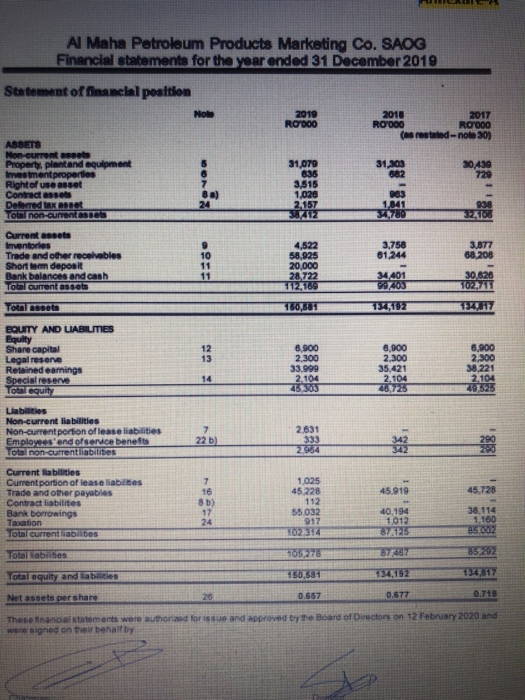

Question #2. Critically analyse the variance conditions when ratio analysis cannot be an efficient method for prudent financial decision making. (5 Marks) Question # 3. Assume that Al-Hassan Engineering Oman is involved in local and export business with subcontinent countries India, Pakistan and Bangladesh. In the tough domestic and international business competition, Al-Hassan Engineering is facing different industrial, international, domestic and firm-specific risks. Required: In view of facing above risks, what prudent strategies should be adopted by the management of Al-Hassan Engineering for its survival and consistent growth? (answer this question in bullets rather in paragraph) Al Maha Petroleum Products Marketing Co. SAOG Financial statements for the year ended 31 December 2019 Statement of financial position Nobe 2010 Roc 2010 2017 RU HT000 (srestate-nola 30) 31.303 882 30 430 729 ASSETS Non-current evet Property, plantand equipment mestment properties Right of use asset Contractesses Deferred tax asset Tournon-current ses 7 8 a) 24 31,070 836 3,516 1.020 2.157 3512 083 1,841 930 S2100 3.758 61 244 3,877 68.208 Current assets mentories Trade and other receivables Short term deposit Rank balances and cash Total current assets 10 11 4,522 58,925 20,000 28,722 112,160 34,401 0403 30,626 102,711 Total asset 150,601 1345102 134,017 12 13 EQUITY AND LIABILMES Equity Share capital Legal reserve Retained earnings Special reserve Totguit Liabilities Non-current liabilities Non-current portion of lease liabilities Employees' end of service benefits ote non currentliabilities 8.900 2.300 33.999 2,104 2633 6.900 2.300 35.421 2,104 46,7255 6,900 2,300 38.221 2,104 20023 14 22b) 2.631 333 2934 200 45.910 45.728 Current liabilities Current portion of lease liabilities Trade and other payables Contract liabilities Bank borrowings Taxation Total current liabilities 7 16 8b) 17 24 1.025 45.228 112 55.032 917 102,314 40,194 1012 38,114 1.160 85002 tarbies 105278 87287 85202 150,587 Total equity and liabilities 134,192 734,817 Net assets per share 0.667 0.677 0.718 These financial statements were authored for issue and approved by the Board of Directors on 12 February 2020 and were signed on their behalf by Question #2. Critically analyse the variance conditions when ratio analysis cannot be an efficient method for prudent financial decision making. (5 Marks) Question # 3. Assume that Al-Hassan Engineering Oman is involved in local and export business with subcontinent countries India, Pakistan and Bangladesh. In the tough domestic and international business competition, Al-Hassan Engineering is facing different industrial, international, domestic and firm-specific risks. Required: In view of facing above risks, what prudent strategies should be adopted by the management of Al-Hassan Engineering for its survival and consistent growth? (answer this question in bullets rather in paragraph) Al Maha Petroleum Products Marketing Co. SAOG Financial statements for the year ended 31 December 2019 Statement of financial position Nobe 2010 Roc 2010 2017 RU HT000 (srestate-nola 30) 31.303 882 30 430 729 ASSETS Non-current evet Property, plantand equipment mestment properties Right of use asset Contractesses Deferred tax asset Tournon-current ses 7 8 a) 24 31,070 836 3,516 1.020 2.157 3512 083 1,841 930 S2100 3.758 61 244 3,877 68.208 Current assets mentories Trade and other receivables Short term deposit Rank balances and cash Total current assets 10 11 4,522 58,925 20,000 28,722 112,160 34,401 0403 30,626 102,711 Total asset 150,601 1345102 134,017 12 13 EQUITY AND LIABILMES Equity Share capital Legal reserve Retained earnings Special reserve Totguit Liabilities Non-current liabilities Non-current portion of lease liabilities Employees' end of service benefits ote non currentliabilities 8.900 2.300 33.999 2,104 2633 6.900 2.300 35.421 2,104 46,7255 6,900 2,300 38.221 2,104 20023 14 22b) 2.631 333 2934 200 45.910 45.728 Current liabilities Current portion of lease liabilities Trade and other payables Contract liabilities Bank borrowings Taxation Total current liabilities 7 16 8b) 17 24 1.025 45.228 112 55.032 917 102,314 40,194 1012 38,114 1.160 85002 tarbies 105278 87287 85202 150,587 Total equity and liabilities 134,192 734,817 Net assets per share 0.667 0.677 0.718 These financial statements were authored for issue and approved by the Board of Directors on 12 February 2020 and were signed on their behalf by