Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 Hasp Limited, a small private company, is planning an initial public offering (IPO) of shares to raise additional equity capital for working capital

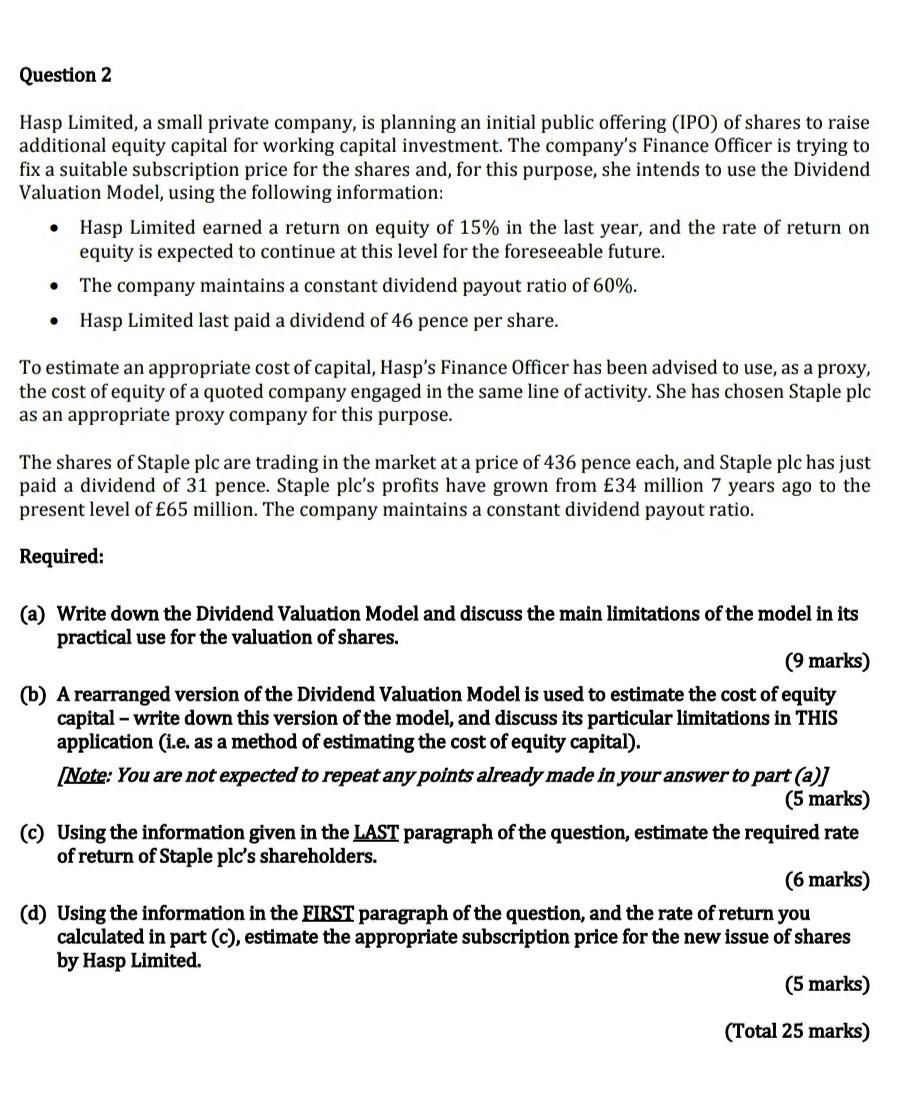

Question 2 Hasp Limited, a small private company, is planning an initial public offering (IPO) of shares to raise additional equity capital for working capital investment. The company's Finance Officer is trying to fix a suitable subscription price for the shares and, for this purpose, she intends to use the Dividend Valuation Model, using the following information: Hasp Limited earned a return on equity of 15% in the last year, and the rate of return on equity is expected to continue at this level for the foreseeable future. The company maintains a constant dividend payout ratio of 60%. Hasp Limited last paid a dividend of 46 pence per share. . To estimate an appropriate cost of capital, Hasp's Finance Officer has been advised to use, as a proxy, the cost of equity of a quoted company engaged in the same line of activity. She has chosen Staple plc as an appropriate proxy company for this purpose. The shares of Staple plc are trading in the market at a price 436 pence each, and Staple plc has just paid a dividend of 31 pence. Staple plc's profits have grown from 34 million 7 years ago to the present level of 65 million. The company maintains a constant dividend payout ratio. Required: (a) Write down the Dividend Valuation Model and discuss the main limitations of the model in its practical use for the valuation of shares. (9 marks) (b) A rearranged version of the Dividend Valuation Model is used to estimate the cost of equity capital - write down this version of the model, and discuss its particular limitations in THIS application (i.e. as a method of estimating the cost of equity capital). (Note: You are not expected to repeat any points already made in your answer to part (a)] (5 marks) (c) Using the information given in the LAST paragraph of the question, estimate the required rate of return of Staple plc's shareholders. (6 marks) (d) Using the information in the FIRST paragraph of the question, and the rate of return you calculated in part (c), estimate the appropriate subscription price for the new issue of shares by Hasp Limited. (5 marks) (Total 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started