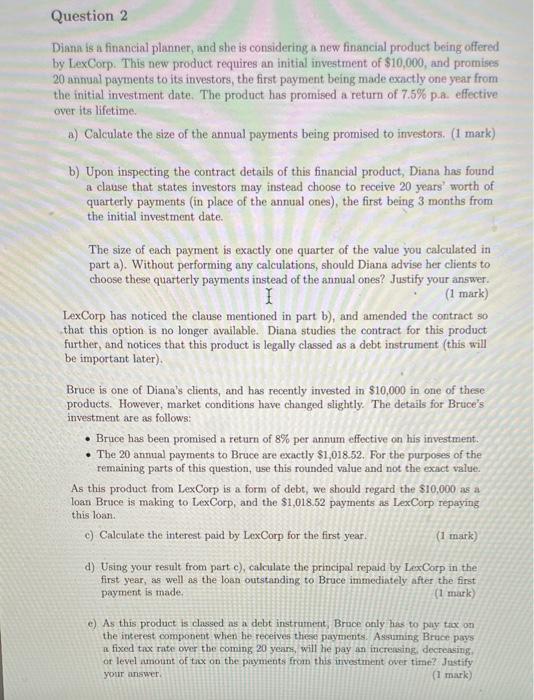

Question 2 Diana is a financial planner, and she is considering a new financial product being offered by LexCorp. This new product requires an initial investment of $10,000, and promises 20 annual payments to its investors, the first payment being made exactly one year from the initial investment date. The product has promised a return of 7.5% p.effective over its lifetime a) Calculate the size of the annual payments being promised to investors. (1 mark) b) Upon inspecting the contract details of this financial product, Diana has found a clause that states investors may instead choose to receive 20 years' worth of quarterly payments (in place of the annual ones), the first being 3 months from the initial investment date. The size of each payment is exactly one quarter of the value you calculated in part a). Without performing any calculations, should Diana advise her clients to choose these quarterly payments instead of the annual ones? Justify your answer. (1 mark) LexCorp has noticed the clause mentioned in part b), and amended the contract so that this option is no longer available. Diana studies the contract for this product further, and notices that this product is legally classed as a debt instrument (this will be important later) a Bruce is one of Diana's clients, and has recently invested in $10,000 in one of these products. However, market conditions have changed slightly. The details for Bruce's investment are as follows: Bruce has been promised a return of 8% per annum effective on his investment. The 20 annual payments to Bruce are exactly $1,018.52. For the purposes of the remaining parts of this question, use this rounded value and not the exact value. As this product from LexCorp is a form of debt, we should regard the $10,000 as a loan Bruce is making to LexCorp, and the $1,018.52 payments as LexCorp repaying this loan. c) Calculate the interest paid by LexCorp for the first year, (1 mark) d) Using your result from part c), calculate the principal repaid by LexCorp in the first year, as well as the loan outstanding to Bruce immediately after the first payment is made (1 mark) e) As this product is classed as a debt instrument, Bruce only has to pay tax on the interest component when he receives these payments. Assuming Bruce pays fixed tax rate over the coming 20 years, will he pay an increasing, decreasing or level amount of tax on the payments from this investment over time? Justify your answer (1 mark