Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 Grumpy Ltd. (Grumpy) owns and operates a chain of health shops across Ireland. You are the junior accountant for Grumpy and are currently

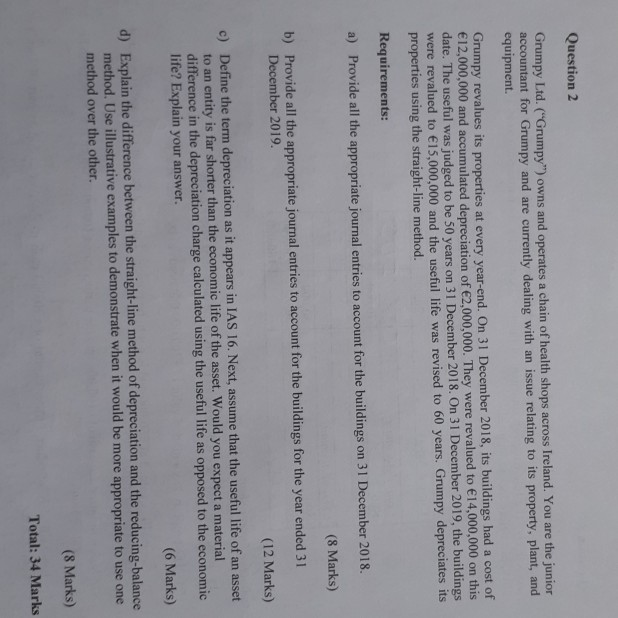

Question 2 Grumpy Ltd. ("Grumpy") owns and operates a chain of health shops across Ireland. You are the junior accountant for Grumpy and are currently dealing with an issue relating to its property, plant, and equipment Grumpy revalues its properties at every year-end. On 31 December 2018, its buildings had a cost of 12,000,000 and accumulated depreciation of 2,000,000. They were revalued to 14,000,000 on this date. The useful was judged to be 50 years on 31 December 2018. On 31 December 2019, the buildings were revalued to 15,000,000 and the useful life was revised to 60 years. Grumpy depreciates its properties using the straight-line method. Requirements: a) Provide all the appropriate journal entries to account for the buildings on 31 December 2018. (8 Marks) b) Provide all the appropriate journal entries to account for the buildings for the year ended 31 December 2019. (12 Marks) c) Define the term depreciation as it appears in IAS 16. Next, assume that the useful life of an asset to an entity is far shorter than the economic life of the asset. Would you expect a material difference in the depreciation charge calculated using the useful life as opposed to the economic life? Explain your answer. (6 Marks) d) Explain the difference between the straight-line method of depreciation and the reducing-balance method. Use illustrative examples to demonstrate when it would be more appropriate to use one method over the other. (8 Marks) Total: 34 Marks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started