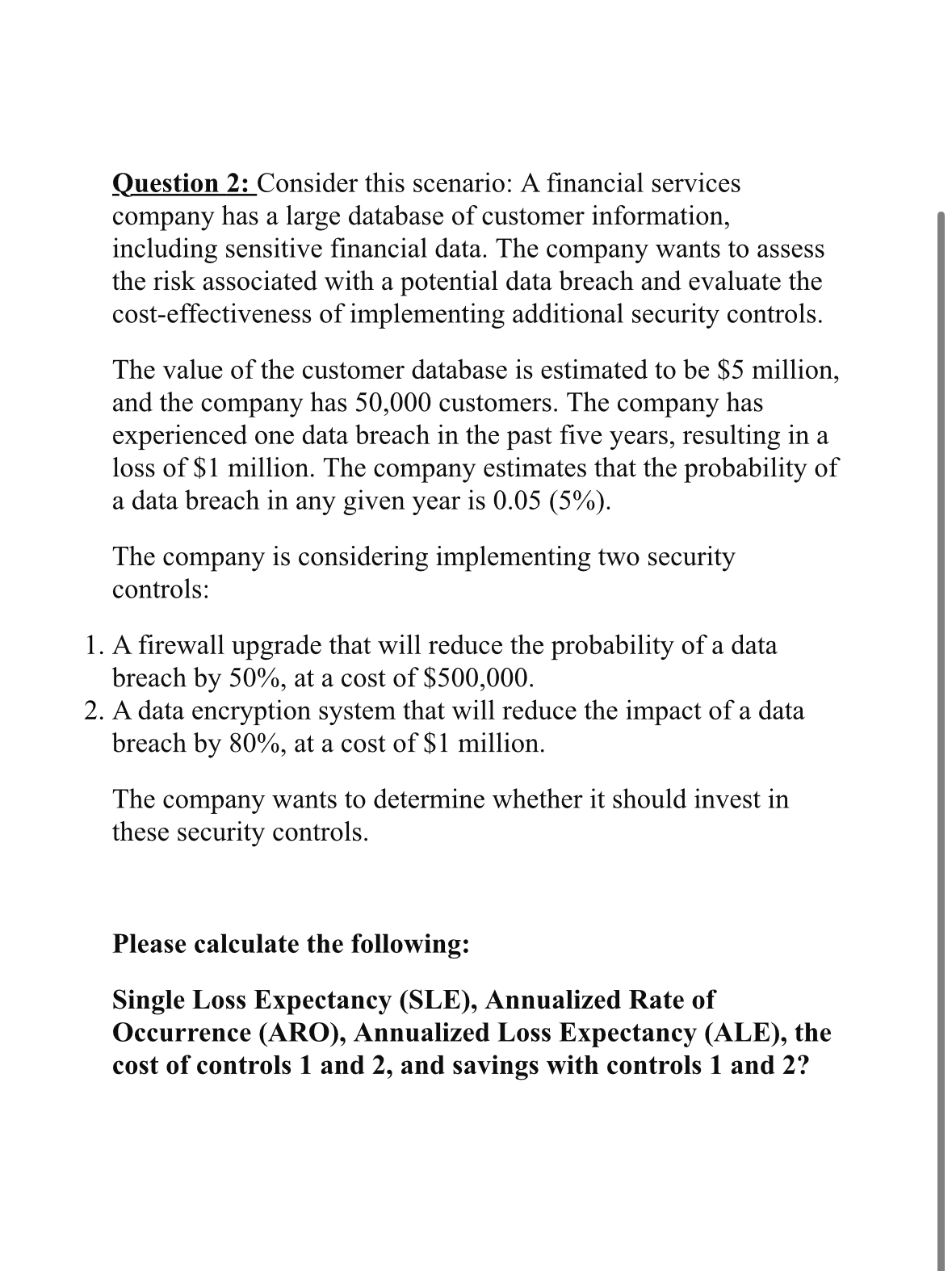

Question 2 : Consider this scenario: A financial services company has a large database of customer information, including sensitive financial data. The company wants to

Question : Consider this scenario: A financial services company has a large database of customer information, including sensitive financial data. The company wants to assess the risk associated with a potential data breach and evaluate the costeffectiveness of implementing additional security controls.

The value of the customer database is estimated to be $ million, and the company has customers. The company has experienced one data breach in the past five years, resulting in a loss of $ million. The company estimates that the probability of a data breach in any given year is

The company is considering implementing two security controls:

A firewall upgrade that will reduce the probability of a data breach by at a cost of $

A data encryption system that will reduce the impact of a data breach by at a cost of $ million.

The company wants to determine whether it should invest in these security controls.

Please calculate the following:

Single Loss Expectancy SLE Annualized Rate of Occurrence ARO Annualized Loss Expectancy ALE the cost of controls and and savings with controls and

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started