Question 2:

Question 2:

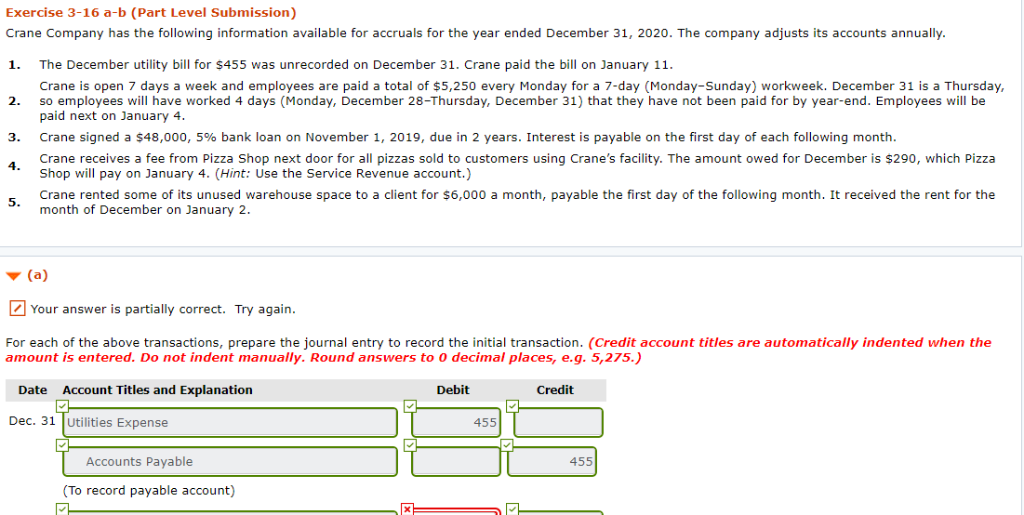

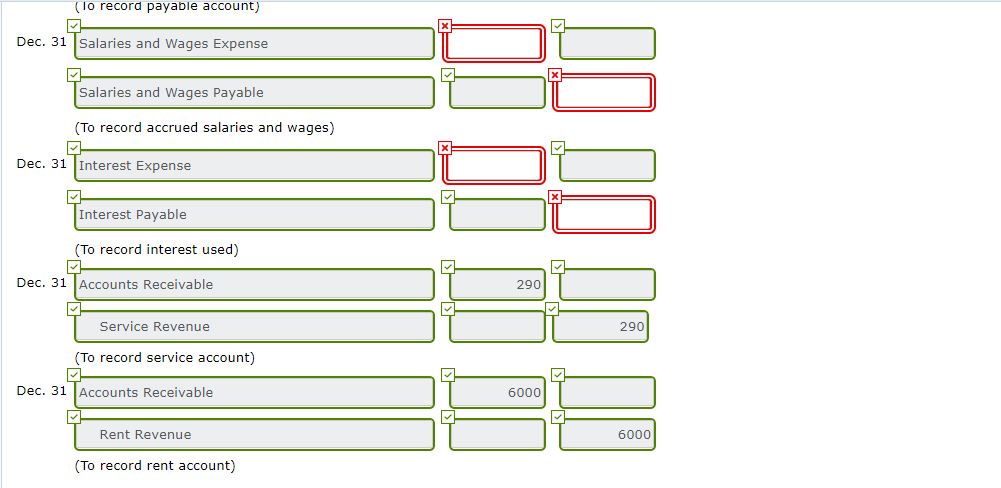

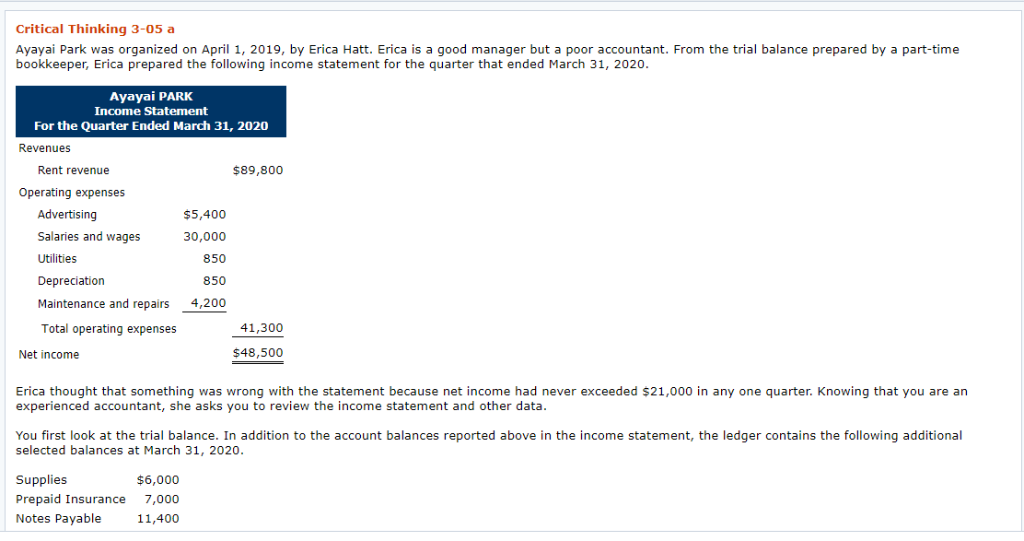

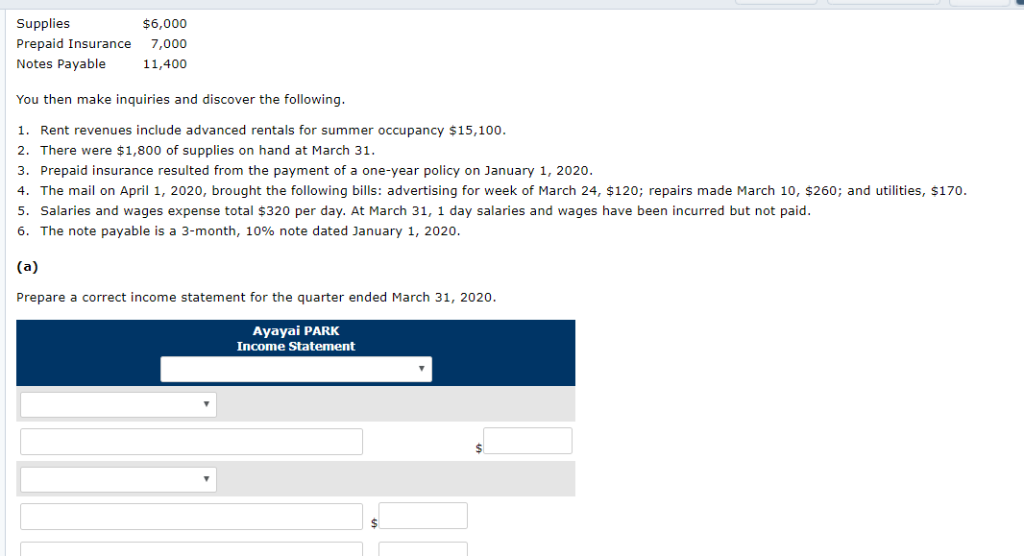

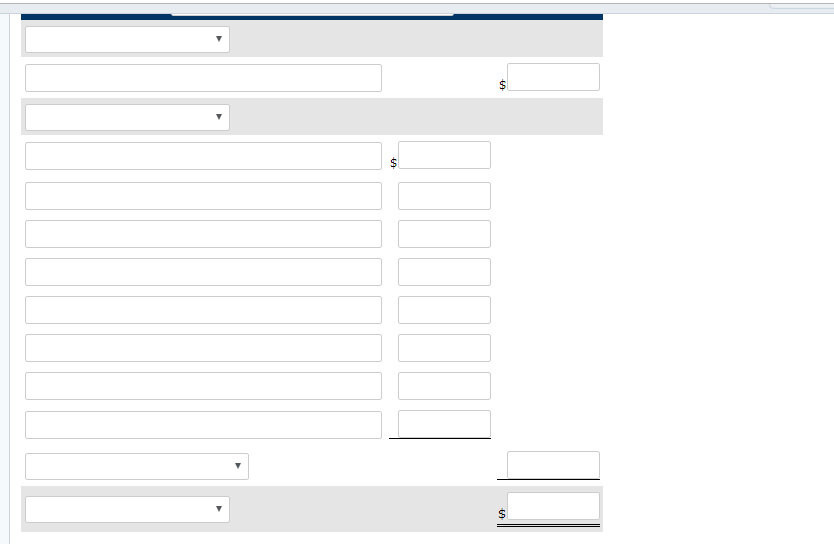

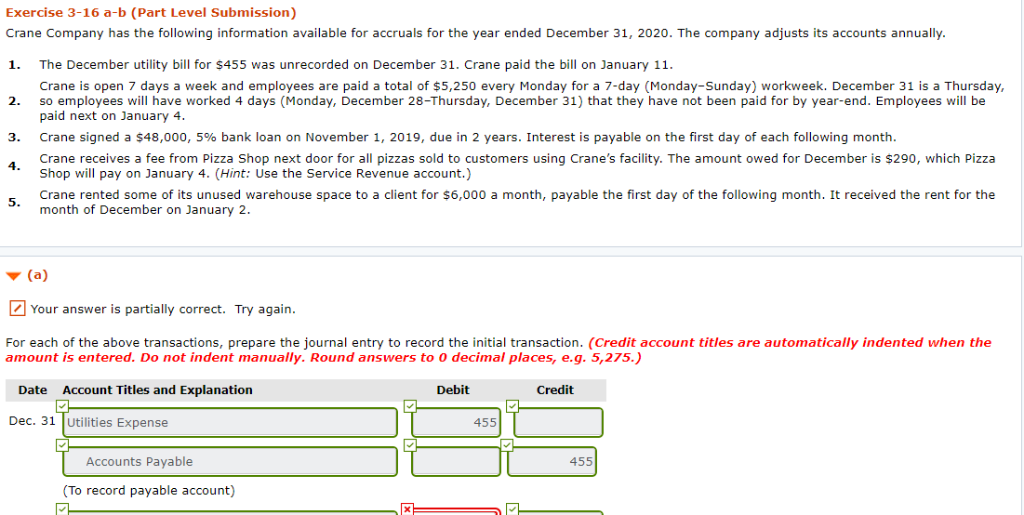

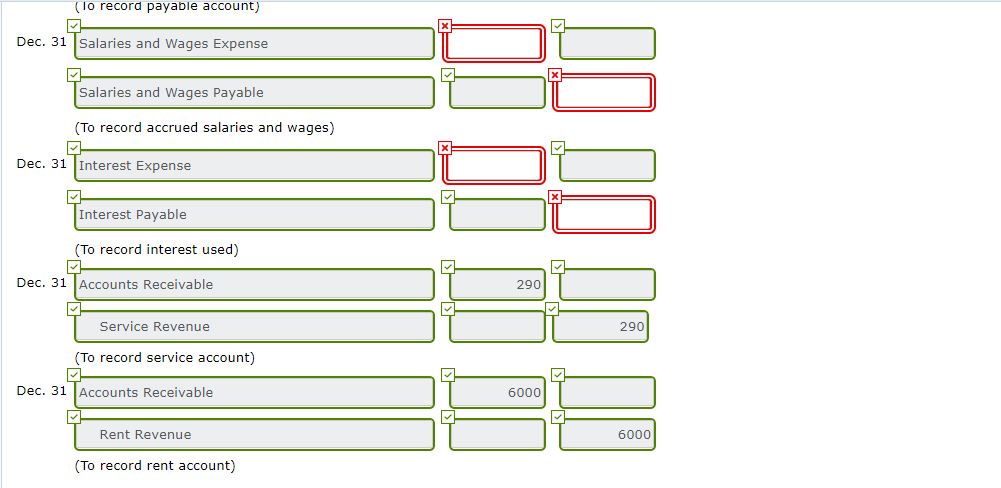

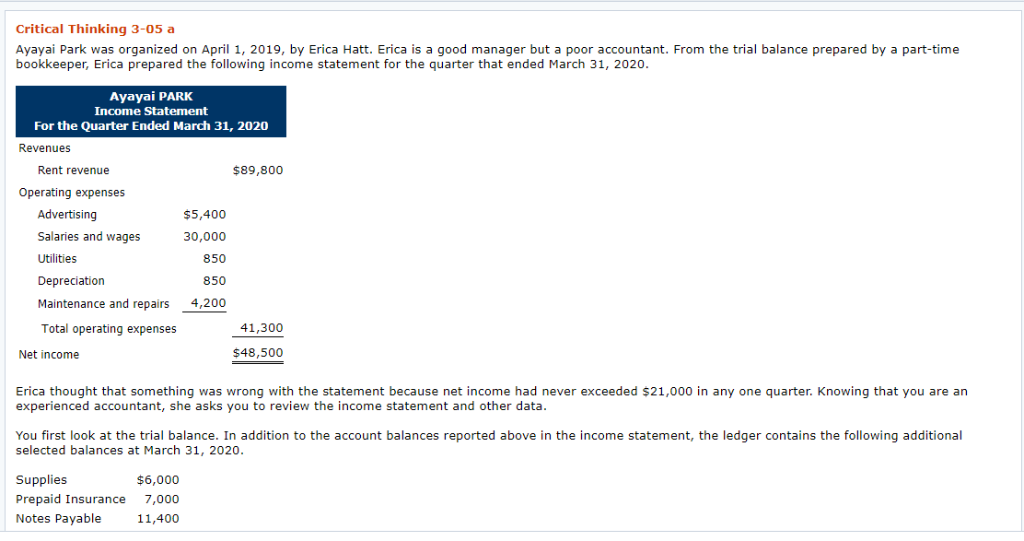

Critical Thinking 3-05 a Ayayai Park was organized on April 1, 2019, by Erica Hatt. Erica is a good manager but a poor accountant. From the trial baance prepared by a part-time bookkeeper, Erica prepared the following income statement for the quarter that ended March 31, 2020 Ayaya PARK Income Statement For the Quarter Ended March 31, 2020 Revenues Rent revenue $89,800 Operating expenses Advertising Salaries ad wages Utilities Depreciation Maintenance and repairs Total operating expenses $5,400 30,000 850 850 4,200 41,300 Net income $48,500 Erica thought that something was wrong with the statement because net income had never exceeded $21,000 in any one quarter. Knowing that you are an experienced accountant, she asks you to review the income statement and other data You first look at the trial balance. In addition to the account balances reported above in the income statement, the ledger contains the following additional selected balances at March 31, 2020 Supplies Prepaid Insurance Notes Payable $6,000 7,000 11,400 Supplies Prepaid Insurance 7,000 Notes Payable 11,400 $6,000 You then make inquiries and discover the following 1. Rent revenues include advanced rentals for summer occupancy $15,10o. 2. There were $1,800 of supplies on hand at March 31. 3. Prepaid insurance resulted from the payment of a one-year policy on January 1, 2020. 4. The mail on April 1, 2020, brought the following bills: advertising for week of March 24, $120; repairs made March 10, $260; and utities, $170. 5. Salaries and wages expense total $320 per day. At March 31, 1 day salaries and wages have been incurred but not paid. 6. The note payable is a 3-month, 10% note dated January 1, 2020. Prepare a correct income statement for the quarter ended March 31, 2020 Ayayai PARK Income Statement Exercise 3-16 a-b (Part Level Submission) Crane Company has the following informanlable for accruals for the year ended December 31, 2020. The company adjusts its accounts annually. 1. The December utility bill for $455 was unrecorded on December 31. Crane paid the bill on January 11 2. so employees will have worked 4 days (Monday, December 28-Thursday, December 31) that they have not been paid for by year-end. Employees will be 3. Crane signed a $48,000, 5% bank loan on November 1, 2019, due in 2 years. Interest is payable on the first day of each following month. 4. Crane is open 7 days a week and employees are paid a total of $5,250 every Monday for a 7-day (Monday-Sunday) workweek. December 31 is a Thursday, paid next on January 4. Crane receives a fee from Pizza Shop next door for all pizzas sold to customers using Crane's facility. The amount owed for December is $290, which Pizza Shop will pay on January 4. (Hint: Use the Service Revenue account.) Crane rented some of its unused warehouse space to a client for $6,000 a month, payable the first day of the following month. It received the rent for the month of December on January 2. 5. Your answer is partially correct. Try again. For each of the above transactions, prepare the journal entry to record the initial transaction. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to o decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit Credit Dec. 31 Utilities Expense 455 Accounts Payable 455 (To record payable account) (To record payabie account) Dec. 31 Salaries and Wages Expense Salaries and Wages Payable To record accrued salaries and wages) Dec. 31 Interest Expense Interest Payable (To record interest used) Dec. 31 Accounts Receivable 290 Service Revenue 290 To record service account) Dec. 31 Accounts Receivable 6000 Rent Revenue 6000 To record rent account)

Question 2:

Question 2: