Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2 Cranberries Sdn. Bhd. had the following transactions during its first month of operations: 1. Purchased raw materials on account, RM80,000. 2. Raw materials

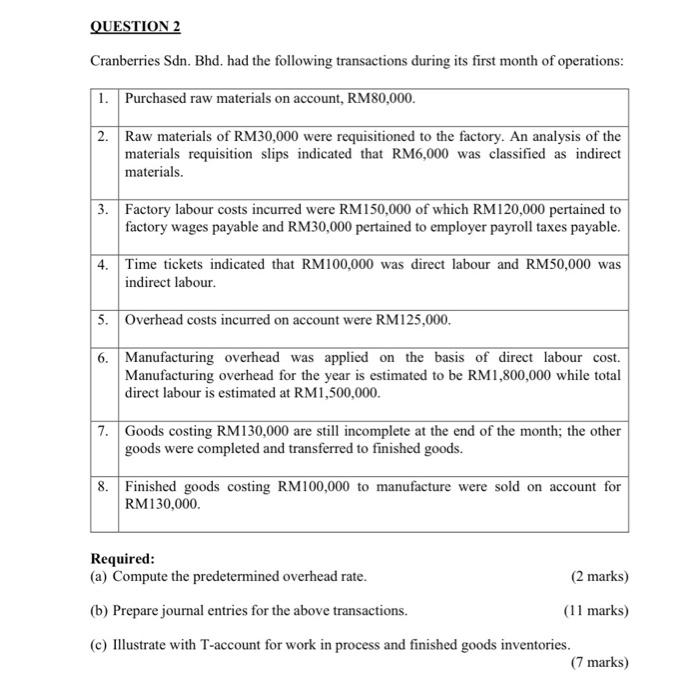

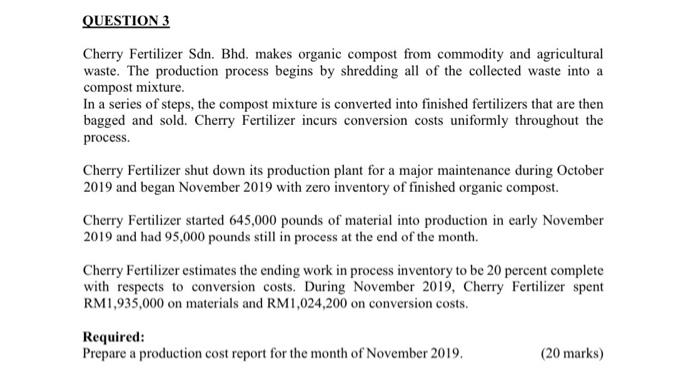

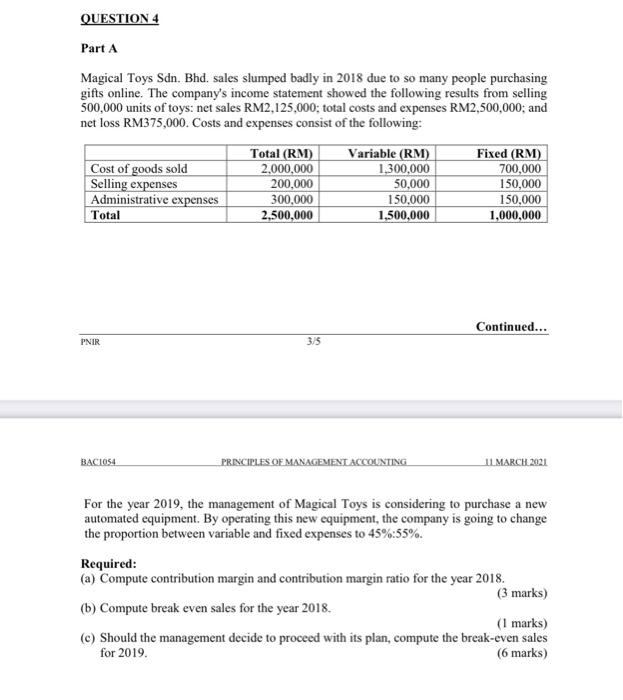

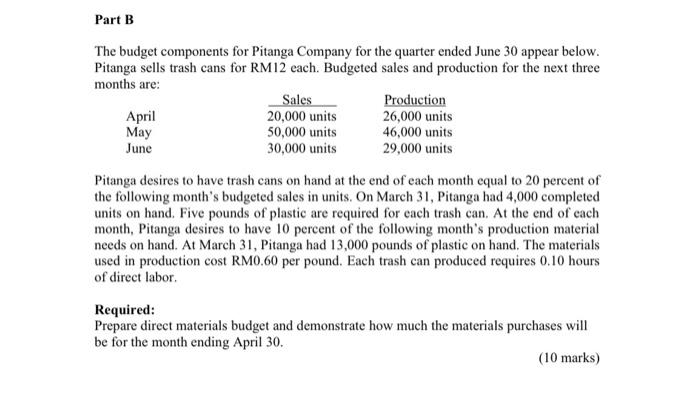

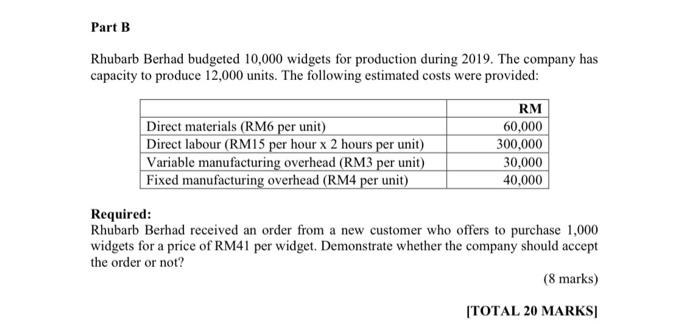

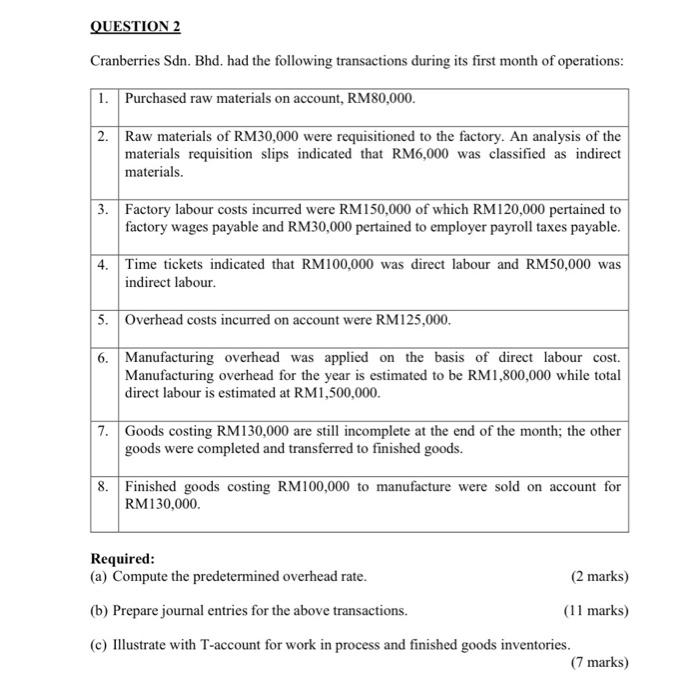

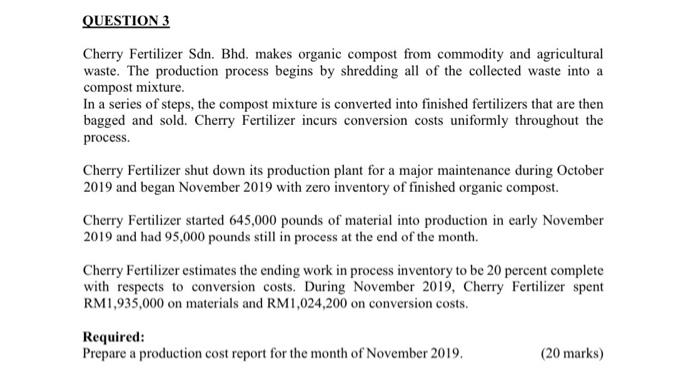

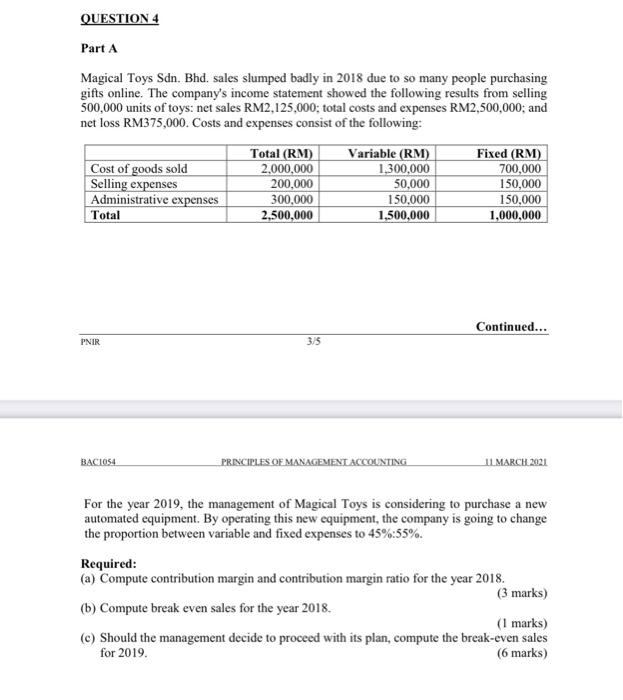

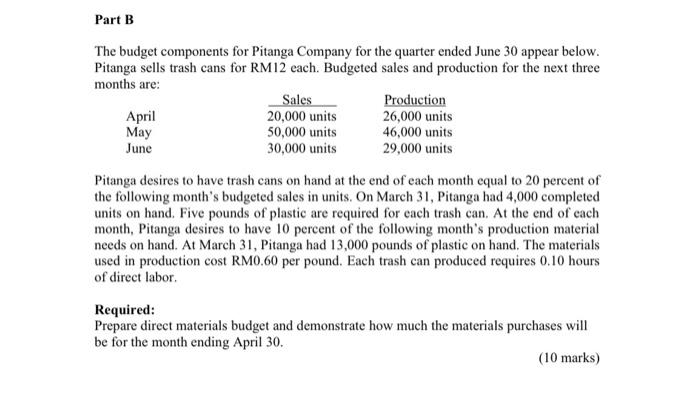

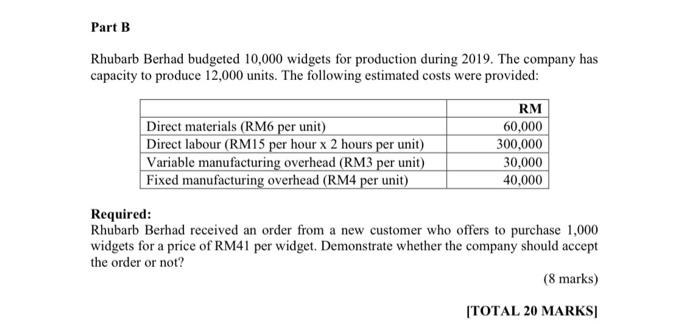

QUESTION 2 Cranberries Sdn. Bhd. had the following transactions during its first month of operations: 1. Purchased raw materials on account, RM80,000. 2. Raw materials of RM30,000 were requisitioned to the factory. An analysis of the materials requisition slips indicated that RM6,000 was classified as indirect materials. 3. Factory labour costs incurred were RM150,000 of which RM120,000 pertained to factory wages payable and RM30,000 pertained to employer payroll taxes payable. 4. Time tickets indicated that RM100,000 was direct labour and RM50,000 was indirect labour. 5. Overhead costs incurred on account were RM125,000. 6. Manufacturing overhead was applied on the basis of direct labour cost. Manufacturing overhead for the year is estimated to be RM1,800,000 while total direct labour is estimated at RM1,500,000. 7. Goods costing RM130,000 are still incomplete at the end of the month; the other goods were completed and transferred to finished goods. 8. Finished goods costing RM100,000 to manufacture were sold on account for RM130,000 Required: (a) Compute the predetermined overhead rate. (2 marks) (b) Prepare journal entries for the above transactions. (11 marks) (C) Illustrate with T-account for work in process and finished goods inventories. (7 marks) QUESTION 3 Cherry Fertilizer Sdn. Bhd. makes organic compost from commodity and agricultural waste. The production process begins by shredding all of the collected waste into a compost mixture. In a series of steps, the compost mixture is converted into finished fertilizers that are then bagged and sold. Cherry Fertilizer incurs conversion costs uniformly throughout the process. Cherry Fertilizer shut down its production plant for a major maintenance during October 2019 and began November 2019 with zero inventory of finished organic compost. Cherry Fertilizer started 645,000 pounds of material into production in early November 2019 and had 95,000 pounds still in process at the end of the month. Cherry Fertilizer estimates the ending work in process inventory to be 20 percent complete with respects to conversion costs. During November 2019, Cherry Fertilizer spent RM1,935,000 on materials and RM1,024,200 on conversion costs. Required: Prepare a production cost report for the month of November 2019, (20 marks) QUESTION 4 Part A Magical Toys Sdn. Bhd. sales slumped badly in 2018 due to so many people purchasing gifts online. The company's income statement showed the following results from selling 500,000 units of toys: net sales RM2,125,000; total costs and expenses RM2,500,000; and net loss RM375,000. Costs and expenses consist of the following: Total (RM) Variable (RM) Fixed (RM) Cost of goods sold 2,000,000 1,300,000 700,000 Selling expenses 200,000 50,000 150,000 Administrative expenses 300,000 150,000 150,000 Total 2,500,000 1,500,000 1,000,000 Continued... PNIR BACIO54 PRINCIPLES OF MANAGEMENT ACCOUNTING 11 MARCH 2021 For the year 2019, the management of Magical Toys is considering to purchase a new automated equipment . By operating this new equipment, the company is going to change the proportion between variable and fixed expenses to 45%:55%. Required: (a) Compute contribution margin and contribution margin ratio for the year 2018. (3 marks) (b) Compute break even sales for the year 2018. (1 marks) (c) Should the management decide to proceed with its plan, compute the break-even sales for 2019. (6 marks) Part B The budget components for Pitanga Company for the quarter ended June 30 appear below. Pitanga sells trash cans for RM12 each. Budgeted sales and production for the next three months are: Sales Production April 20,000 units 26,000 units May 50,000 units 46,000 units June 30,000 units 29,000 units Pitanga desires to have trash cans on hand at the end of each month equal to 20 percent of the following month's budgeted sales in units. On March 31, Pitanga had 4,000 completed units on hand. Five pounds of plastic are required for each trash can. At the end of each month, Pitanga desires to have 10 percent of the following month's production material needs on hand. At March 31, Pitanga had 13,000 pounds of plastic on hand. The materials used in production cost RM0.60 per pound. Each trash can produced requires 0.10 hours of direct labor Required: Prepare direct materials budget and demonstrate how much the materials purchases will be for the month ending April 30. (10 marks) Part B Rhubarb Berhad budgeted 10,000 widgets for production during 2019. The company has capacity to produce 12,000 units. The following estimated costs were provided: RM Direct materials (RM6 per unit) 60,000 Direct labour (RM15 per hour x 2 hours per unit) 300,000 Variable manufacturing overhead (RM3 per unit) 30,000 Fixed manufacturing overhead (RM4 per unit) 40,000 Required: Rhubarb Berhad received an order from a new customer who offers to purchase 1,000 widgets for a price of RM41 per widget. Demonstrate whether the company should accept the order or not? (8 marks) TOTAL 20 MARKS

QUESTION 2 Cranberries Sdn. Bhd. had the following transactions during its first month of operations: 1. Purchased raw materials on account, RM80,000. 2. Raw materials of RM30,000 were requisitioned to the factory. An analysis of the materials requisition slips indicated that RM6,000 was classified as indirect materials. 3. Factory labour costs incurred were RM150,000 of which RM120,000 pertained to factory wages payable and RM30,000 pertained to employer payroll taxes payable. 4. Time tickets indicated that RM100,000 was direct labour and RM50,000 was indirect labour. 5. Overhead costs incurred on account were RM125,000. 6. Manufacturing overhead was applied on the basis of direct labour cost. Manufacturing overhead for the year is estimated to be RM1,800,000 while total direct labour is estimated at RM1,500,000. 7. Goods costing RM130,000 are still incomplete at the end of the month; the other goods were completed and transferred to finished goods. 8. Finished goods costing RM100,000 to manufacture were sold on account for RM130,000 Required: (a) Compute the predetermined overhead rate. (2 marks) (b) Prepare journal entries for the above transactions. (11 marks) (C) Illustrate with T-account for work in process and finished goods inventories. (7 marks) QUESTION 3 Cherry Fertilizer Sdn. Bhd. makes organic compost from commodity and agricultural waste. The production process begins by shredding all of the collected waste into a compost mixture. In a series of steps, the compost mixture is converted into finished fertilizers that are then bagged and sold. Cherry Fertilizer incurs conversion costs uniformly throughout the process. Cherry Fertilizer shut down its production plant for a major maintenance during October 2019 and began November 2019 with zero inventory of finished organic compost. Cherry Fertilizer started 645,000 pounds of material into production in early November 2019 and had 95,000 pounds still in process at the end of the month. Cherry Fertilizer estimates the ending work in process inventory to be 20 percent complete with respects to conversion costs. During November 2019, Cherry Fertilizer spent RM1,935,000 on materials and RM1,024,200 on conversion costs. Required: Prepare a production cost report for the month of November 2019, (20 marks) QUESTION 4 Part A Magical Toys Sdn. Bhd. sales slumped badly in 2018 due to so many people purchasing gifts online. The company's income statement showed the following results from selling 500,000 units of toys: net sales RM2,125,000; total costs and expenses RM2,500,000; and net loss RM375,000. Costs and expenses consist of the following: Total (RM) Variable (RM) Fixed (RM) Cost of goods sold 2,000,000 1,300,000 700,000 Selling expenses 200,000 50,000 150,000 Administrative expenses 300,000 150,000 150,000 Total 2,500,000 1,500,000 1,000,000 Continued... PNIR BACIO54 PRINCIPLES OF MANAGEMENT ACCOUNTING 11 MARCH 2021 For the year 2019, the management of Magical Toys is considering to purchase a new automated equipment . By operating this new equipment, the company is going to change the proportion between variable and fixed expenses to 45%:55%. Required: (a) Compute contribution margin and contribution margin ratio for the year 2018. (3 marks) (b) Compute break even sales for the year 2018. (1 marks) (c) Should the management decide to proceed with its plan, compute the break-even sales for 2019. (6 marks) Part B The budget components for Pitanga Company for the quarter ended June 30 appear below. Pitanga sells trash cans for RM12 each. Budgeted sales and production for the next three months are: Sales Production April 20,000 units 26,000 units May 50,000 units 46,000 units June 30,000 units 29,000 units Pitanga desires to have trash cans on hand at the end of each month equal to 20 percent of the following month's budgeted sales in units. On March 31, Pitanga had 4,000 completed units on hand. Five pounds of plastic are required for each trash can. At the end of each month, Pitanga desires to have 10 percent of the following month's production material needs on hand. At March 31, Pitanga had 13,000 pounds of plastic on hand. The materials used in production cost RM0.60 per pound. Each trash can produced requires 0.10 hours of direct labor Required: Prepare direct materials budget and demonstrate how much the materials purchases will be for the month ending April 30. (10 marks) Part B Rhubarb Berhad budgeted 10,000 widgets for production during 2019. The company has capacity to produce 12,000 units. The following estimated costs were provided: RM Direct materials (RM6 per unit) 60,000 Direct labour (RM15 per hour x 2 hours per unit) 300,000 Variable manufacturing overhead (RM3 per unit) 30,000 Fixed manufacturing overhead (RM4 per unit) 40,000 Required: Rhubarb Berhad received an order from a new customer who offers to purchase 1,000 widgets for a price of RM41 per widget. Demonstrate whether the company should accept the order or not? (8 marks) TOTAL 20 MARKS

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started