Answered step by step

Verified Expert Solution

Question

1 Approved Answer

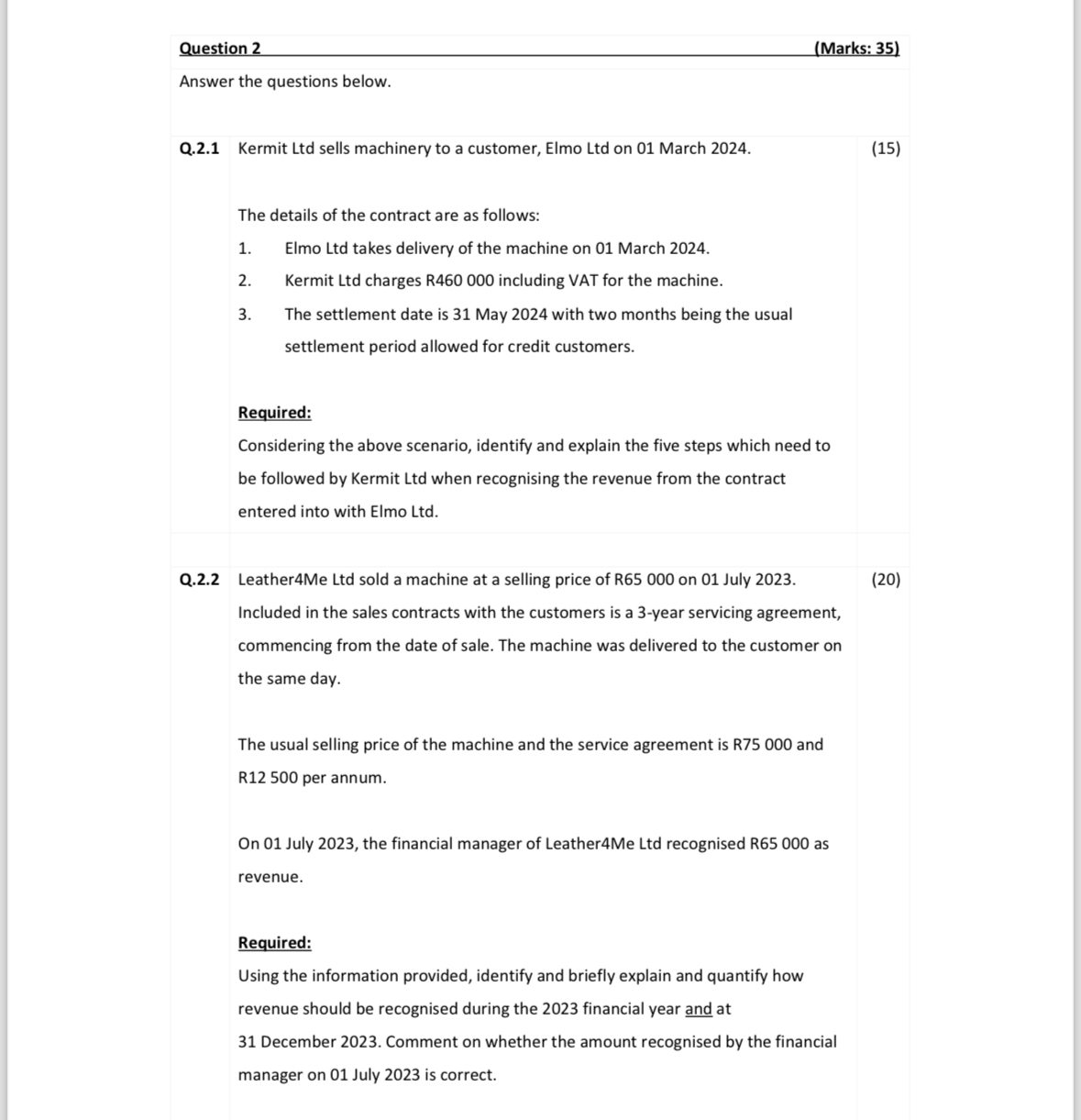

Question 2 ( Marks: 3 5 ) Answer the questions below. Q . 2 . 1 Kermit Ltd sells machinery to a customer, Elmo Ltd

Question

Marks:

Answer the questions below.

Q Kermit Ltd sells machinery to a customer, Elmo Ltd on March

The details of the contract are as follows:

Elmo Ltd takes delivery of the machine on March

Kermit Ltd charges R including VAT for the machine.

The settlement date is May with two months being the usual settlement period allowed for credit customers.

Required:

Considering the above scenario, identify and explain the five steps which need to be followed by Kermit Ltd when recognising the revenue from the contract entered into with Elmo Ltd

Q LeatherMe Ltd sold a machine at a selling price of R on July

Included in the sales contracts with the customers is a year servicing agreement, commencing from the date of sale. The machine was delivered to the customer on the same day.

The usual selling price of the machine and the service agreement is R and R per annum.

On July the financial manager of LeatherMe Ltd recognised R as revenue.

Required:

Using the information provided, identify and briefly explain and quantify how revenue should be recognised during the financial year and at

December Comment on whether the amount recognised by the financial manager on July is correct.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started