Answered step by step

Verified Expert Solution

Question

1 Approved Answer

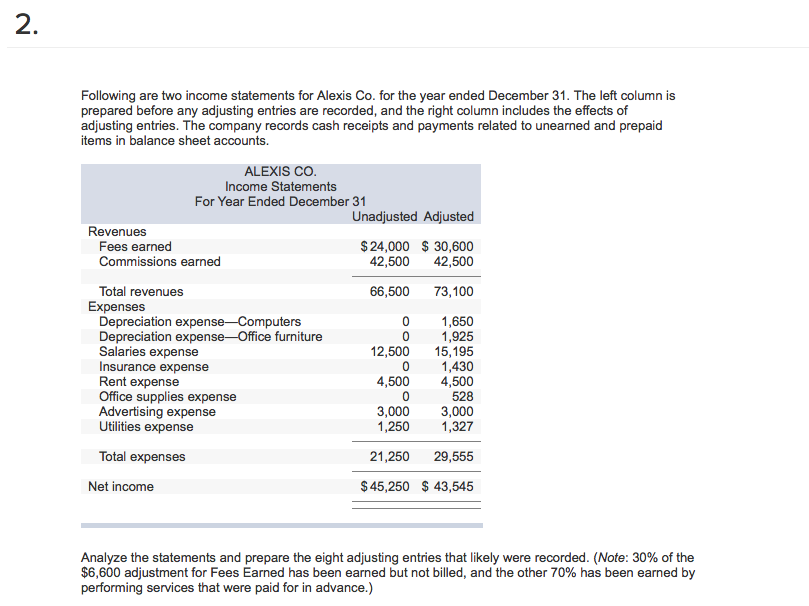

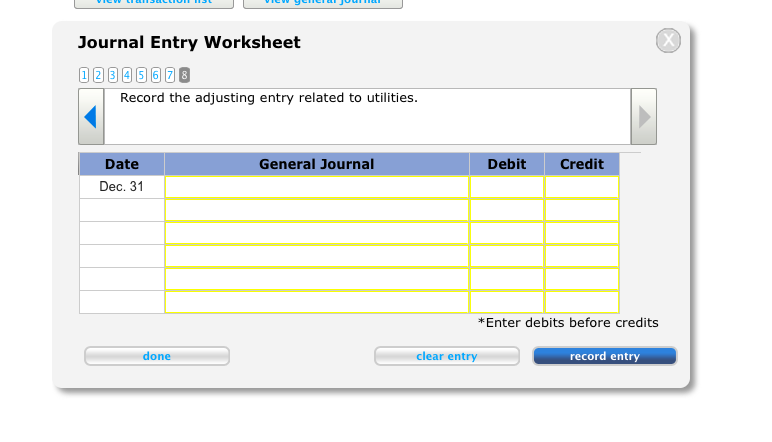

Question 2 Following are two income statements for Alexis Co. for the year ended December 31. The left column is prepared before any adjusting entries

Question 2

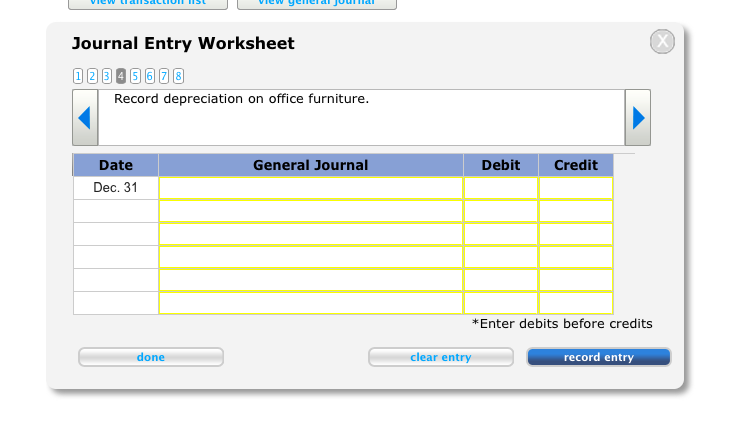

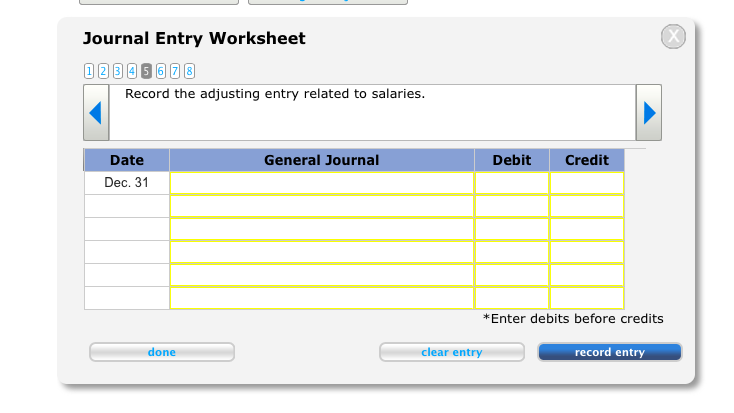

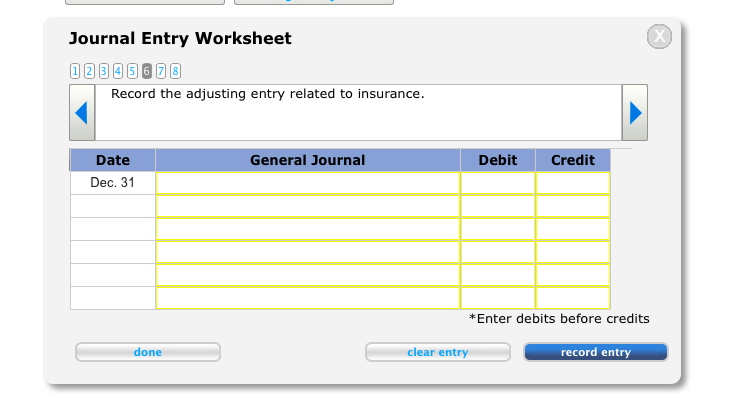

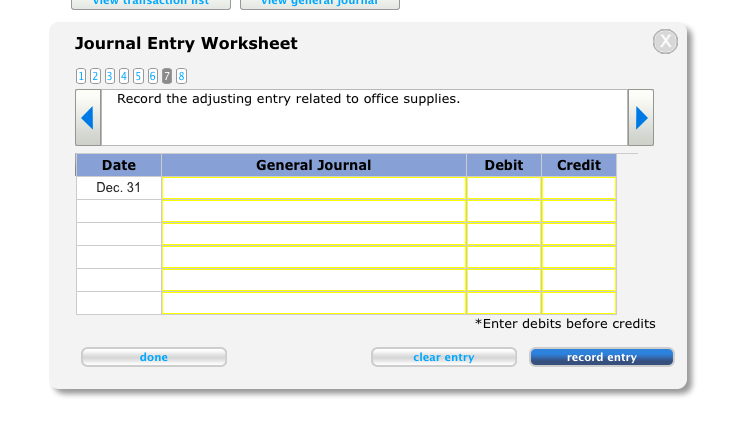

Step by Step Solution

There are 3 Steps involved in it

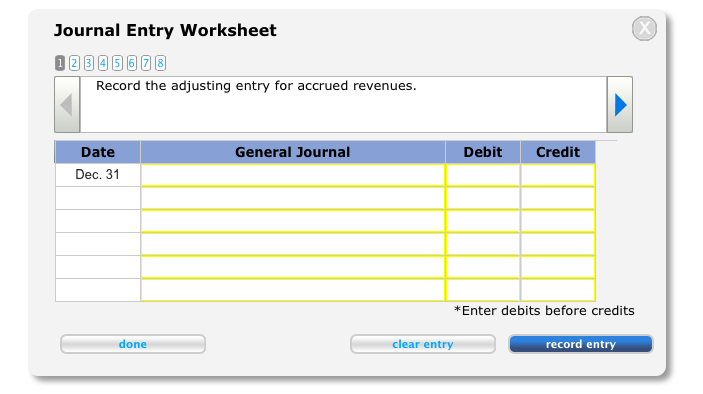

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

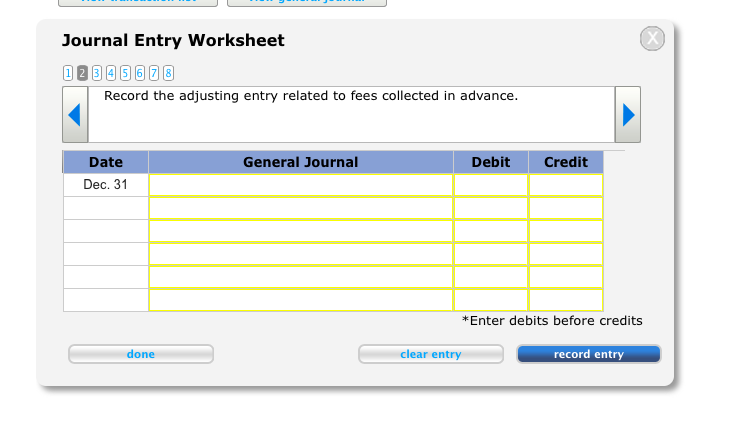

Step: 2

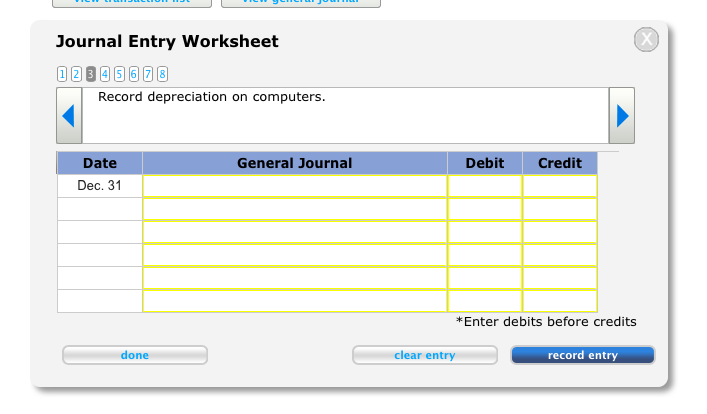

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started