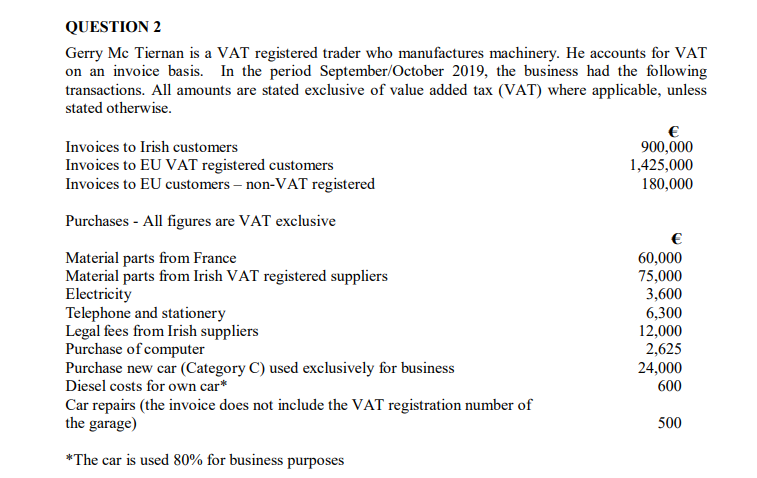

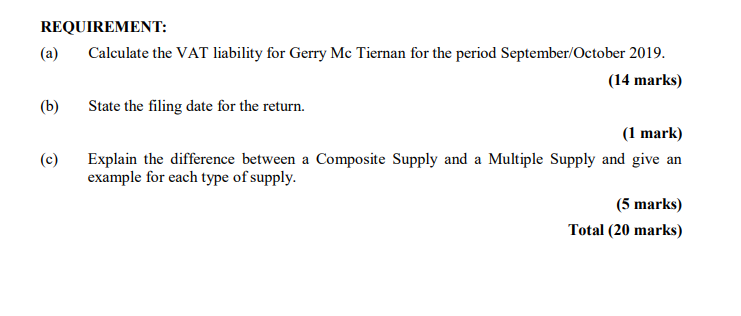

QUESTION 2 Gerry Mc Tiernan is a VAT registered trader who manufactures machinery. He accounts for VAT on an invoice basis. In the period September/October 2019, the business had the following transactions. All amounts are stated exclusive of value added tax (VAT) where applicable, unless stated otherwise. Invoices to Irish customers 900,000 Invoices to EU VAT registered customers 1,425,000 Invoices to EU customers - non-VAT registered 180,000 Purchases - All figures are VAT exclusive Material parts from France 60,000 Material parts from Irish VAT registered suppliers 75,000 Electricity 3,600 Telephone and stationery 6,300 Legal fees from Irish suppliers 12,000 Purchase of computer 2,625 Purchase new car (Category C) used exclusively for business 24,000 Diesel costs for own car* 600 Car repairs (the invoice does not include the VAT registration number of the garage) 500 *The car is used 80% for business purposes REQUIREMENT: (a) Calculate the VAT liability for Gerry Mc Tiernan for the period September/October 2019. (14 marks) (b) State the filing date for the return. (1 mark) (c) Explain the difference between a Composite Supply and a Multiple Supply and give an example for each type of supply. (5 marks) Total (20 marks) QUESTION 2 Gerry Mc Tiernan is a VAT registered trader who manufactures machinery. He accounts for VAT on an invoice basis. In the period September/October 2019, the business had the following transactions. All amounts are stated exclusive of value added tax (VAT) where applicable, unless stated otherwise. Invoices to Irish customers 900,000 Invoices to EU VAT registered customers 1,425,000 Invoices to EU customers - non-VAT registered 180,000 Purchases - All figures are VAT exclusive Material parts from France 60,000 Material parts from Irish VAT registered suppliers 75,000 Electricity 3,600 Telephone and stationery 6,300 Legal fees from Irish suppliers 12,000 Purchase of computer 2,625 Purchase new car (Category C) used exclusively for business 24,000 Diesel costs for own car* 600 Car repairs (the invoice does not include the VAT registration number of the garage) 500 *The car is used 80% for business purposes REQUIREMENT: (a) Calculate the VAT liability for Gerry Mc Tiernan for the period September/October 2019. (14 marks) (b) State the filing date for the return. (1 mark) (c) Explain the difference between a Composite Supply and a Multiple Supply and give an example for each type of supply. (5 marks) Total (20 marks)