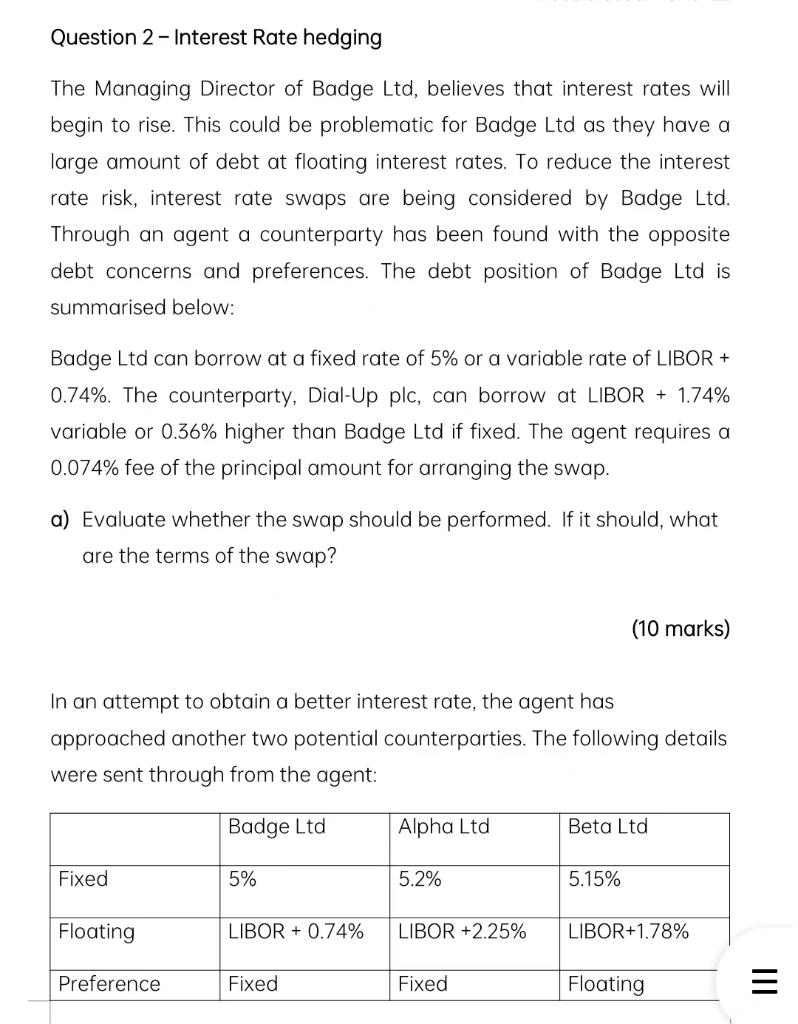

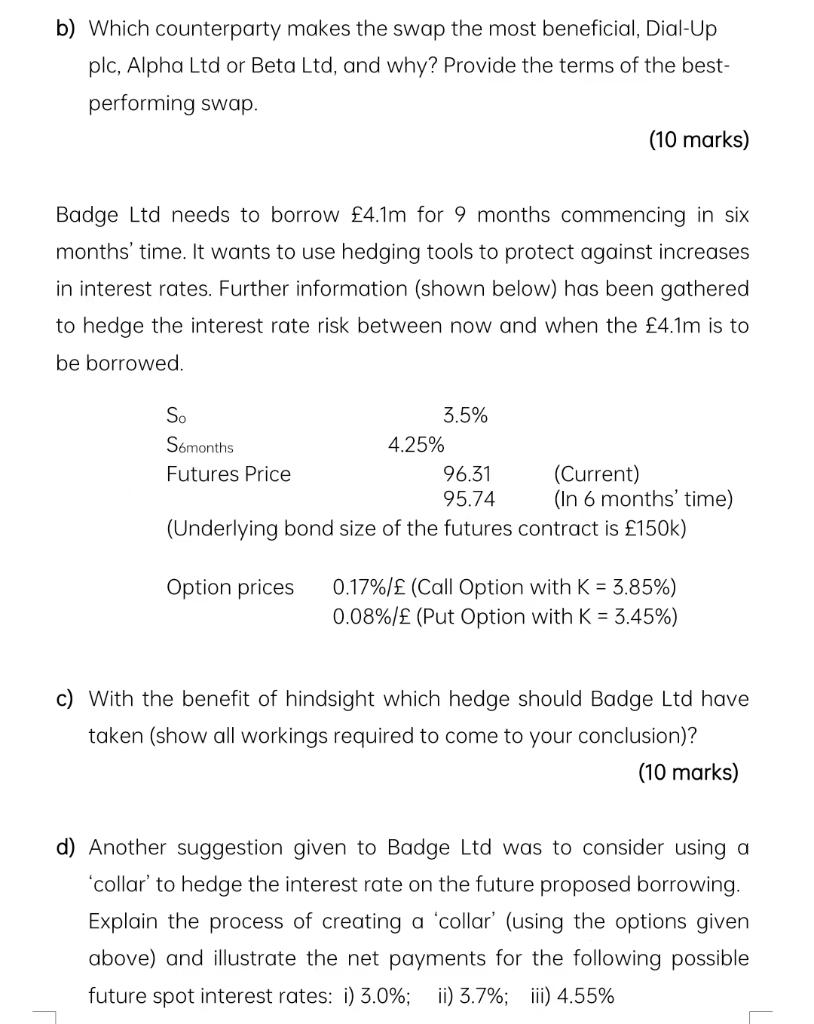

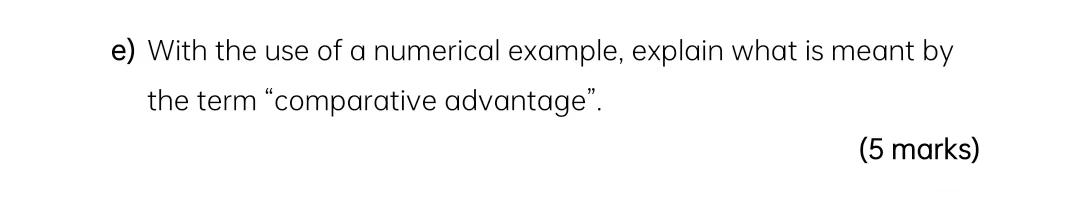

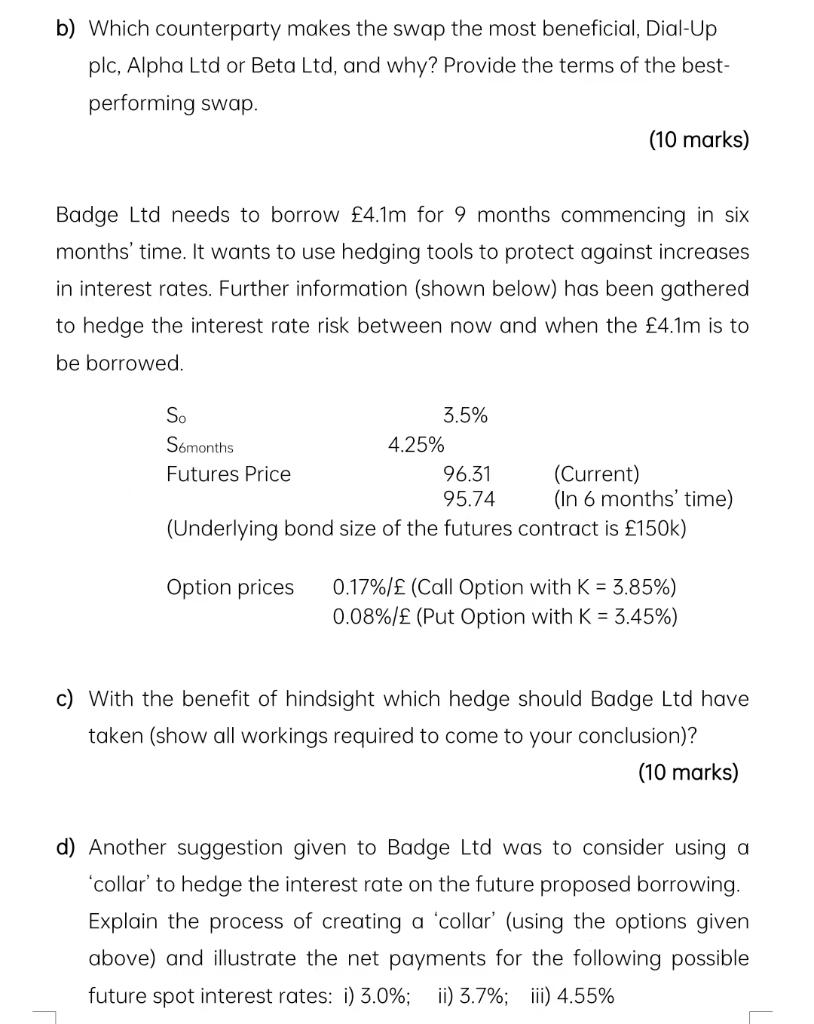

Question 2 - Interest Rate hedging The Managing Director of Badge Ltd, believes that interest rates will begin to rise. This could be problematic for Badge Ltd as they have a large amount of debt at floating interest rates. To reduce the interest rate risk, interest rate swaps are being considered by Badge Ltd. Through an agent a counterparty has been found with the opposite debt concerns and preferences. The debt position of Badge Ltd is summarised below: Badge Ltd can borrow at a fixed rate of 5% or a variable rate of LIBOR + 0.74%. The counterparty, Dial-Up plc, can borrow at LIBOR + 1.74% variable or 0.36% higher than Badge Ltd if fixed. The agent requires a 0.074% fee of the principal amount for arranging the swap. a) Evaluate whether the swap should be performed. If it should, what are the terms of the swap? In an attempt to obtain a better interest rate, the agent has approached another two potential counterparties. The following details were sent through from the agent: Badge Ltd Fixed Floating Preference 5% LIBOR + 0.74% Fixed Alpha Ltd 5.2% LIBOR +2.25% Fixed (10 marks) Beta Ltd 5.15% LIBOR+1.78% Floating ||| b) Which counterparty makes the swap the most beneficial, Dial-Up plc, Alpha Ltd or Beta Ltd, and why? Provide the terms of the best- performing swap. Badge Ltd needs to borrow 4.1m for 9 months commencing in six months' time. It wants to use hedging tools to protect against increases in interest rates. Further information (shown below) has been gathered to hedge the interest rate risk between now and when the 4.1m is to be borrowed. So S6months Futures Price 3.5% 4.25% (10 marks) 96.31 95.74 (Current) (In 6 months' time) (Underlying bond size of the futures contract is 150k) Option prices 0.17%/ (Call Option with K = 3.85%) 0.08%/ (Put Option with K = 3.45%) c) With the benefit of hindsight which hedge should Badge Ltd have taken (show all workings required to come to your conclusion)? (10 marks) d) Another suggestion given to Badge Ltd was to consider using a 'collar' to hedge the interest rate on the future proposed borrowing. Explain the process of creating a 'collar' (using the options given above) and illustrate the net payments for the following possible future spot interest rates: i) 3.0%; ii) 3.7%; iii) 4.55% e) With the use of a numerical example, explain what is meant by the term "comparative advantage