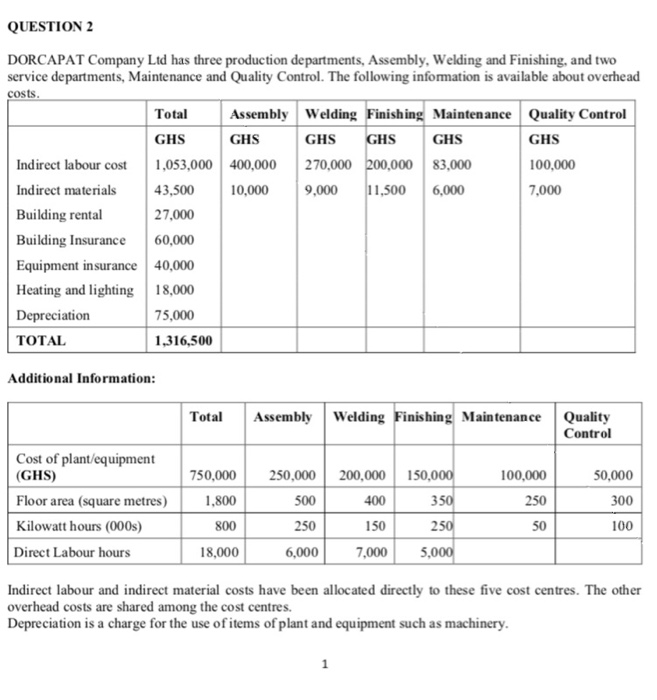

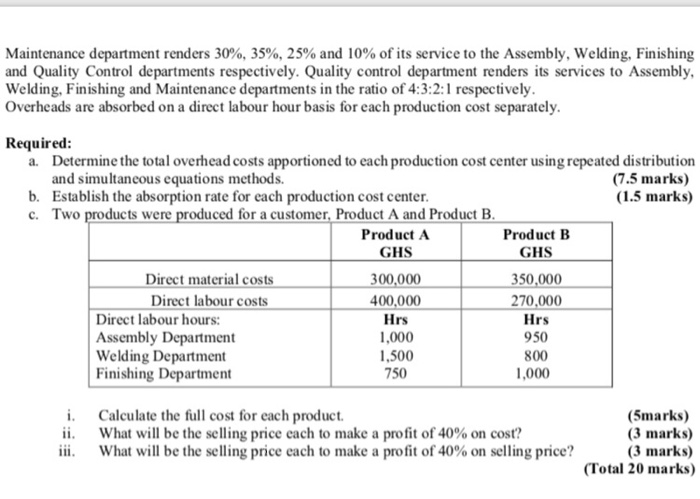

QUESTION 2 DORCAPAT Company Ltd has three production departments, Assembly, Welding and Finishing, and two service departments, Maintenance and Quality Control. The following information is available about overhead costs. Total Assembly Welding Finishing Maintenance Quality Control GHS GHS GHS GHS GHS GHS Indirect labour cost 1,053,000 400,000 270,000 200,000 83,000 100,000 Indirect materials 43,500 10,000 9,000 11,500 6,000 7,000 Building rental 27,000 Building Insurance 60,000 Equipment insurance 40,000 Heating and lighting 18,000 Depreciation 75,000 TOTAL 1,316,500 Additional Information: Total Assembly Welding Finishing Maintenance Quality Control Cost of plant/equipment (GHS) Floor area (square metres) Kilowatt hours (000s) Direct Labour hours 750,000 1,800 800 18,000 250,000 200,000 150,000 500 400 350 250 150 250 6,000 7,000 5,000 100,000 250 50 50,000 300 100 Indirect labour and indirect material costs have been allocated directly to these five cost centres. The other overhead costs are shared among the cost centres. Depreciation is a charge for the use of items of plant and equipment such as machinery. Maintenance department renders 30%, 35%, 25% and 10% of its service to the Assembly, Welding, Finishing and Quality Control departments respectively. Quality control department renders its services to Assembly, Welding, Finishing and Maintenance departments in the ratio of 4:3:2:1 respectively. Overheads are absorbed on a direct labour hour basis for each production cost separately. Required: . Determine the total overhead costs apportioned to each production cost center using repeated distribution and simultaneous equations methods. (7.5 marks) b. Establish the absorption rate for each production cost center. (1.5 marks) c. Two products were produced for a customer, Product A and Product B. Product A Product B GHS GHS Direct material costs 300,000 350,000 Direct labour costs 400,000 270,000 Direct labour hours: Hrs Hrs Assembly Department 950 Welding Department 1,500 800 Finishing Department 750 1,000 1,000 i. Calculate the full cost for each product ii. What will be the selling price each to make a profit of 40% on cost? What will be the selling price each to make a profit of 40% on selling price? (5marks) (3 marks) (3 marks) (Total 20 marks)