Answered step by step

Verified Expert Solution

Question

1 Approved Answer

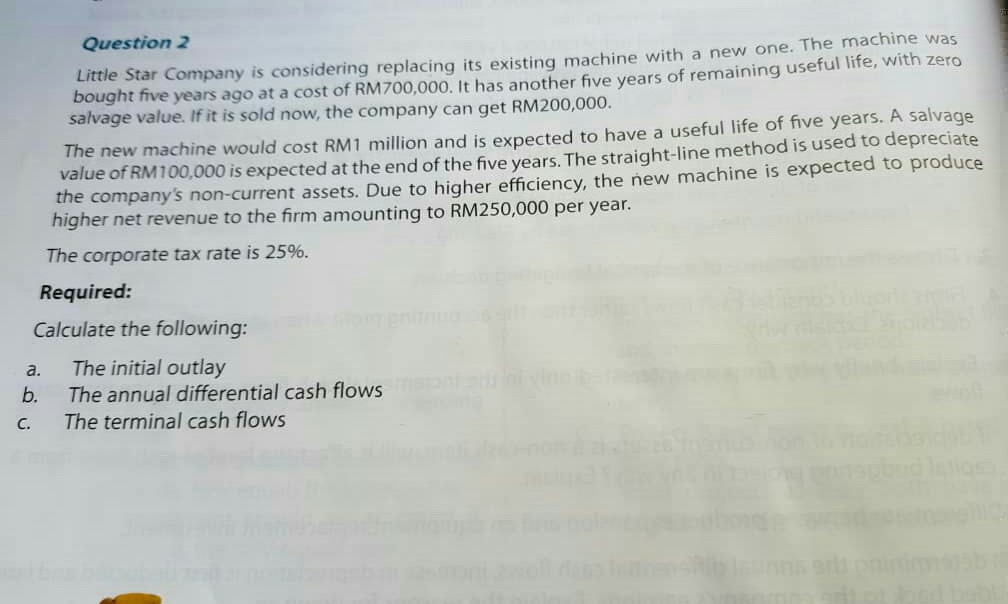

Question 2 Little Star Company is considering replacing its ex estar company is considering replacing its existing machine with a new one. The machine was

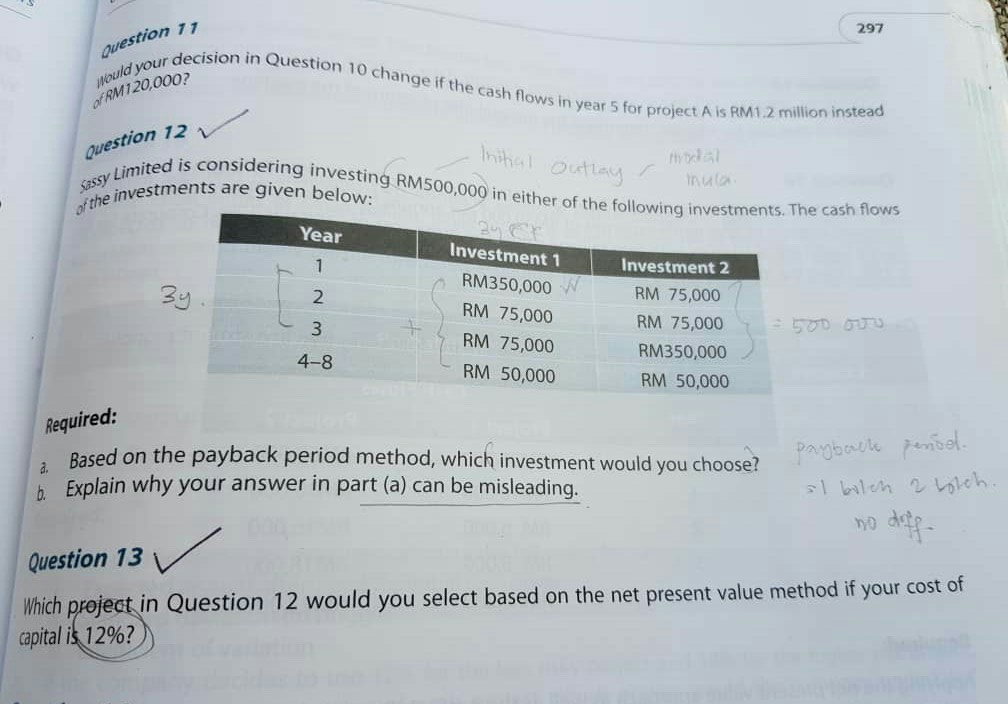

Question 2 Little Star Company is considering replacing its ex estar company is considering replacing its existing machine with a new one. The machine was or five years of remaining useful life, with zero bought five years ago at a cost of RM700,000. It has another five years of remaining user salvage value. If it is sold now, the company can get RM200,000. The new machine would cost RM1 million and is expected to have a useful lite o value of RM100,000 is expected at the end of the five years. The straiaht-line method is used to depreciate the company's non-current assets. Due to higher efficiency, the new machine is expec higher net revenue to the firm amounting to RM250,000 per year. The corporate tax rate is 25%. Required: Calculate the following: a. The initial outlay b. The annual differential cash flows C. The terminal cash flows 297 in Question 10 change if the cash flows in year 5 for pri question 71 Would your de af RM120.0002 Sin year 5 for project A is RM1.2 million instead Question 12 Initial outray mula considering investing RM500,000 in either of the following inves sy Limited is consider vestments are given below: of the investme e following investments. The cash flows Year Nm Investment 1 RM350,000 W RM 75,000 RM 75,000 RM 50,000 Investment 2 RM 75,000 RM 75,000 RM350,000 RM 50,000 4-8 Required: Based on the payback period method, which investment would you choose? Explain why your answer in part (a) can be misleading. paybach pendol al bolen a bolch. Question 13 V Which project in Question 12 would you select based on the net present value method if your cost of capital is 12%?)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started