Answered step by step

Verified Expert Solution

Question

1 Approved Answer

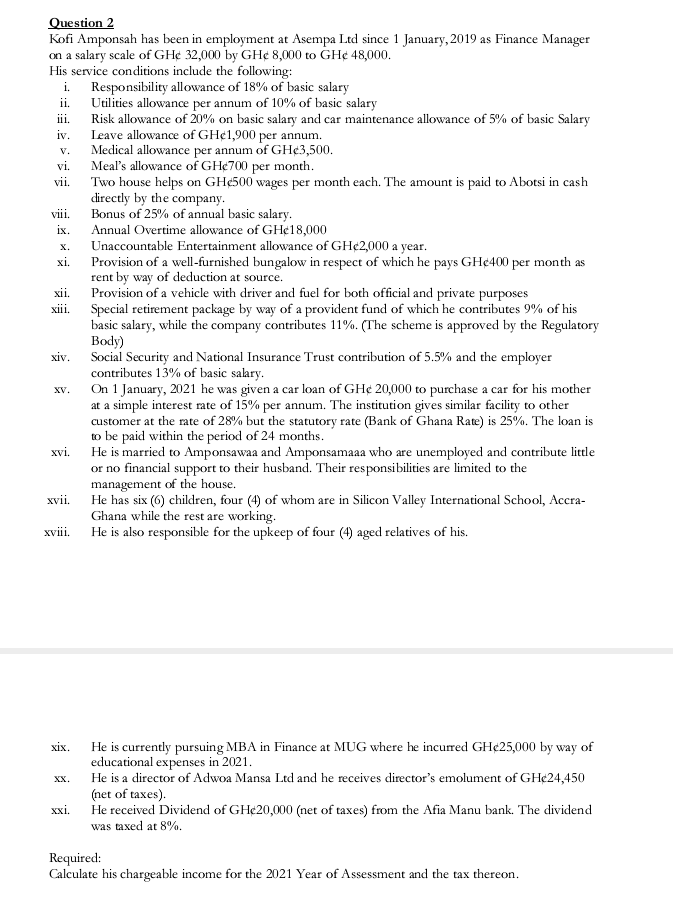

Question 2 Kofi Amponsah has been in employment at Asempa Ltd since 1 January, 2019 as Finance Manager on a salary scale of GHe32,000 by

Question 2 Kofi Amponsah has been in employment at Asempa Ltd since 1 January, 2019 as Finance Manager on a salary scale of GHe32,000 by GHd 8,000 to GHd 48,000. His service conditions include the following: i. Responsibility allowance of 18% of basic salary ii. Utilities allowance per annum of 10% of basic salary iii. Risk allowance of 20% on basic salary and car maintenance allowance of 5% of basic Salary iv. Leave allowance of GHc1,900 per annum. v. Medical allowance per annum of GHe3,500. vi. Meal's allowance of GHe700 per month. vii. Two house helps on GHe500 wages per month each. The amount is paid to Abotsi in cash directly by the company. viii. Bonus of 25% of annual basic salary. ix. Annual Overtime allowance of GHe18,000 x. Unaccountable Entertainment allowance of GHe2,000 a year. xi. Provision of a well-furnished bungalow in respect of which he pays GHC400 per month as rent by way of deduction at source. xii. Provision of a vehicle with driver and fuel for both of ficial and private purposes xiii. Special retirement package by way of a provident fund of which he contributes 9% of his basic salary, while the company contributes 11%. (The scheme is approved by the Regulatory Body) xiv. Social Security and National Insurance Trust contribution of 5.5% and the employer contributes 13% of basic salary. xv. On 1 January, 2021 he was given a car loan of GHe 20,000 to purchase a car for his mother at a simple interest rate of 15% per annum. The institution gives similar facility to other customer at the rate of 28% but the statutory rate (Bank of Ghana Rate) is 25%. The loan is to be paid within the period of 24 months. xvi. He is married to Amponsawaa and Amponsamaaa who are unemployed and contribute little or no financial support to their husband. Their responsibilities are limited to the management of the house. xvii. He has six (6) children, four (4) of whom are in Silicon Valley International School, AccraGhana while the rest are working. xviii. He is also responsible for the upkeep of four (4) aged relatives of his. xix. He is currently pursuing MBA in Finance at MUG where he incurred GHe25,000 by way of educational expenses in 2021. xx. He is a director of Adwoa Mansa Ltd and he receives director's emolument of GHe24,450 (net of taxes). xxi. He received Dividend of GHe 20,000 (net of taxes) from the Afia Manu bank. The dividend was axed at 8%. Required: Calculate his chargeable income for the 2021 Year of Assessment and the tax thereon

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started