Answered step by step

Verified Expert Solution

Question

1 Approved Answer

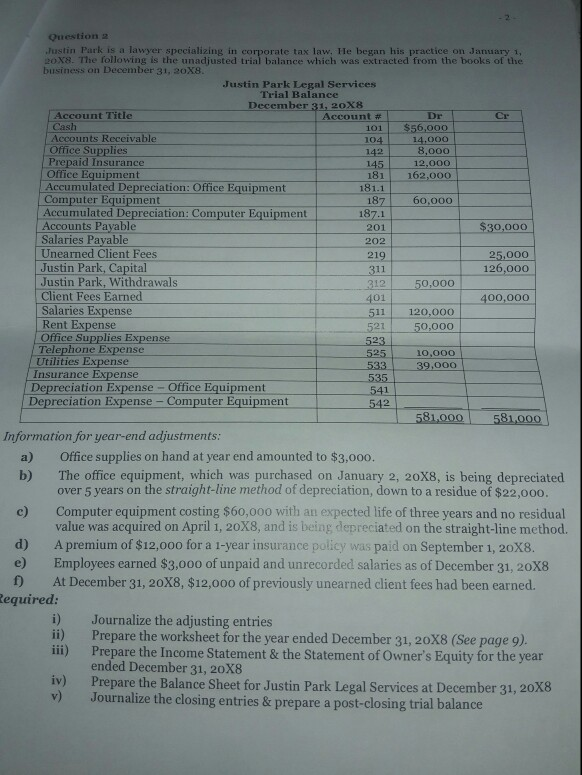

Question 2 Justin Park is a lawyer specializing in corporate tax law. He began his practice on January 1, 20X8. The following is the unndiusted

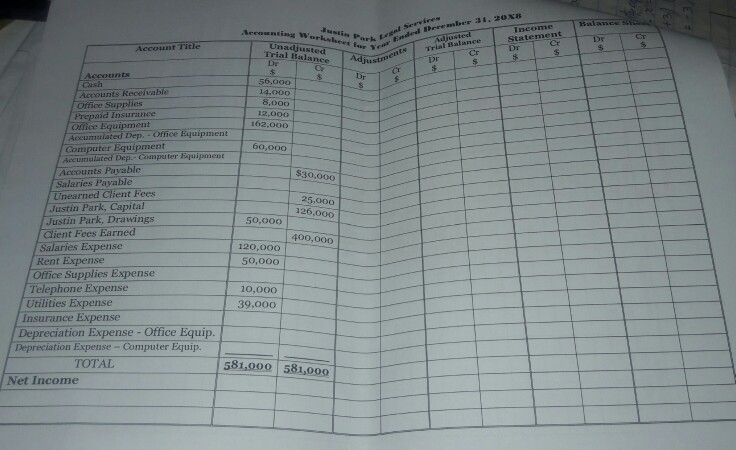

Question 2 Justin Park is a lawyer specializing in corporate tax law. He began his practice on January 1, 20X8. The following is the unndiusted trial balance which was extracted from the books of the business on December 31, 20X8 Justin Park Legal Services Trial Balance December 31, 20X8 Account Title Account # Dr Cash 101 $56,000 Accounts Receivable 104 14.000 Office Supplies 8.000 Prepaid Insurance 145 12,000 Office Equipment 181 162,000 Accumulated Depreciation: Office Equipment 181.1 Computer Equipment 187 60,000 Accumulated Depreciation: Computer Equipment 187.1 Accounts Payable 201 $30,000 Salaries Payable 202 Unearned Client Fees 219 25,000 Justin Park, Capital 311 126,000 Justin Park, Withdrawals 312 50,000 Client Fees Earned 401 400,000 Salaries Expense 511 120,000 Rent Expense 521 50,000 Office Supplies Expense 523 Telephone Expense 525 10,000 Utilities Expense 533 39,000 Insurance Expense 535 Depreciation Expense - Office Equipment 541 Depreciation Expense - Computer Equipment 542 581,000 581.000 Information for year-end adjustments: a) Office supplies on hand at year end amounted to $3.000. b) The office equipment, which was purchased on January 2, 20X8, is being depreciated over 5 years on the straight-line method of depreciation, down to a residue of $22,000. c) Computer equipment costing $60,000 with an expected life of three years and no residual value was acquired on April 1, 20X8, and is being depreciated on the straight-line method. d) A premium of $12,000 for a 1-year insurance policy was paid on September 1, 20X8. Employees earned $3,000 of unpaid and unrecorded salaries as of December 31, 20X8 1 At December 31, 20X8, $12,000 of previously unearned client fees had been earned. Required: Journalize the adjusting entries ii) Prepare the worksheet for the year ended December 31, 20X8 (See page 9). iii) Prepare the Income Statement & the Statement of Owner's Equity for the year ended December 31, 20X8 iv) Prepare the Balance Sheet for Justin Park Legal Services at December 31, 20X8 Journalize the closing entries & prepare a post-closing trial balance i) december 31. BOX in Worces Unadjusted Trial Balance Income Statement Najland Account Title Bar Ended CE Adhustruents Dp $30,000 25,000 126.000 Accounts 56.000 1 Accounts Receivable 14.000 Office Supplies 8,000 Prepaid Insurance 12.000 Orice Equipment 162.000 Areumated Dep. - Office Equipment Computer Equipment 60,000 Acumulated Dep. - Computer Equipment Accounts Payable Salaries Payable Unewned Client Fees Justin Park, Capital Justin Park, Drawings 50,000 Client Fees Earned Salaries Expense 120,000 Rent Expense 50,000 Office Supplies Expense Telephone Expense 10,000 Utilities Expense 39.000 Insurance Expense Depreciation Expense - Office Equip. Depreciation Expense - Computer Equip. TOTAL Net Income 400,000 581,000 581,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started