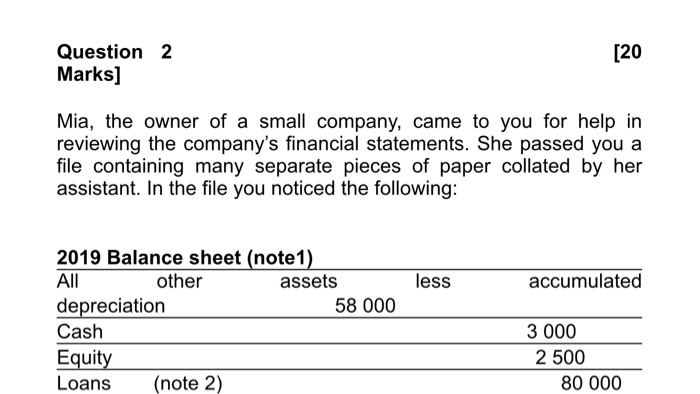

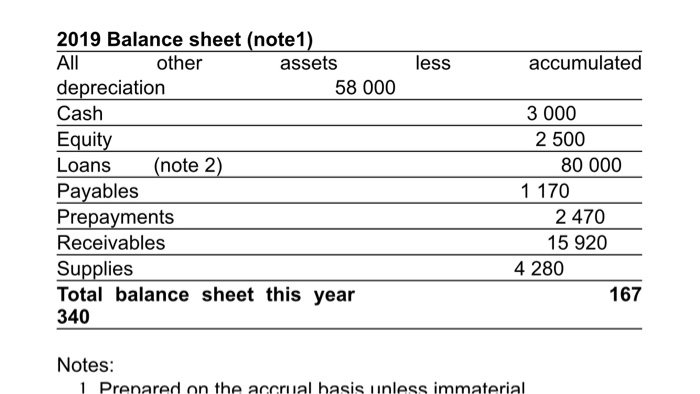

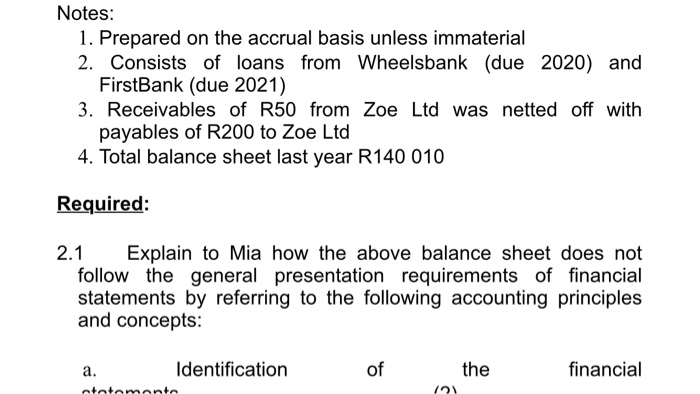

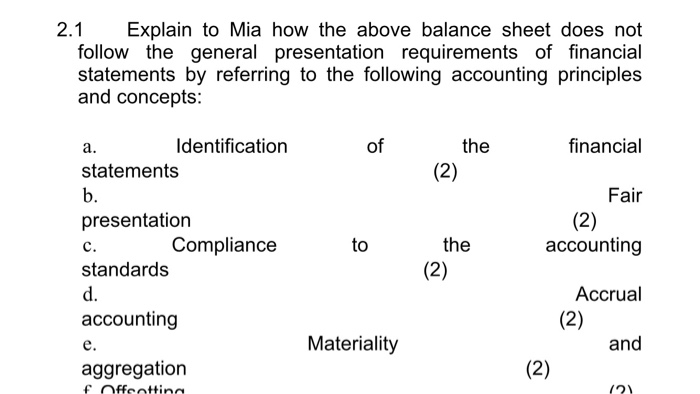

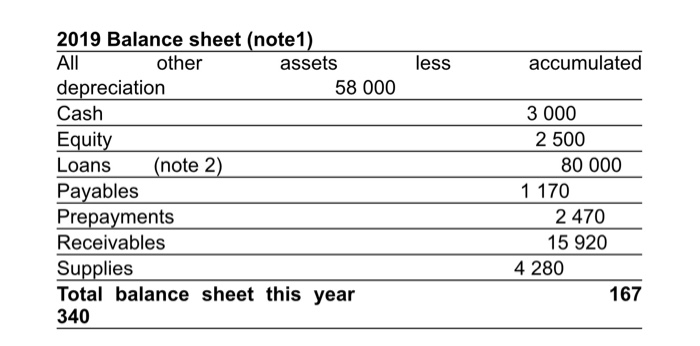

Question 2 Marks] [20 Mia, the owner of a small company, came to you for help in reviewing the company's financial statements. She passed you a file containing many separate pieces of paper collated by her assistant. In the file you noticed the following: less accumulated 2019 Balance sheet (note1) All other assets depreciation 58 000 Cash Equity Loans (note 2) 3 000 2 500 80 000 less accumulated 2019 Balance sheet (note1). All other assets depreciation 58 000 Cash Equity Loans (note 2) Payables Prepayments Receivables Supplies Total balance sheet this year 340 3 000 2 500 80 000 1 170 2470 15 920 4 280 167 Notes: 1 Prenared on the accrual basis unless immaterial Notes: 1. Prepared on the accrual basis unless immaterial 2. Consists of loans from Wheelsbank (due 2020) and FirstBank (due 2021) 3. Receivables of R50 from Zoe Ltd was netted off with payables of R200 to Zoe Ltd 4. Total balance sheet last year R140 010 Required: 2.1 Explain to Mia how the above balance sheet does not follow the general presentation requirements of financial statements by referring to the following accounting principles and concepts: of the financial a. Identification ototomonto 2.1 Explain to Mia how the above balance sheet does not follow the general presentation requirements of financial statements by referring to the following accounting principles and concepts: of financial the (2) Fair (2) accounting to a. Identification statements b. presentation c. Compliance standards d. accounting e. aggregation the (2) Accrual (2) and Materiality (2) fffcnttina to accounting the (2) c. Compliance standards d. accounting e. aggregation f. Offsetting Materiality Accrual (2) and (2) (2) and (2) Consistency comparability 2.2. What else should Mia have included in the file? (complete set of financial statements) (6) Question 2 Marks] [20 Mia, the owner of a small company, came to you for help in reviewing the company's financial statements. She passed you a file containing many separate pieces of paper collated by her assistant. In the file you noticed the following: less accumulated 2019 Balance sheet (note 1). All other assets depreciation 58 000 Cash Equity Loans (note 2) Payables Prepayments Receivables Supplies Total balance sheet this year 340 3 000 2 500 80 000 1 170 2 470 15 920 4 280 167 Notes: 1. Prepared on the accrual basis unless immaterial 2. Consists of loans from Wheelsbank (due 2020) and FirstBank (due 2021) 3. Receivables of R50 from Zoe Ltd was netted off with payables of R200 to Zoe Ltd 4. Total balance sheet last year R140 010 Required: 2.1 Explain to Mia how the above balance sheet does not follow the general presentation requirements of financial statements by referring to the following accounting principles and concepts: of financial a. Identification statements the (2) b. presentation c. Compliance standards Fair (2) accounting to the (2) d. accounting Accrual (2) and (2) e. Materiality aggregation Materiality and e. aggregation f. Offsetting (2) (2) and Consistency comparability (2) 2.2 What else should Mia have included in the file? (complete set of financial statements) (6) Question 2 Marks] [20 Mia, the owner of a small company, came to you for help in reviewing the company's financial statements. She passed you a file containing many separate pieces of paper collated by her assistant. In the file you noticed the following: less accumulated 2019 Balance sheet (note1) All other assets depreciation 58 000 Cash Equity Loans (note 2) 3 000 2 500 80 000 less accumulated 2019 Balance sheet (note1). All other assets depreciation 58 000 Cash Equity Loans (note 2) Payables Prepayments Receivables Supplies Total balance sheet this year 340 3 000 2 500 80 000 1 170 2470 15 920 4 280 167 Notes: 1 Prenared on the accrual basis unless immaterial Notes: 1. Prepared on the accrual basis unless immaterial 2. Consists of loans from Wheelsbank (due 2020) and FirstBank (due 2021) 3. Receivables of R50 from Zoe Ltd was netted off with payables of R200 to Zoe Ltd 4. Total balance sheet last year R140 010 Required: 2.1 Explain to Mia how the above balance sheet does not follow the general presentation requirements of financial statements by referring to the following accounting principles and concepts: of the financial a. Identification ototomonto 2.1 Explain to Mia how the above balance sheet does not follow the general presentation requirements of financial statements by referring to the following accounting principles and concepts: of financial the (2) Fair (2) accounting to a. Identification statements b. presentation c. Compliance standards d. accounting e. aggregation the (2) Accrual (2) and Materiality (2) fffcnttina to accounting the (2) c. Compliance standards d. accounting e. aggregation f. Offsetting Materiality Accrual (2) and (2) (2) and (2) Consistency comparability 2.2. What else should Mia have included in the file? (complete set of financial statements) (6) Question 2 Marks] [20 Mia, the owner of a small company, came to you for help in reviewing the company's financial statements. She passed you a file containing many separate pieces of paper collated by her assistant. In the file you noticed the following: less accumulated 2019 Balance sheet (note 1). All other assets depreciation 58 000 Cash Equity Loans (note 2) Payables Prepayments Receivables Supplies Total balance sheet this year 340 3 000 2 500 80 000 1 170 2 470 15 920 4 280 167 Notes: 1. Prepared on the accrual basis unless immaterial 2. Consists of loans from Wheelsbank (due 2020) and FirstBank (due 2021) 3. Receivables of R50 from Zoe Ltd was netted off with payables of R200 to Zoe Ltd 4. Total balance sheet last year R140 010 Required: 2.1 Explain to Mia how the above balance sheet does not follow the general presentation requirements of financial statements by referring to the following accounting principles and concepts: of financial a. Identification statements the (2) b. presentation c. Compliance standards Fair (2) accounting to the (2) d. accounting Accrual (2) and (2) e. Materiality aggregation Materiality and e. aggregation f. Offsetting (2) (2) and Consistency comparability (2) 2.2 What else should Mia have included in the file? (complete set of financial statements) (6)