Answered step by step

Verified Expert Solution

Question

1 Approved Answer

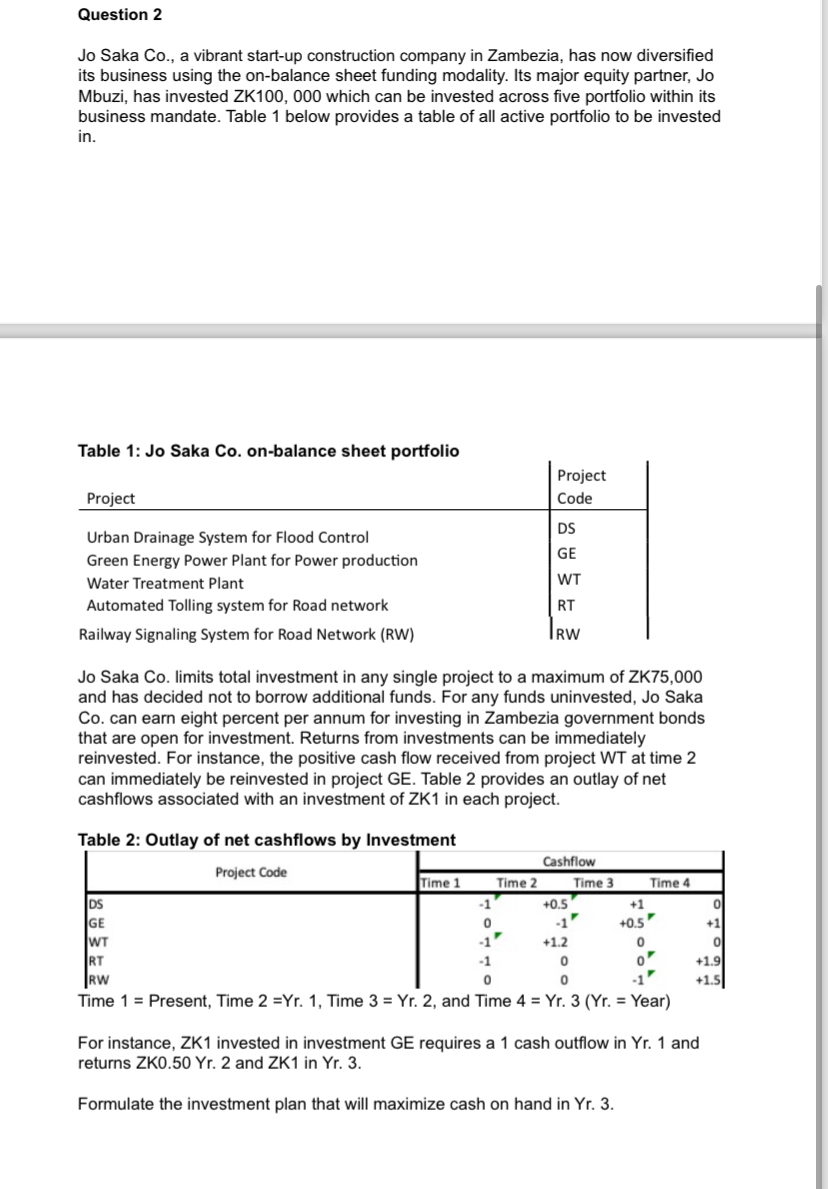

Question 2 Jo Saka Co . , a vibrant start - up construction company in Zambezia, has now diversified its business using the on -

Question

Jo Saka Co a vibrant startup construction company in Zambezia, has now diversified

its business using the onbalance sheet funding modality. Its major equity partner, Jo

Mbuzi, has invested ZK which can be invested across five portfolio within its

business mandate. Table below provides a table of all active portfolio to be invested

in

Table : Jo Saka Co onbalance sheet portfolio

Jo Saka Co limits total investment in any single project to a maximum of ZK

and has decided not to borrow additional funds. For any funds uninvested, Jo Saka

Co can earn eight percent per annum for investing in Zambezia government bonds

that are open for investment. Returns from investments can be immediately

reinvested. For instance, the positive cash flow received from project WT at time

can immediately be reinvested in project GE Table provides an outlay of net

cashflows associated with an investment of ZK in each project.

Table : Outlay of net cashflows by Investment

Time Present, Time Yr Time Yr and Time YrYr Year

For instance, ZK invested in investment GE requires a cash outflow in Yr and

returns ZK Yr and ZK in Yr

Formulate the investment plan that will maximize cash on hand in Yr

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started