Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 2 Depreciation and overhauls GST version Branson Ltd owns two delivery vehicles (each with a residual value of $5,000 and useful life of 4

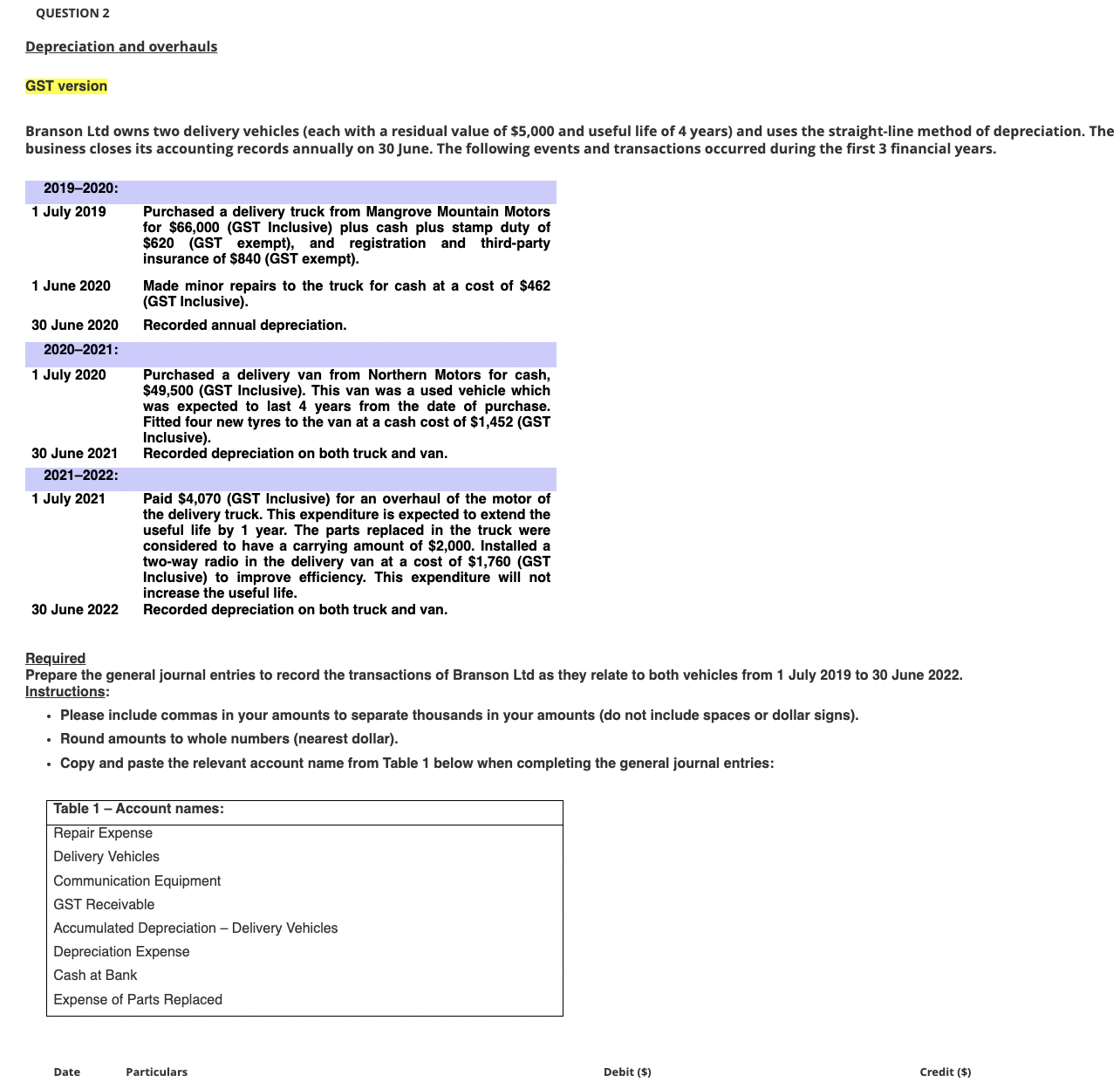

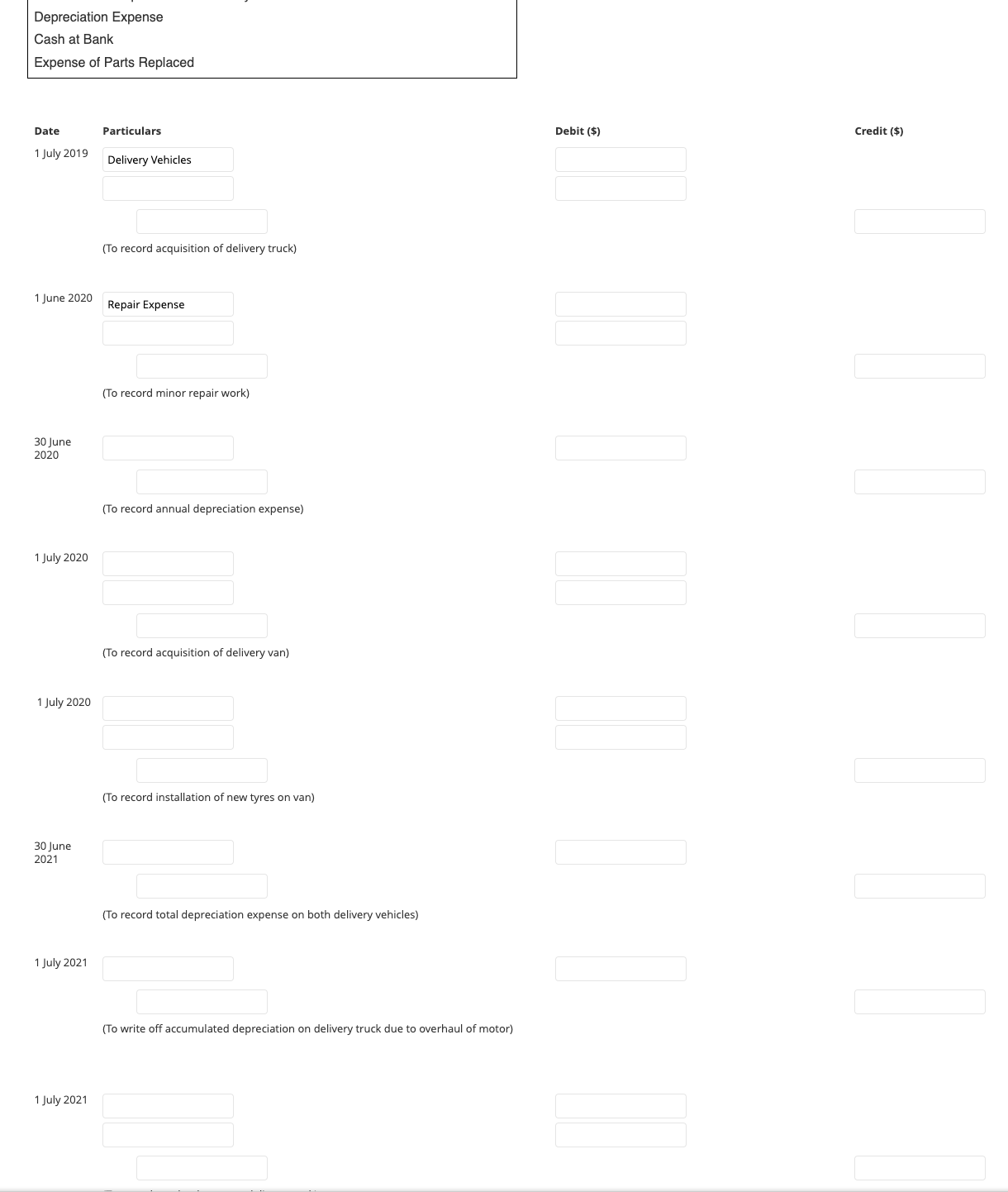

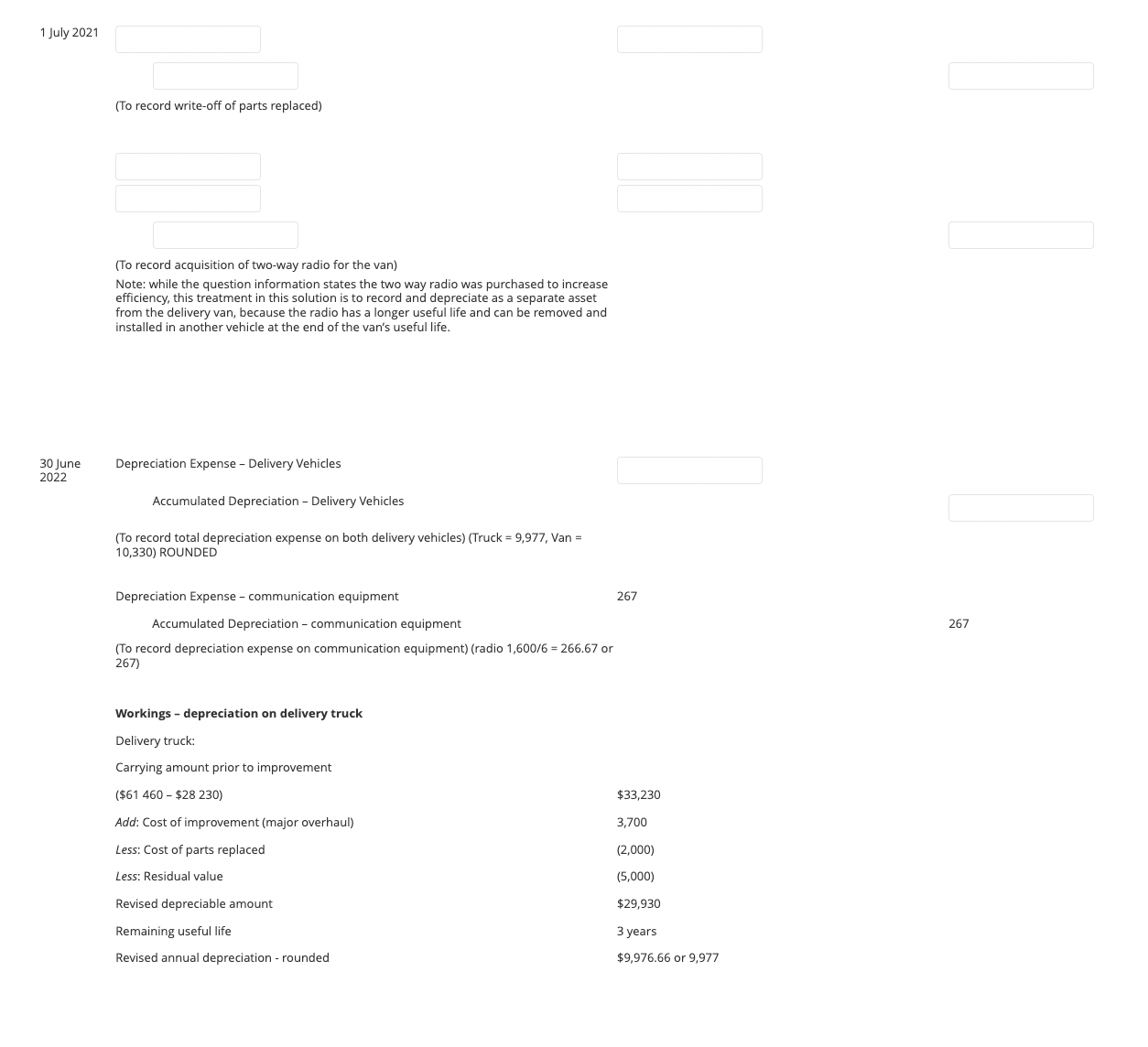

QUESTION 2 Depreciation and overhauls GST version Branson Ltd owns two delivery vehicles (each with a residual value of $5,000 and useful life of 4 years) and uses the straight-line method of depreciation. The business closes its accounting records annually on 30 June. The following events and transactions occurred during the first 3 financial years. Required Prepare the general journal entries to record the transactions of Branson Ltd as they relate to both vehicles from 1 July 2019 to 30 June 2022. Instructions: - Please include commas in your amounts to separate thousands in your amounts (do not include spaces or dollar signs). - Round amounts to whole numbers (nearest dollar). - Copy and paste the relevant account name from Table 1 below when completing the general journal entries: Depreciation Expense Cash at Bank Expense of Parts Replaced Date Particulars 1 July 2019 Delivery Vehicles (To record acquisition of delivery truck) 1 June 2020 Repair Expense (To record minor repair work) 30 June 2020 1 July 2020 1 July 2020 (To record annual depreciation expense) (To record acquisition of delivery van) (To record installation of new tyres on van) 30 June 2021 (To record total depreciation expense on both delivery vehicles) 1 July 2021 (To write off accumulated depreciation on delivery truck due to overhaul of motor) Debit (\$) Credit (\$) (To record write-off of parts replaced) (To record acquisition of two-way radio for the van) Note: while the question information states the two way radio was purchased to increase efficiency, this treatment in this solution is to record and depreciate as a separate asset from the delivery van, because the radio has a longer useful life and can be removed and installed in another vehicle at the end of the van's useful life. QUESTION 2 Depreciation and overhauls GST version Branson Ltd owns two delivery vehicles (each with a residual value of $5,000 and useful life of 4 years) and uses the straight-line method of depreciation. The business closes its accounting records annually on 30 June. The following events and transactions occurred during the first 3 financial years. Required Prepare the general journal entries to record the transactions of Branson Ltd as they relate to both vehicles from 1 July 2019 to 30 June 2022. Instructions: - Please include commas in your amounts to separate thousands in your amounts (do not include spaces or dollar signs). - Round amounts to whole numbers (nearest dollar). - Copy and paste the relevant account name from Table 1 below when completing the general journal entries: Depreciation Expense Cash at Bank Expense of Parts Replaced Date Particulars 1 July 2019 Delivery Vehicles (To record acquisition of delivery truck) 1 June 2020 Repair Expense (To record minor repair work) 30 June 2020 1 July 2020 1 July 2020 (To record annual depreciation expense) (To record acquisition of delivery van) (To record installation of new tyres on van) 30 June 2021 (To record total depreciation expense on both delivery vehicles) 1 July 2021 (To write off accumulated depreciation on delivery truck due to overhaul of motor) Debit (\$) Credit (\$) (To record write-off of parts replaced) (To record acquisition of two-way radio for the van) Note: while the question information states the two way radio was purchased to increase efficiency, this treatment in this solution is to record and depreciate as a separate asset from the delivery van, because the radio has a longer useful life and can be removed and installed in another vehicle at the end of the van's useful life

QUESTION 2 Depreciation and overhauls GST version Branson Ltd owns two delivery vehicles (each with a residual value of $5,000 and useful life of 4 years) and uses the straight-line method of depreciation. The business closes its accounting records annually on 30 June. The following events and transactions occurred during the first 3 financial years. Required Prepare the general journal entries to record the transactions of Branson Ltd as they relate to both vehicles from 1 July 2019 to 30 June 2022. Instructions: - Please include commas in your amounts to separate thousands in your amounts (do not include spaces or dollar signs). - Round amounts to whole numbers (nearest dollar). - Copy and paste the relevant account name from Table 1 below when completing the general journal entries: Depreciation Expense Cash at Bank Expense of Parts Replaced Date Particulars 1 July 2019 Delivery Vehicles (To record acquisition of delivery truck) 1 June 2020 Repair Expense (To record minor repair work) 30 June 2020 1 July 2020 1 July 2020 (To record annual depreciation expense) (To record acquisition of delivery van) (To record installation of new tyres on van) 30 June 2021 (To record total depreciation expense on both delivery vehicles) 1 July 2021 (To write off accumulated depreciation on delivery truck due to overhaul of motor) Debit (\$) Credit (\$) (To record write-off of parts replaced) (To record acquisition of two-way radio for the van) Note: while the question information states the two way radio was purchased to increase efficiency, this treatment in this solution is to record and depreciate as a separate asset from the delivery van, because the radio has a longer useful life and can be removed and installed in another vehicle at the end of the van's useful life. QUESTION 2 Depreciation and overhauls GST version Branson Ltd owns two delivery vehicles (each with a residual value of $5,000 and useful life of 4 years) and uses the straight-line method of depreciation. The business closes its accounting records annually on 30 June. The following events and transactions occurred during the first 3 financial years. Required Prepare the general journal entries to record the transactions of Branson Ltd as they relate to both vehicles from 1 July 2019 to 30 June 2022. Instructions: - Please include commas in your amounts to separate thousands in your amounts (do not include spaces or dollar signs). - Round amounts to whole numbers (nearest dollar). - Copy and paste the relevant account name from Table 1 below when completing the general journal entries: Depreciation Expense Cash at Bank Expense of Parts Replaced Date Particulars 1 July 2019 Delivery Vehicles (To record acquisition of delivery truck) 1 June 2020 Repair Expense (To record minor repair work) 30 June 2020 1 July 2020 1 July 2020 (To record annual depreciation expense) (To record acquisition of delivery van) (To record installation of new tyres on van) 30 June 2021 (To record total depreciation expense on both delivery vehicles) 1 July 2021 (To write off accumulated depreciation on delivery truck due to overhaul of motor) Debit (\$) Credit (\$) (To record write-off of parts replaced) (To record acquisition of two-way radio for the van) Note: while the question information states the two way radio was purchased to increase efficiency, this treatment in this solution is to record and depreciate as a separate asset from the delivery van, because the radio has a longer useful life and can be removed and installed in another vehicle at the end of the van's useful life Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started