Question

Question 2. DCF Analysis (2 Points) Assume that Kims Inc. has the following expected future free cash flows (FFCFs). Year 1 2 3 4 5

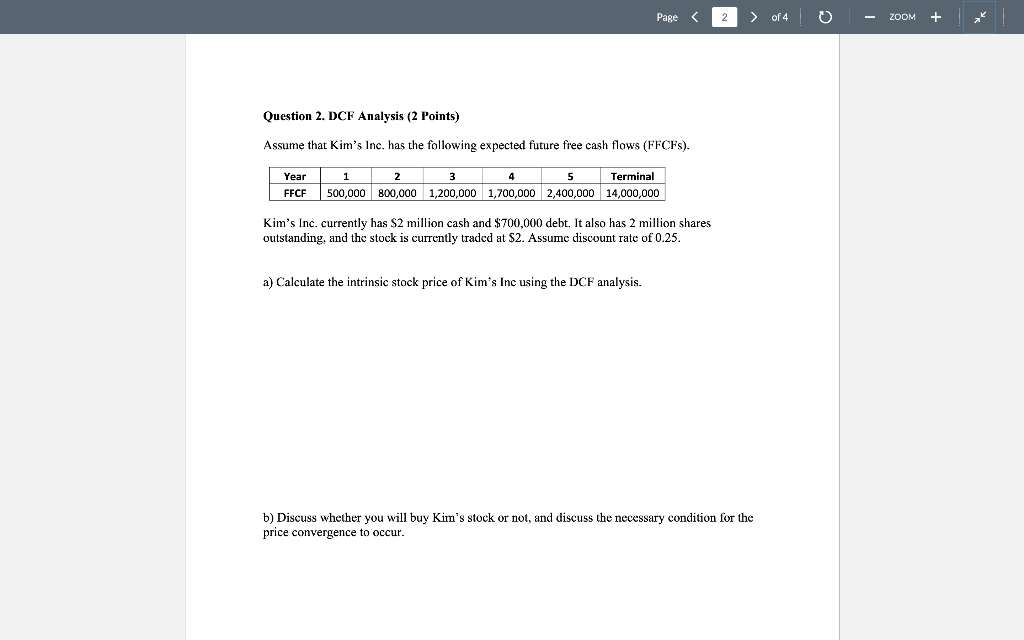

Question 2. DCF Analysis (2 Points)

Assume that Kims Inc. has the following expected future free cash flows (FFCFs). Year 1 2 3 4 5 Terminal FFCF 500,000 800,000 1,200,000 1,700,000 2,400,000 14,000,000 Kims Inc. currently has $2 million cash and $700,000 debt. It also has 2 million shares outstanding, and the stock is currently traded at $2. Assume discount rate of 0.25.

a) Calculate the intrinsic stock price of Kims Inc using the DCF analysis.

b) Discuss whether you will buy Kims stock or not, and discuss the necessary condition for the price convergence to occur.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started