Answered step by step

Verified Expert Solution

Question

1 Approved Answer

question 2 has been posted above and I can't seem to add a photo or cipy and paste the question b) In question 2, we

question 2 has been posted above and I can't seem to add a photo or cipy and paste the question

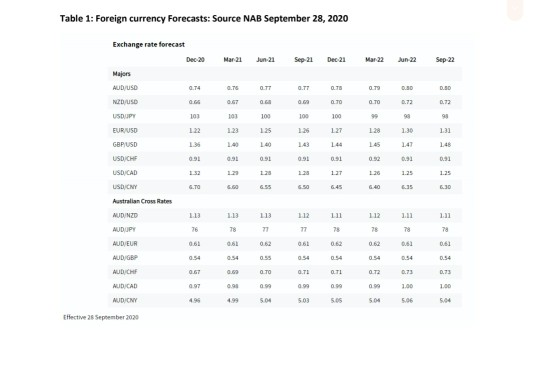

b) In question 2, we looked at exposures of an Australian company in major currencies such as USD and JPY. If the firm had exposures in currencies such as Brazilian Real or Indonesian Rupiah, what options does the firm have in terms of hedging/foreign exchange risk management? (10 marks) Table 1: Foreign currency Forecasts: Source NAB September 28, 2020 Exchange rate forecast Mar 21 Jun 21 Sep 21 Dec 21 Mar 22 Jun 22 Sep 22 0.14 0.70 OTT D.BD AUD/USD NED/USD USDUPY TO 0.79 9 0.72 191 100 100 9 101 122 1.23 1.25 127 1.28 1.30 131 1.40 140 145 141 1.48 091 0.91 0.31 0.91 0:52 0.91 091 1.2 LT 126 1.25 1.25 EUR USD GBPUSD USDICHE USD CAD USD CNY Australian Cross Rates MUDINZO AUDUPY G.TO 6.55 5.50 6.45 6:40 6.35 3D 1.13 1.13 113 112 111 112 1.11 111 76 78 77 77 78 78 0.61 0.61 0.61 0.62 0.62 Dul 061 AUD/EUR AUD GBP 0.55 0.54 0.54 0.54 0.67 0.69 Q.TO 0.71 0.71 0.72 0.73 0.73 AUDCHF AUD CAD AUDINY 1.00 5.04 5.03 5.05 504 5.06 5.04 Effective 28 September 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started