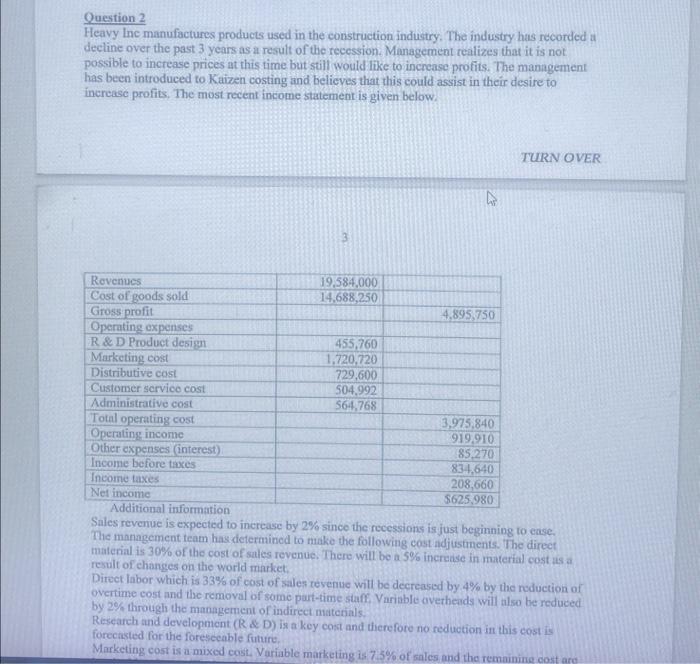

Question 2 Heavy Ine manufactures products used in the construction industry. The industry has recorded a decline over the past 3 years as a result of the recession. Management realizes that it is not possible to increase prices at this time but still would like to increase profits. The management has been introduced to Kaizen costing and believes that this could assist in their desire to increase profits, The most recent income statement is given below. TURN OVER 3. Sales revenue is expected to increase by 2% since the recessions is just beginning to ease. The management team has determined to make the following cost adjustments. The direet material is 30% of the cost of sales revenue. There will be a 5% increase in material cost is a result of changes on the world market. Direct labor which is 33% of cost of sales tevenue will be decreased by 4% by the reduction of overtime cost and the removal of some part-time staff. Variable overheads will also be reduced. by 2% through the managernent of indirect materials. Research and development (R \& D) is a key cost and therefote no reduction in this cost is forectisted for the foresecable future. Marketing cost is a mixed cost. Variable marketing is 7.5% of sales and the remaining cost are Question 2 Heavy Ine manufactures products used in the construction industry. The industry has recorded a decline over the past 3 years as a result of the recession. Management realizes that it is not possible to increase prices at this time but still would like to increase profits. The management has been introduced to Kaizen costing and believes that this could assist in their desire to increase profits, The most recent income statement is given below. TURN OVER 3. Sales revenue is expected to increase by 2% since the recessions is just beginning to ease. The management team has determined to make the following cost adjustments. The direet material is 30% of the cost of sales revenue. There will be a 5% increase in material cost is a result of changes on the world market. Direct labor which is 33% of cost of sales tevenue will be decreased by 4% by the reduction of overtime cost and the removal of some part-time staff. Variable overheads will also be reduced. by 2% through the managernent of indirect materials. Research and development (R \& D) is a key cost and therefote no reduction in this cost is forectisted for the foresecable future. Marketing cost is a mixed cost. Variable marketing is 7.5% of sales and the remaining cost are