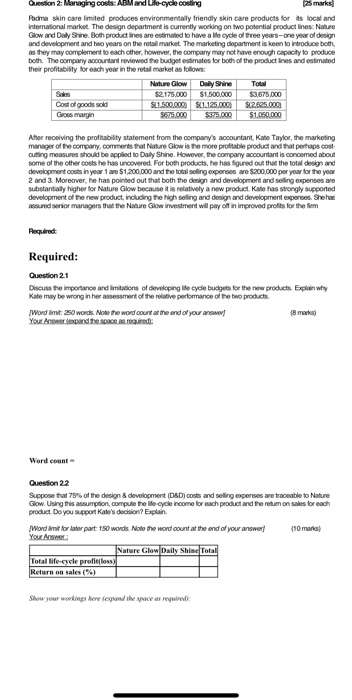

Question 2: Managing costs: ABM and Life-cycle costing 125 marks Padma skin care limited produces environmentally friendly skin care products for its local and international market. The design department is currently working on two potential product lines: Nature Glow and Daily Shine. Both product lines are estimated to have a life cycle of three years-one year of design and development and two years on the retail market. The marketing department is keen to introduce both, as they may complement to each other, however, the company may not have enough capacity to produce both. The company accountant reviewed the budget estimates for both of the product lines and estimated their profitability for each year in the retail market as follows: Nature Glow Daily Shine Total $2.175,000 $1.500,000 $3,675.000 Cost of goods sold SL1.500.000 $21.125.000 $12.625.000 Gross margin 5375.000 $1.050.000 After receiving the profitability statement from the company's accountant, Kate Taylor, the marketing manager of the company.comments that Nature Glow is the more profitable product and that perhaps cost cuting measures should be applied to Daly Shine. However, the company accountants coroomed about some of the other costs he has uncovered. For bon products, he has figured out that the total design and development costs year 1 are $1.200.000 and the total saling perses are $200.000 per year for the year 2 and 3. Moreover, he has pointed out that both the design and development and selling expenses are substantially higher for Nature Glow because it is relatively a new product Kate has strongly supported development of the new product, including the high seling and design and development perses. She had sured senior managers that the Nature Glow investment will pay off in improved profits for the firm Required: Required: Question 21 Discuss the importance and imtations of developing life cycle budgets for the new products Explain why Kate may be wrong in her assessment of the relative performance of the two products Word Int. 20 works Note the word court at the end of your own 18 marks) Your android Word count Question 22 Suppose that 75% of the design & development (DSD, costs and soling expenses are traceable to Nature Glow. Using this assumption, compute the life cycle income for each product and the retum on sales for each produd. Do you support Kate's decision? Explain Word limit for inter part 10 words. Note the word count at the end of your answer (10 mars You Awe Nature Glow Daily Shine Total Total life-cycle profiles) Return on sales (%) Show your working here (expand the space as required. Question 2: Managing costs: ABM and Life-cycle costing 125 marks Padma skin care limited produces environmentally friendly skin care products for its local and international market. The design department is currently working on two potential product lines: Nature Glow and Daily Shine. Both product lines are estimated to have a life cycle of three years-one year of design and development and two years on the retail market. The marketing department is keen to introduce both, as they may complement to each other, however, the company may not have enough capacity to produce both. The company accountant reviewed the budget estimates for both of the product lines and estimated their profitability for each year in the retail market as follows: Nature Glow Daily Shine Total $2.175,000 $1.500,000 $3,675.000 Cost of goods sold SL1.500.000 $21.125.000 $12.625.000 Gross margin 5375.000 $1.050.000 After receiving the profitability statement from the company's accountant, Kate Taylor, the marketing manager of the company.comments that Nature Glow is the more profitable product and that perhaps cost cuting measures should be applied to Daly Shine. However, the company accountants coroomed about some of the other costs he has uncovered. For bon products, he has figured out that the total design and development costs year 1 are $1.200.000 and the total saling perses are $200.000 per year for the year 2 and 3. Moreover, he has pointed out that both the design and development and selling expenses are substantially higher for Nature Glow because it is relatively a new product Kate has strongly supported development of the new product, including the high seling and design and development perses. She had sured senior managers that the Nature Glow investment will pay off in improved profits for the firm Required: Required: Question 21 Discuss the importance and imtations of developing life cycle budgets for the new products Explain why Kate may be wrong in her assessment of the relative performance of the two products Word Int. 20 works Note the word court at the end of your own 18 marks) Your android Word count Question 22 Suppose that 75% of the design & development (DSD, costs and soling expenses are traceable to Nature Glow. Using this assumption, compute the life cycle income for each product and the retum on sales for each produd. Do you support Kate's decision? Explain Word limit for inter part 10 words. Note the word count at the end of your answer (10 mars You Awe Nature Glow Daily Shine Total Total life-cycle profiles) Return on sales (%) Show your working here (expand the space as required