Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 - Funding Pension Funds Read Article 1 and Article 3 in appendix before solving Q.2. The exercise below makes some simplifying assumptions to

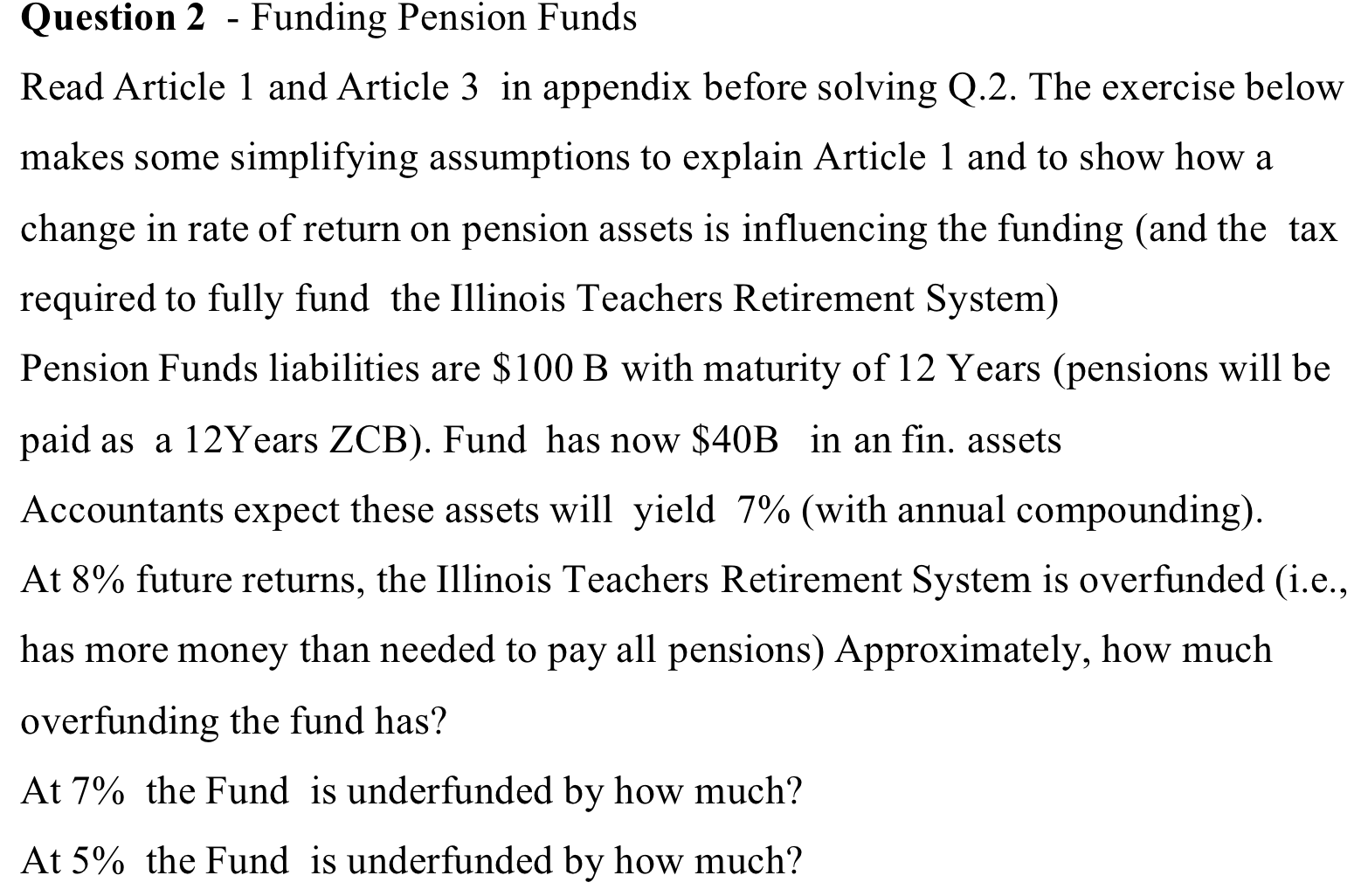

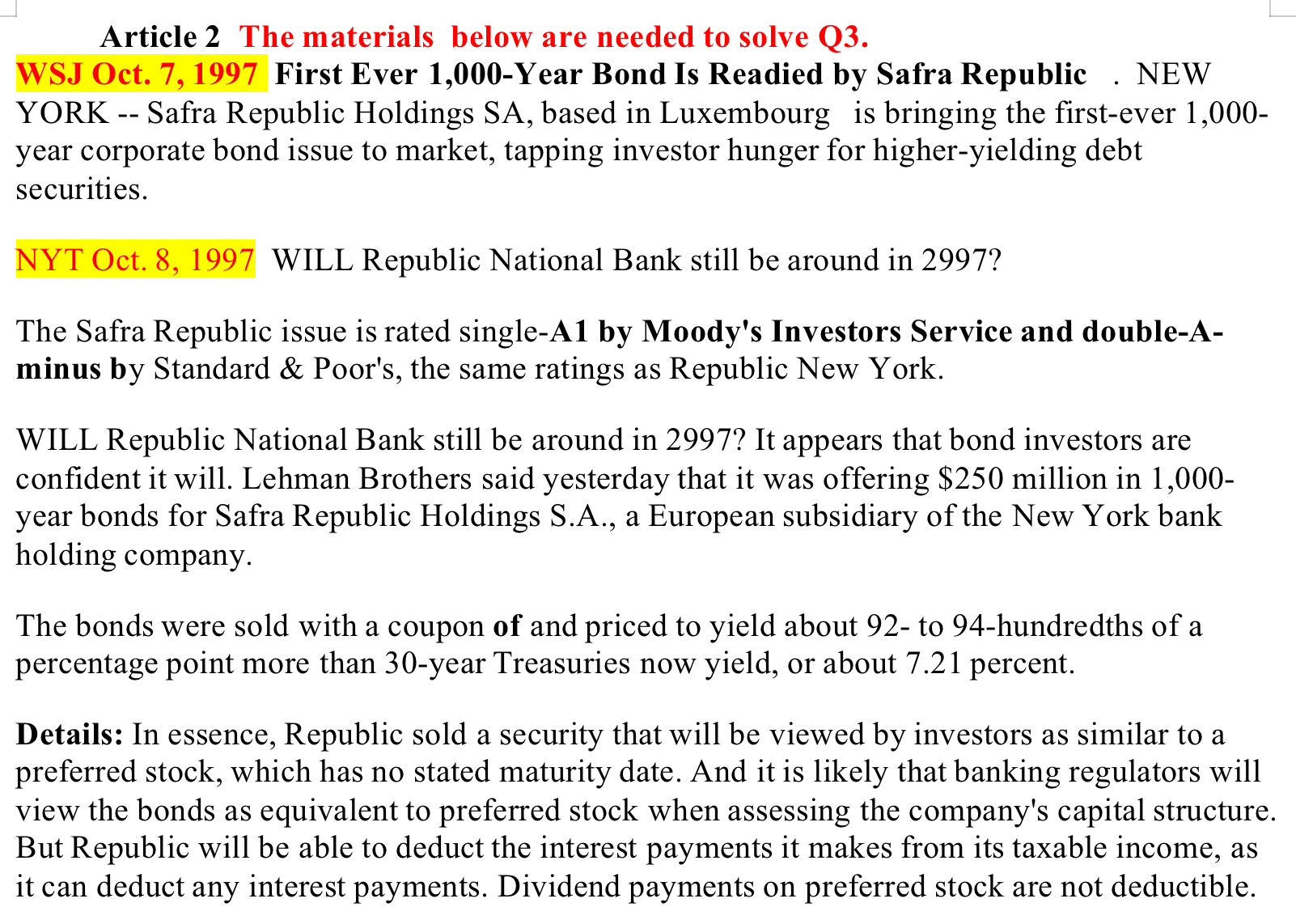

Question 2 - Funding Pension Funds Read Article 1 and Article 3 in appendix before solving Q.2. The exercise below makes some simplifying assumptions to explain Article 1 and to show how a change in rate of return on pension assets is influencing the funding (and the tax required to fully fund the Illinois Teachers Retirement System) Pension Funds liabilities are $100B with maturity of 12 Years (pensions will be paid as a 12 Years ZCB). Fund has now $40B in an fin. assets Accountants expect these assets will yield 7\% (with annual compounding). At 8% future returns, the Illinois Teachers Retirement System is overfunded (i.e., has more money than needed to pay all pensions) Approximately, how much overfunding the fund has? At 7% the Fund is underfunded by how much? At 5% the Fund is underfunded by how much? Article 2 The materials below are needed to solve Q3. WSJ Oct. 7, 1997 First Ever 1,000-Year Bond Is Readied by Safra Republic . NEW YORK -- Safra Republic Holdings SA, based in Luxembourg is bringing the first-ever 1,000year corporate bond issue to market, tapping investor hunger for higher-yielding debt securities. WILL Republic National Bank still be around in 2997? The Safra Republic issue is rated single-A1 by Moody's Investors Service and double-Aminus by Standard \& Poor's, the same ratings as Republic New York. WILL Republic National Bank still be around in 2997? It appears that bond investors are confident it will. Lehman Brothers said yesterday that it was offering $250 million in 1,000year bonds for Safra Republic Holdings S.A., a European subsidiary of the New York bank holding company. The bonds were sold with a coupon of and priced to yield about 92- to 94-hundredths of a percentage point more than 30-year Treasuries now yield, or about 7.21 percent. Details: In essence, Republic sold a security that will be viewed by investors as similar to a preferred stock, which has no stated maturity date. And it is likely that banking regulators will view the bonds as equivalent to preferred stock when assessing the company's capital structure But Republic will be able to deduct the interest payments it makes from its taxable income, as it can deduct any interest payments. Dividend payments on preferred stock are not deductible

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started