Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 Efficient Market Hypothesis (EMH) essentially says that all known information about investment securities, such as stocks, is already factored into the prices

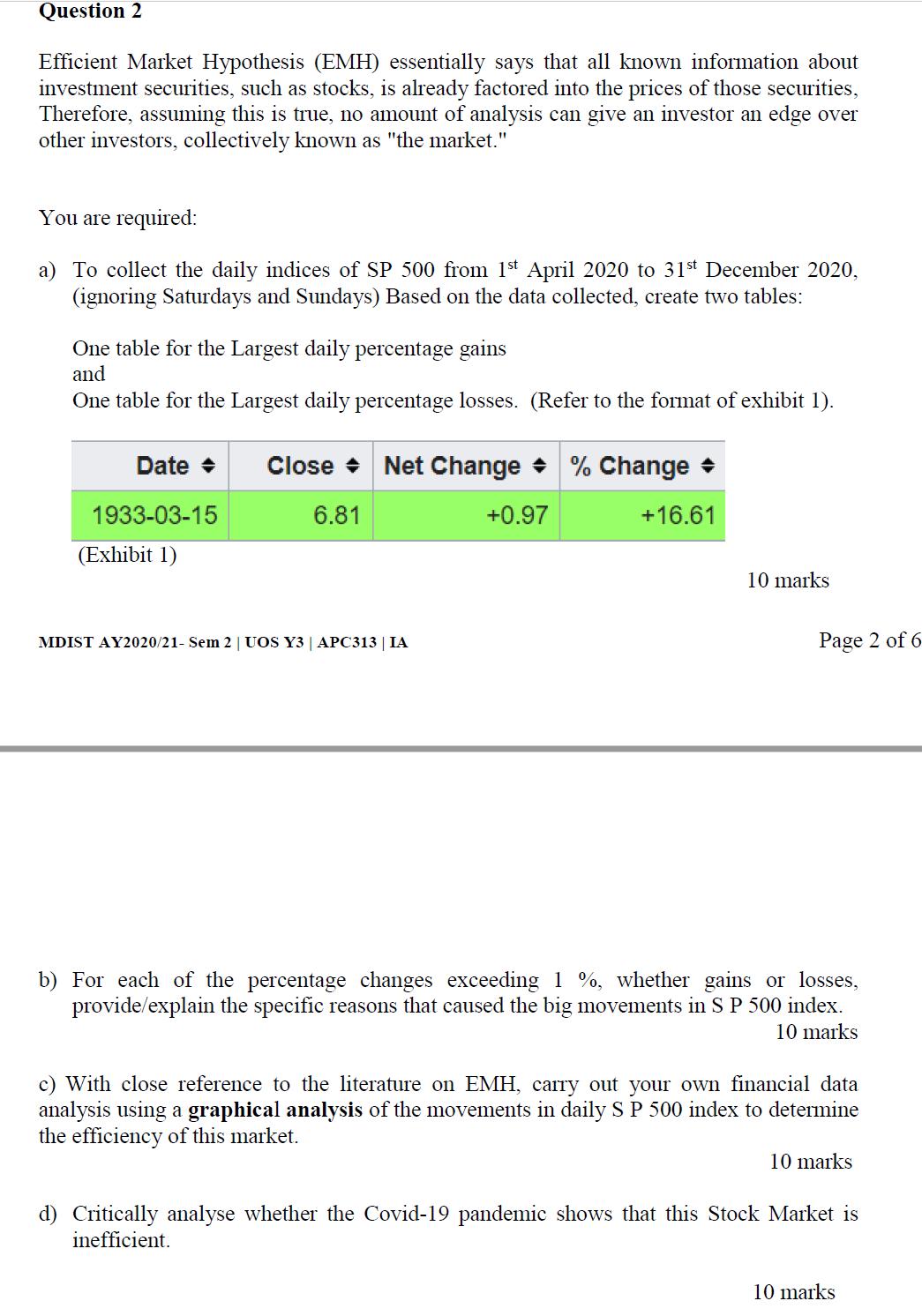

Question 2 Efficient Market Hypothesis (EMH) essentially says that all known information about investment securities, such as stocks, is already factored into the prices of those securities, Therefore, assuming this is true, no amount of analysis can give an investor an edge over other investors, collectively known as "the market." You are required: a) To collect the daily indices of SP 500 from 1st April 2020 to 31st December 2020, (ignoring Saturdays and Sundays) Based on the data collected, create two tables: One table for the Largest daily percentage gains and One table for the Largest daily percentage losses. (Refer to the format of exhibit 1). Close Net Change % Change 6.81 +16.61 Date + 1933-03-15 (Exhibit 1) MDIST AY2020/21- Sem 2 | UOS Y3 | APC313 | IA +0.97 10 marks Page 2 of 6 b) For each of the percentage changes exceeding 1%, whether gains or losses, provide/explain the specific reasons that caused the big movements in S P 500 index. 10 marks c) With close reference to the literature on EMH, carry out your own financial data analysis using a graphical analysis of the movements in daily S P 500 index to determine the efficiency of this market. 10 marks d) Critically analyse whether the Covid-19 pandemic shows that this Stock Market is inefficient. 10 marks

Step by Step Solution

★★★★★

3.28 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a To collect the daily indices of SP 500 from 1st April 2020 to 31st December 2020 ignoring Saturdays and Sundays Based on the data collected create two tables One table for the Largest daily percenta...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started