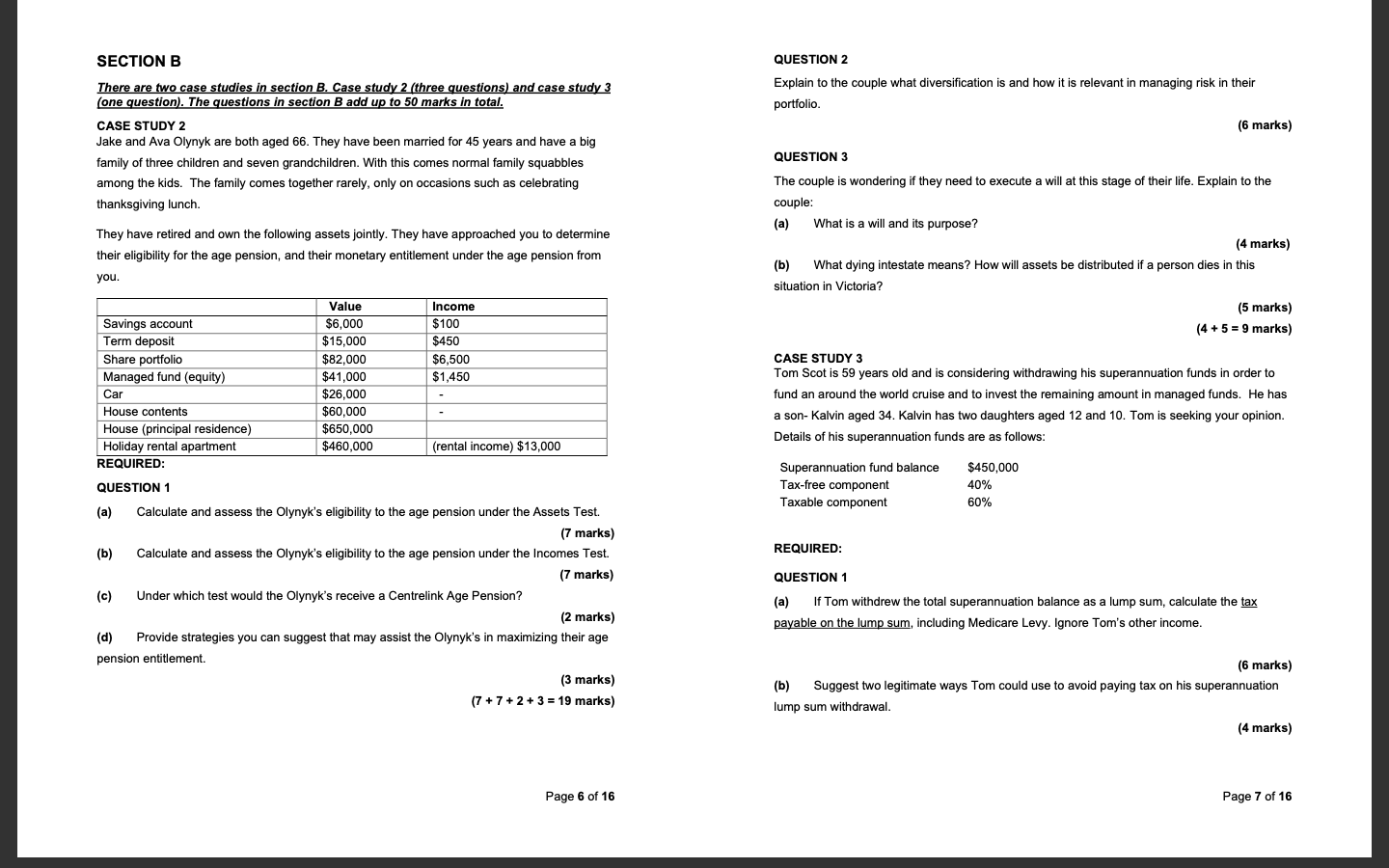

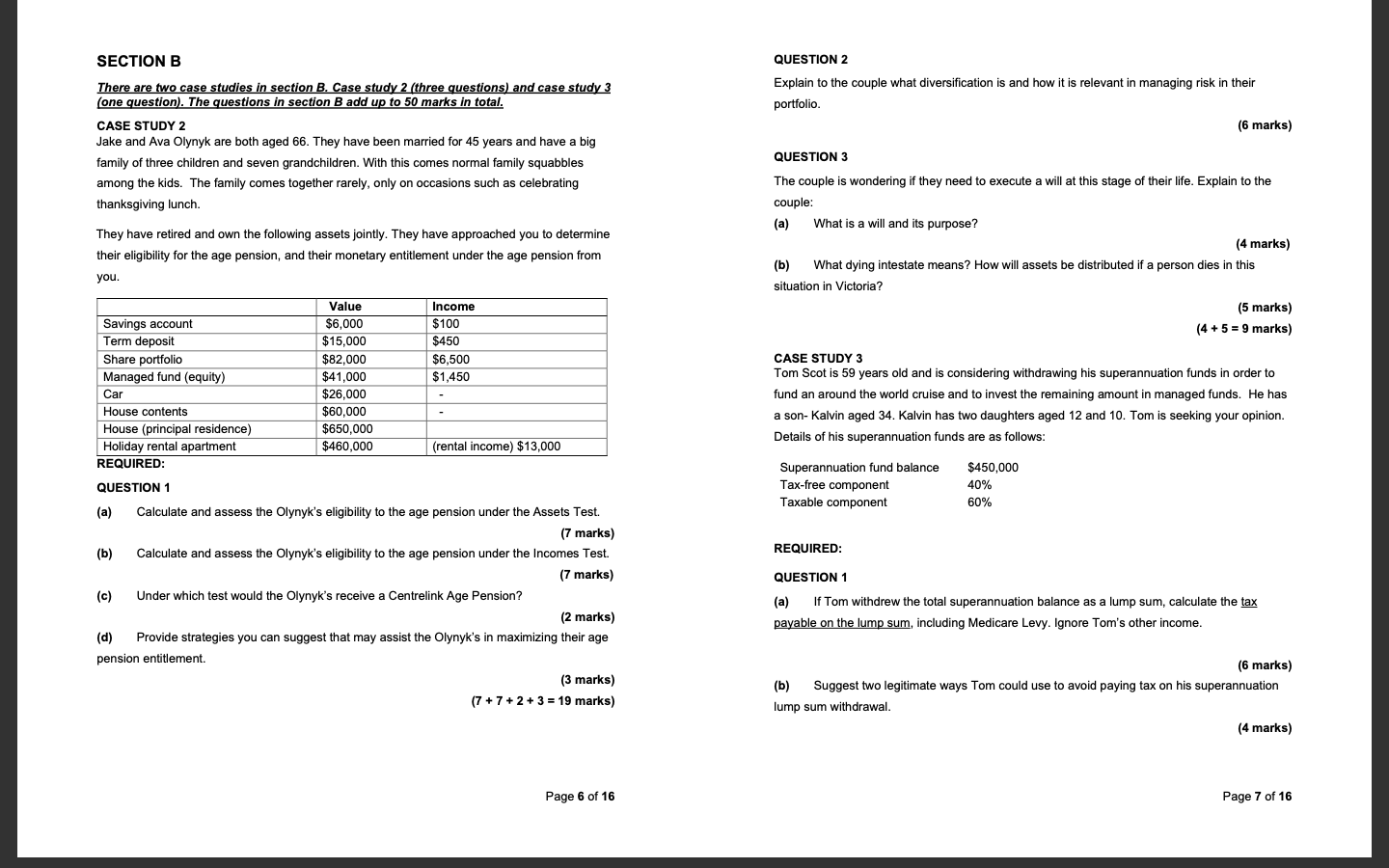

QUESTION 2 Explain to the couple what diversification is and how it is relevant in managing risk in their portfolio. (6 marks) SECTION B There are two case studies in section B. Case study 2 (three questions) and case study 3 (one question). The questions in section B add up to 50 marks in total. CASE STUDY 2 Jake and Ava Olynyk are both aged 66. They have been married for 45 years and have a big family of three children and seven grandchildren. With this comes normal family squabbles among the kids. The family comes together rarely, only on occasions such as celebrating thanksgiving lunch. QUESTION 3 They have retired and own the following assets jointly. They have approached you to determine their eligibility for the age pension, and their monetary entitlement under the age pension from you. The couple is wondering if they need to execute a will at this stage of their life. Explain to the couple: What is a will and its purpose? marks) (b) What dying intestate means? How will assets be distributed if a person dies in this situation in Victoria? (5 marks) (4 + 5 = 9 marks) Value $6,000 $15,000 $82,000 $41,000 $26,000 $60,000 $650,000 $460,000 Income $100 $450 $6,500 $1,450 Savings account Term deposit Share portfolio Managed fund (equity) Car House contents House (principal residence) Holiday rental apartment REQUIRED: CASE STUDY 3 Tom Scot is 59 years old and is considering withdrawing his superannuation funds in order to fund an around the world cruise and to invest the remaining amount in managed funds. He has a son- Kalvin aged 34. Kalvin has two daughters aged 12 and 10. Tom is seeking your opinion. Details of his superannuation funds are as follows: (rental income) QUESTION 1 Superannuation fund balance Tax-free component Taxable component $450,000 40% 60% REQUIRED: QUESTION 1 (a) Calculate and assess the Olynyk's eligibility to the age pension under the Assets Test. (7 marks) (b) Calculate and assess the Olynyk's eligibility to the age pension under the Incomes Test. (7 marks) (c) Under which test would the Olynyk's receive a Centrelink Age Pension? (2 marks) (d) Provide strategies you can suggest that may assist the Olynyk's in maximizing their age pension entitlement. (3 marks) (7 + 7 + 2 + 3 = 19 marks) (a) If Tom withdrew the total superannuation balance as a lump sum, calculate the tax payable on the lump sum, including Medicare Levy. Ignore Tom's other income. (6 marks) (b) Suggest two legitimate ways Tom could use to avoid paying tax on his superannuation lump sum withdrawal. (4 marks) Page 6 of 16 Page 7 of 16 QUESTION 2 Explain to the couple what diversification is and how it is relevant in managing risk in their portfolio. (6 marks) SECTION B There are two case studies in section B. Case study 2 (three questions) and case study 3 (one question). The questions in section B add up to 50 marks in total. CASE STUDY 2 Jake and Ava Olynyk are both aged 66. They have been married for 45 years and have a big family of three children and seven grandchildren. With this comes normal family squabbles among the kids. The family comes together rarely, only on occasions such as celebrating thanksgiving lunch. QUESTION 3 They have retired and own the following assets jointly. They have approached you to determine their eligibility for the age pension, and their monetary entitlement under the age pension from you. The couple is wondering if they need to execute a will at this stage of their life. Explain to the couple: What is a will and its purpose? marks) (b) What dying intestate means? How will assets be distributed if a person dies in this situation in Victoria? (5 marks) (4 + 5 = 9 marks) Value $6,000 $15,000 $82,000 $41,000 $26,000 $60,000 $650,000 $460,000 Income $100 $450 $6,500 $1,450 Savings account Term deposit Share portfolio Managed fund (equity) Car House contents House (principal residence) Holiday rental apartment REQUIRED: CASE STUDY 3 Tom Scot is 59 years old and is considering withdrawing his superannuation funds in order to fund an around the world cruise and to invest the remaining amount in managed funds. He has a son- Kalvin aged 34. Kalvin has two daughters aged 12 and 10. Tom is seeking your opinion. Details of his superannuation funds are as follows: (rental income) QUESTION 1 Superannuation fund balance Tax-free component Taxable component $450,000 40% 60% REQUIRED: QUESTION 1 (a) Calculate and assess the Olynyk's eligibility to the age pension under the Assets Test. (7 marks) (b) Calculate and assess the Olynyk's eligibility to the age pension under the Incomes Test. (7 marks) (c) Under which test would the Olynyk's receive a Centrelink Age Pension? (2 marks) (d) Provide strategies you can suggest that may assist the Olynyk's in maximizing their age pension entitlement. (3 marks) (7 + 7 + 2 + 3 = 19 marks) (a) If Tom withdrew the total superannuation balance as a lump sum, calculate the tax payable on the lump sum, including Medicare Levy. Ignore Tom's other income. (6 marks) (b) Suggest two legitimate ways Tom could use to avoid paying tax on his superannuation lump sum withdrawal. (4 marks) Page 6 of 16 Page 7 of 16