Answered step by step

Verified Expert Solution

Question

1 Approved Answer

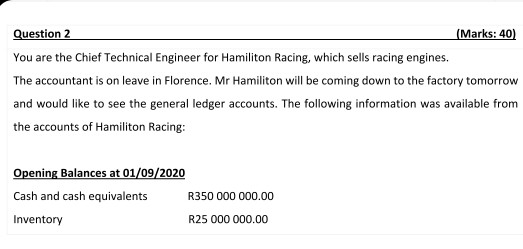

Question 2 (Marks: 40) You are the Chief Technical Engineer for Hamilton Racing, which sells racing engines. The accountant is on leave in Florence. Mr

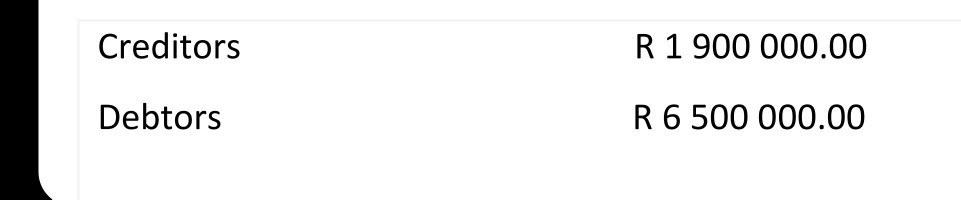

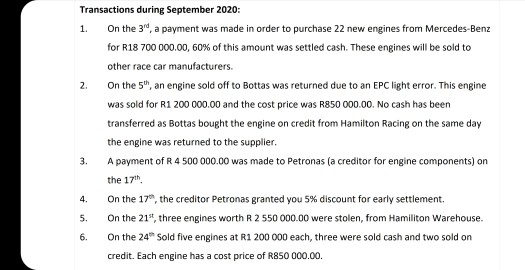

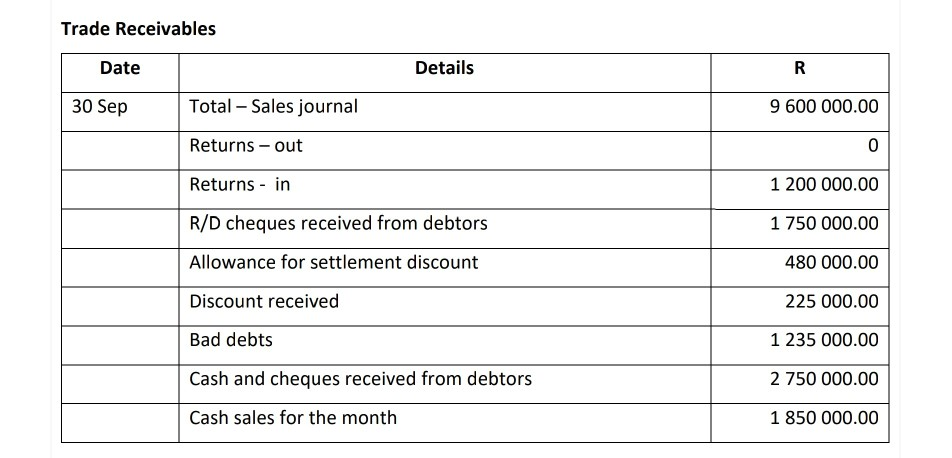

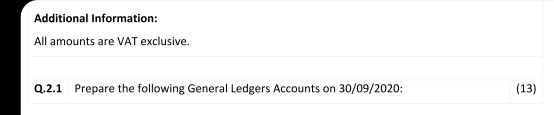

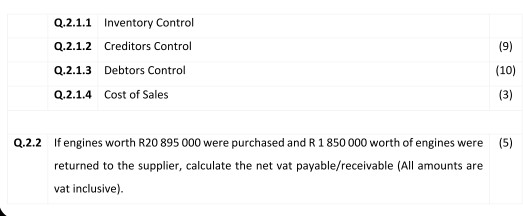

Question 2 (Marks: 40) You are the Chief Technical Engineer for Hamilton Racing, which sells racing engines. The accountant is on leave in Florence. Mr Hamilton will be coming down to the factory tomorrow and would like to see the general ledger accounts. The following information was available from the accounts of Hamiliton Racing: Opening Balances at 01/09/2020 Cash and cash equivalents R350 000 000.00 Inventory R25 000 000.00 Creditors R 1 900 000.00 Debtors R 6 500 000.00 2. Transactions during September 2020: 1. On the 3", a payment was made in order to purchase 22 new engines from Mercedes-Benz for R18 700 000.00, 60% of this amount was settled cash. These engines will be sold to other race car manufacturers. On the 5", an engine sold off to Bottas was returned due to an EPC light error. This engine was sold for R1 200 000.00 and the cost price was R850 000.00. No cash has been transferred as Bottas bought the engine on credit from Hamilton Racing on the same day the engine was returned to the supplier. A payment of R4 500 000.00 was made to Petronas (a creditor for engine components) on the 17th On the 17", the creditor Petronas granted you 5% discount for early settlement On the 214, three engines worth R 2 550 000.00 were stolen, from Hamilton Warehouse. On the 24" Sold five engines at R1 200 000 each, three were sold cash and two sold on credit. Each engine has a cost price of R850 000.00. 3. 4. 5. 6. Trade Receivables Date Details R 30 Sep Total - Sales journal 9 600 000.00 Returns-out o Returns - in 1 200 000.00 R/D cheques received from debtors 1 750 000.00 Allowance for settlement discount 480 000.00 Discount received 225 000.00 Bad debts 1 235 000.00 Cash and cheques received from debtors 2 750 000.00 Cash sales for the month 1 850 000.00 Additional Information: All amounts are VAT exclusive. Q.2.1 Prepare the following General Ledgers Accounts on 30/09/2020: (13) (9) Q.2.1.1 Inventory Control Q.2.1.2 Creditors Control Q.2.1.3 Debtors Control Q.2.1.4 Cost of Sales (10) (3) (5) Q.2.2 If engines worth R20 895 000 were purchased and R 1850 000 worth of engines were returned to the supplier, calculate the net vat payable/receivable (All amounts are vat inclusive)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started