Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 - Kelowna Manufacturing Company Chapter 3 - Manufacturing Transactions Kelowna Manufacturing manufactures specialty business equipment. Each product is treated as a separate job,

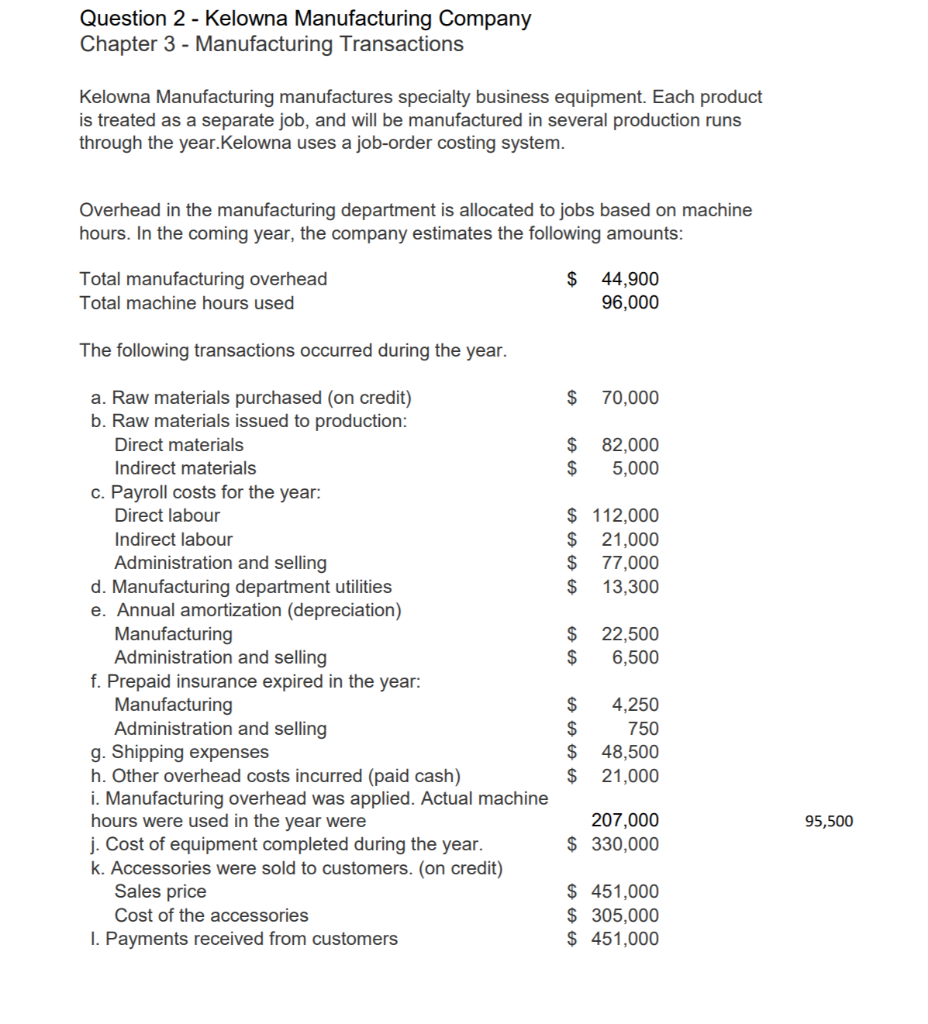

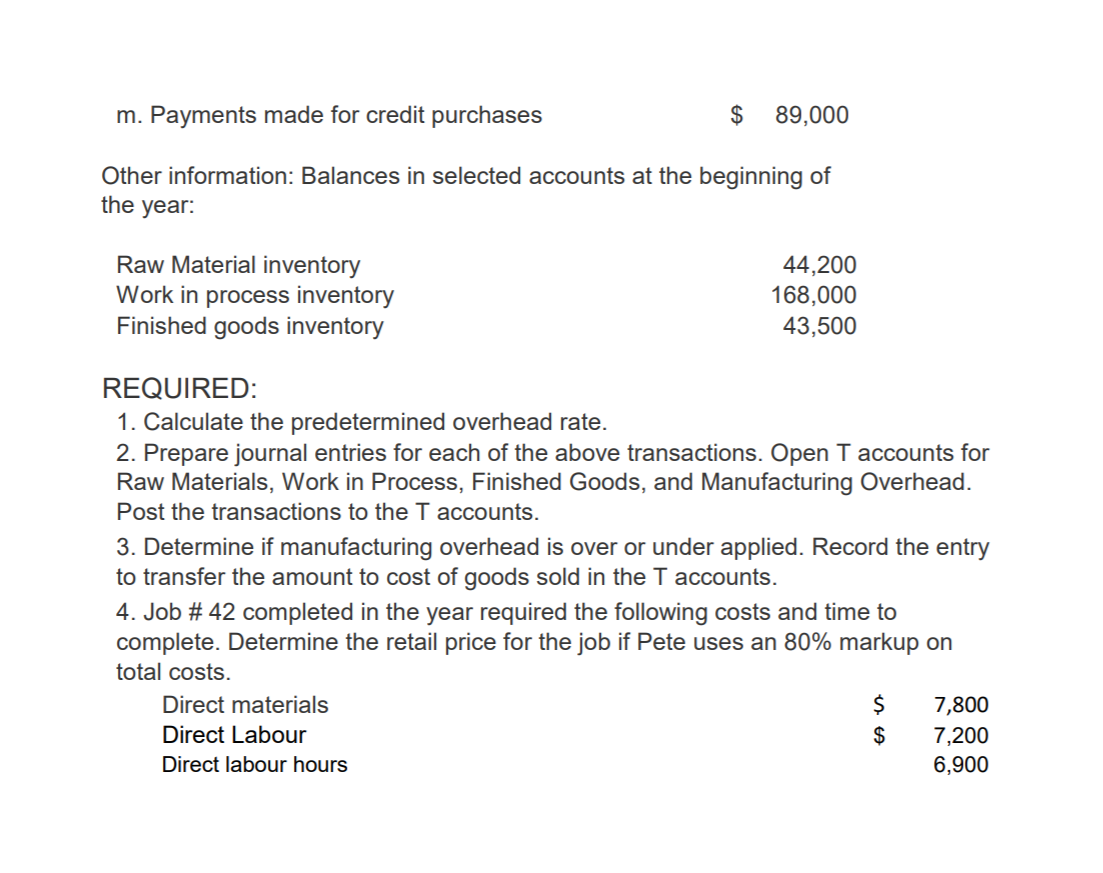

Question 2 - Kelowna Manufacturing Company Chapter 3 - Manufacturing Transactions Kelowna Manufacturing manufactures specialty business equipment. Each product is treated as a separate job, and will be manufactured in several production runs through the year.Kelowna uses a job-order costing system. Overhead in the manufacturing department is allocated to jobs based on machine hours. In the coming year, the company estimates the following amounts: Total manufacturing overhead Total machine hours used $ 44,900 96,000 The following transactions occurred during the year. $ 70,000 $ $ 82,000 5,000 $ 112,000 $ 21,000 $ 77,000 $ 13,300 a. Raw materials purchased (on credit) b. Raw materials issued to production: Direct materials Indirect materials c. Payroll costs for the year: Direct labour Indirect labour Administration and selling d. Manufacturing department utilities e. Annual amortization (depreciation) Manufacturing Administration and selling f. Prepaid insurance expired in the year: Manufacturing Administration and selling g. Shipping expenses h. Other overhead costs incurred (paid cash) i. Manufacturing overhead was applied. Actual machine hours were used in the year were j. Cost of equipment completed during the year. k. Accessories were sold to customers. (on credit) Sales price Cost of the accessories 1. Payments received from customers $ 22,500 $ 6,500 $ 4,250 $ 750 $ 48,500 $ 21,000 95,500 207,000 $ 330,000 $ 451,000 $ 305,000 $ 451,000 m. Payments made for credit purchases $ 89,000 Other information: Balances in selected accounts at the beginning of the year: Raw Material inventory Work in process inventory Finished goods inventory 44,200 168,000 43,500 REQUIRED: 1. Calculate the predetermined overhead rate. 2. Prepare journal entries for each of the above transactions. Open T accounts for Raw Materials, Work in Process, Finished Goods, and Manufacturing Overhead. Post the transactions to the T accounts. 3. Determine if manufacturing overhead is over or under applied. Record the entry to transfer the amount to cost of goods sold in the T accounts. 4. Job #42 completed in the year required the following costs and time to complete. Determine the retail price for the job if Pete uses an 80% markup on total costs. Direct materials $ 7,800 Direct Labour $ 7,200 Direct labour hours 6,900

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started