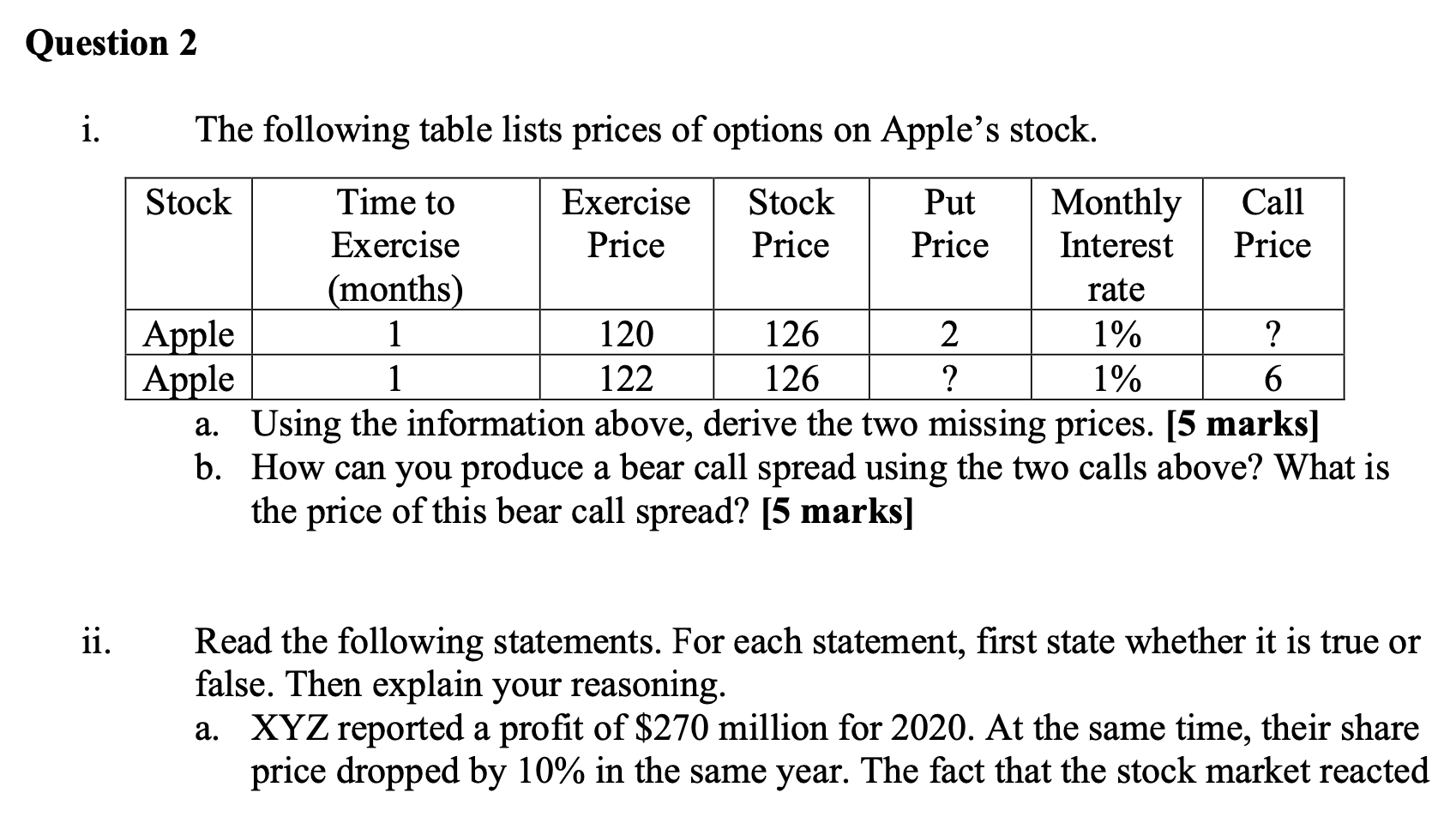

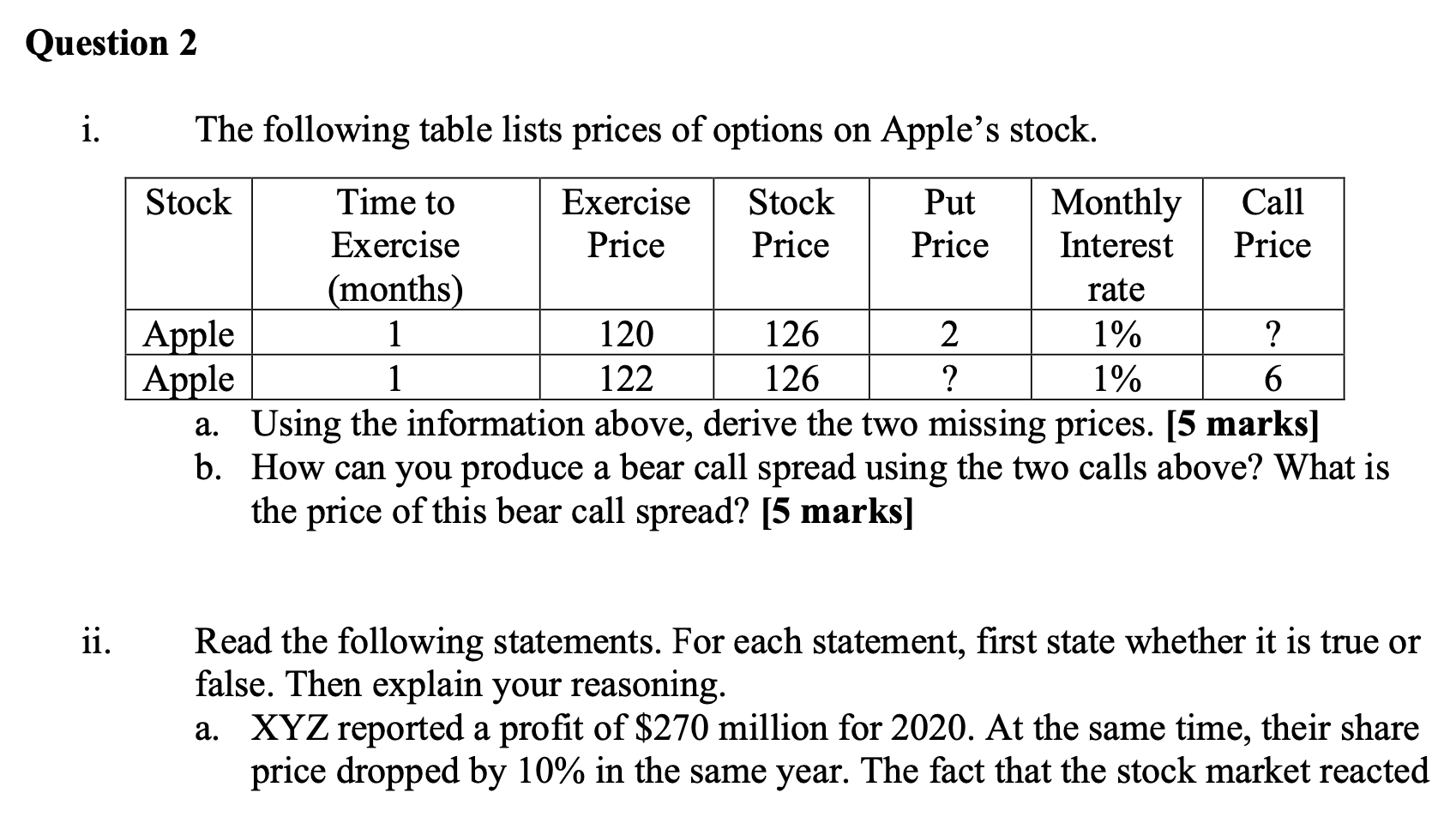

Question 2 i. The following table lists prices of options on Apple's stock. Stock Time to Exercise Stock Put Monthly Call Exercise Price Price Price Interest Price (months) rate Apple 1 120 126 2 1% ? Apple 1 122 126 ? 1% 6 a. Using the information above, derive the two missing prices. [5 marks] b. How can you produce a bear call spread using the two calls above? What is the price of this bear call spread? [5 marks] ii. Read the following statements. For each statement, first state whether it is true or false. Then explain your reasoning. a. XYZ reported a profit of $270 million for 2020. At the same time, their share price dropped by 10% in the same year. The fact that the stock market reacted negatively to positive earnings suggests that it is not informationally efficient. [3 marks] b. Your friend Jonny made a total return of 100% in 2020 by investing in GameStop, beating the market return by a big margin. In the same year, your friend Sammy made a total return of 5% by investing in government bonds, much lower than the market return in 2020. Given that Jonny outperformed Sammy substantially, Jonny must be a better investor. [3 marks] c. Managers make superior returns on their purchases of their company's stock. This violates the strong form of market efficiency. [3 marks] iii. Both Firm A and Firm B earn 20 per share every year. Firm A's equity has a beta of 0.5 and Firm B's equity has a beta of 1.5. The expected market return is 10% per year and the risk-free rate is 2% per year. Firm A pays out all its earnings to equityholders. Firm B retains half its earnings and pays out the other half to equityholders. a. What are the required rates of return for A and B's equity? [2 marks] b. Suppose that the ROE is 15% for Firm B. The first dividend will be paid one year from today. Calculate the current share price for both Firm A and Firm B. Why are the two prices different? [4 marks] Question 2 i. The following table lists prices of options on Apple's stock. Stock Time to Exercise Stock Put Monthly Call Exercise Price Price Price Interest Price (months) rate Apple 1 120 126 2 1% ? Apple 1 122 126 ? 1% 6 a. Using the information above, derive the two missing prices. [5 marks] b. How can you produce a bear call spread using the two calls above? What is the price of this bear call spread? [5 marks] ii. Read the following statements. For each statement, first state whether it is true or false. Then explain your reasoning. a. XYZ reported a profit of $270 million for 2020. At the same time, their share price dropped by 10% in the same year. The fact that the stock market reacted negatively to positive earnings suggests that it is not informationally efficient. [3 marks] b. Your friend Jonny made a total return of 100% in 2020 by investing in GameStop, beating the market return by a big margin. In the same year, your friend Sammy made a total return of 5% by investing in government bonds, much lower than the market return in 2020. Given that Jonny outperformed Sammy substantially, Jonny must be a better investor. [3 marks] c. Managers make superior returns on their purchases of their company's stock. This violates the strong form of market efficiency. [3 marks] iii. Both Firm A and Firm B earn 20 per share every year. Firm A's equity has a beta of 0.5 and Firm B's equity has a beta of 1.5. The expected market return is 10% per year and the risk-free rate is 2% per year. Firm A pays out all its earnings to equityholders. Firm B retains half its earnings and pays out the other half to equityholders. a. What are the required rates of return for A and B's equity? [2 marks] b. Suppose that the ROE is 15% for Firm B. The first dividend will be paid one year from today. Calculate the current share price for both Firm A and Firm B. Why are the two prices different? [4 marks]