Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 2 marking guide (16 marks) Part a (4 marks) 2 marks for the cash flow diagram, as follows. Give a mark for indicating the

|

a.

3+2+1+2=9

b.

3+2+0+2=8

c.

3+2+0+2=8

d.

3+2++2=8

e.

3+2+0+2=7

f.

3+2+1+3=10

g.

None of the other answers

h.

3+2+0+3=8

i.

3+2+1+4=11

j.

3+2+1+4=11

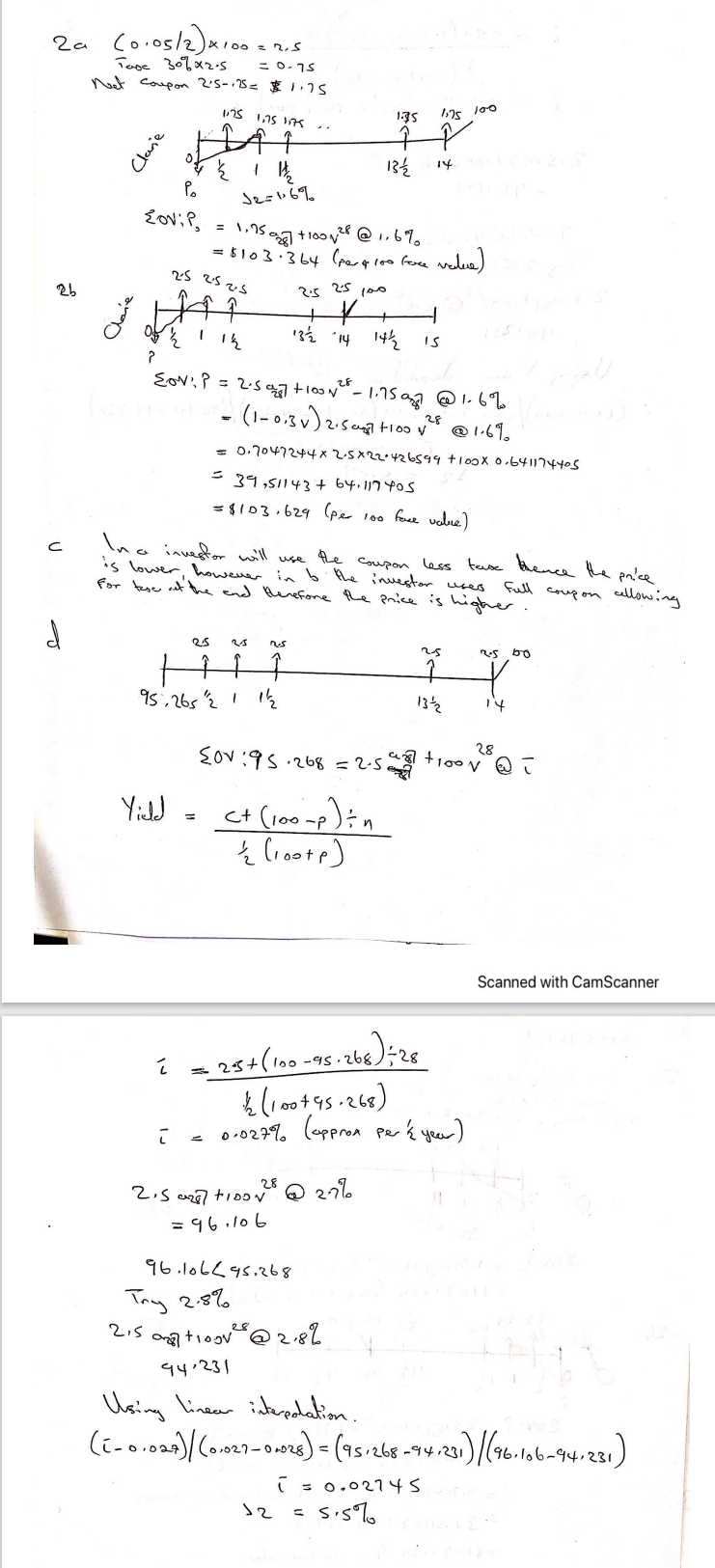

175 1.75 IK 675 100 Clanie za (0.05/2)x100 100 2.5 Tase 30%x2.s = 0.75 Neet coupon 25-125 $115 1.35 BA1 i IH 13 P Zovi? 1.7567 +100128 @ 1,6% = $103.364 (per 100 fore value) 25 25 poo UK 21 145 J2=16% 25 25 25 2b 1 13 14 ? .28 SON: P = 2-saga toorto_1.15 amg @1.6% = (1-0,3V) 2.5 ay to Saggy too v 1.69. s 0.7047244x2.5*22.426594 +10oX 0.640174405 39,51143 + 64,117 405 = $103.629 (per 100 face value) Ina investor will use the coupon less tax hence the price is lower, however in b the investor uses full coupon cellowing for tese at the end therefore the price is higher d OS Sbo 13th Y 95.265 il 14. 42? +100 v QT sov:95.268=2.5 28 Yield - - ct (100up) in { Croate) Scanned with CamScanner loo :. i 29+(108-95.168)26 (100793-268) 0.027% (approx per & year) 28 2.5 ael tipos @ 27% = 96.106 2,5 96.1.6L 95.268 Try 2.8% 022] loguer@2182 44:231 Using linear interedation. (1-0.021)/(0-290.025) = (95.268-94 1231)|(16.106-94.231) = 0.02745 = 5,5% J2 175 1.75 IK 675 100 Clanie za (0.05/2)x100 100 2.5 Tase 30%x2.s = 0.75 Neet coupon 25-125 $115 1.35 BA1 i IH 13 P Zovi? 1.7567 +100128 @ 1,6% = $103.364 (per 100 fore value) 25 25 poo UK 21 145 J2=16% 25 25 25 2b 1 13 14 ? .28 SON: P = 2-saga toorto_1.15 amg @1.6% = (1-0,3V) 2.5 ay to Saggy too v 1.69. s 0.7047244x2.5*22.426594 +10oX 0.640174405 39,51143 + 64,117 405 = $103.629 (per 100 face value) Ina investor will use the coupon less tax hence the price is lower, however in b the investor uses full coupon cellowing for tese at the end therefore the price is higher d OS Sbo 13th Y 95.265 il 14. 42? +100 v QT sov:95.268=2.5 28 Yield - - ct (100up) in { Croate) Scanned with CamScanner loo :. i 29+(108-95.168)26 (100793-268) 0.027% (approx per & year) 28 2.5 ael tipos @ 27% = 96.106 2,5 96.1.6L 95.268 Try 2.8% 022] loguer@2182 44:231 Using linear interedation. (1-0.021)/(0-290.025) = (95.268-94 1231)|(16.106-94.231) = 0.02745 = 5,5% J2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started