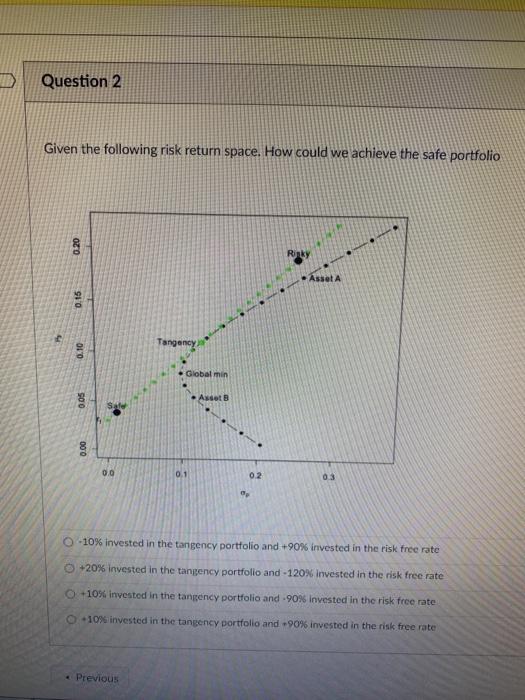

Question 2 Given the following risk return space. How could we achieve the safe portfolio 0.20 Asset A 0.15 angency 0.10 Global min 900 Asset 0.00 0.0 0.1 02 03 0 -10% invested in the tangency portfolio and +90% invested in the risk free rate +20% invested in the tangency portfolio and -120% invested in the risk free rate +10% invested in the tangency portfolio and -90% invested in the risk free rate +10% invested in the tangency portfolio and 90% invested in the risk free rate Previous s for 65 minutes timed, and must be completed in 1 sitting. forget your Honor Code declaration. questions or concerns, send the details to our Canvas messages and/or my email. luck! Question 3 When calculating the Q matrix for your 10 asset portfolio you know you will have O a 5 x 5 covariance matrix O can not be determined O a 20 x 10 covariance matrix h a 10 x 10 covariance matrix Previous and must be completed in 1 sitting. forget your Honor Code declaration questions or concerns, send the details to our Canvas messages and/or my email. d luck! Question 10 Given the following SP500 return is 2%, variance is 5% Bitcoin return is 2%, variance is 12% the SP500 and Bitcoin have a correlation measured 0.75 Since there is a positive correlation between SP500 and Bitcoin, we should not be able construct a portfolio of these 2 assets and expect to reduce risk True False Previous Question 14 Matrix Multiplication is undefined if note: /= means does not equal O the matrix 1 columns /=matrix 2 rows the matrix 1 rows - matrix 2 columns the matrix 1 columns - matrix 2 rows Previne Question 2 Given the following risk return space. How could we achieve the safe portfolio 0.20 Asset A 0.15 angency 0.10 Global min 900 Asset 0.00 0.0 0.1 02 03 0 -10% invested in the tangency portfolio and +90% invested in the risk free rate +20% invested in the tangency portfolio and -120% invested in the risk free rate +10% invested in the tangency portfolio and -90% invested in the risk free rate +10% invested in the tangency portfolio and 90% invested in the risk free rate Previous s for 65 minutes timed, and must be completed in 1 sitting. forget your Honor Code declaration. questions or concerns, send the details to our Canvas messages and/or my email. luck! Question 3 When calculating the Q matrix for your 10 asset portfolio you know you will have O a 5 x 5 covariance matrix O can not be determined O a 20 x 10 covariance matrix h a 10 x 10 covariance matrix Previous and must be completed in 1 sitting. forget your Honor Code declaration questions or concerns, send the details to our Canvas messages and/or my email. d luck! Question 10 Given the following SP500 return is 2%, variance is 5% Bitcoin return is 2%, variance is 12% the SP500 and Bitcoin have a correlation measured 0.75 Since there is a positive correlation between SP500 and Bitcoin, we should not be able construct a portfolio of these 2 assets and expect to reduce risk True False Previous Question 14 Matrix Multiplication is undefined if note: /= means does not equal O the matrix 1 columns /=matrix 2 rows the matrix 1 rows - matrix 2 columns the matrix 1 columns - matrix 2 rows Previne