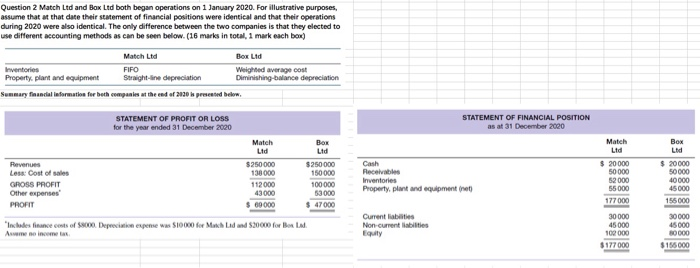

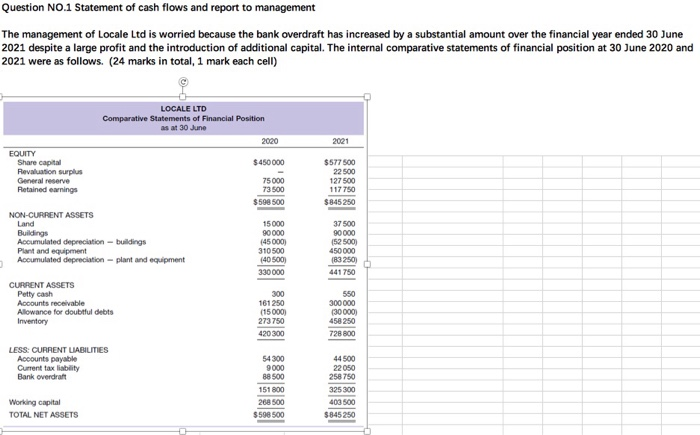

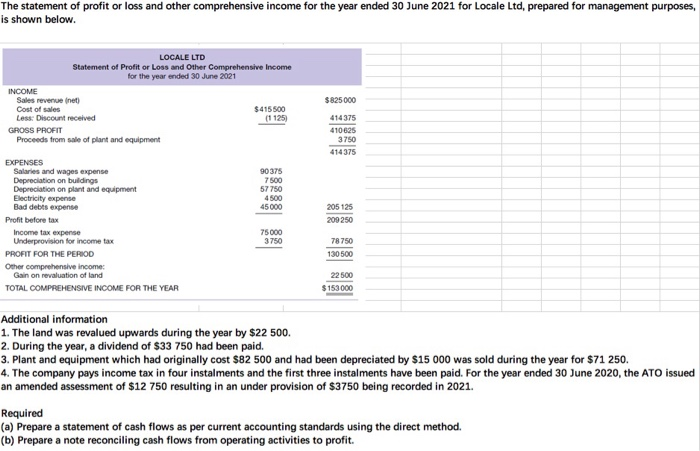

Question 2 Match Ltd and Box Ltd both began operations on 1 January 2020. For illustrative purposes. assume that at that date their statement of financial positions were identical and that their operations during 2020 were also identical. The only difference between the two companies is that they elected to use different accounting methods as can be seen below. (16 marks in total, 1 mark each box) Match Ltd Box Ltd Inventories FIFO Weighted average cost Property, plant and equipment Straight-line depreciation Diminishing balance depreciation Summary financial information for both companies at the end of 2020 ks presented below. STATEMENT OF FINANCIAL POSITION as at 31 December 2000 STATEMENT OF PROFIT OR LOSS for the year ended 31 December 2020 Match Box Ltd Ltd Revenue $250000 $250000 Less: Cost of sales 138000 150000 GROSS PROFIT 112000 100000 Other expenses 43000 53000 PROFIT $ 60000 $ 47000 lockades finance costs of 5.000 Depreciation expense was $10000 Bee Mukh Lad and $20000 for Box. LM. Cash Receivables Inventories Property, plant and equipment (net) Match Ltd $ 20000 50000 52000 55000 177000 30000 45 000 100 000 $177000 Box Ltd $ 20,000 50 000 40000 45000 155 000 Current liabilities Non-current liabilities 30000 45000 0000 $195.000 Question NO.1 Statement of cash flows and report to management The management of Locale Ltd is worried because the bank overdraft has increased by a substantial amount over the financial year ended 30 June 2021 despite a large profit and the introduction of additional capital. The internal comparative statements of financial position at 30 June 2020 and 2021 were as follows. (24 marks in total, 1 mark each cell) LOCALE LTD Comparative Statements of Financial Position as at 30 June 2020 2021 EQUITY Share capital Revaluation surplus General reserve Retained earnings $450 000 75000 73500 $598 500 $577500 22 500 127500 117 750 $845250 NON-CURRENT ASSETS Land Buildings Accumulated depreciation - buildings Plant and equipment Accumulated depreciation - plant and equipment 15000 90000 (45000) 310 500 (405001 330000 37500 90000 (52 500) 450000 (83 250 441750 CURRENT ASSETS Petty cash Accounts receivable Allowance for doubtfuldebts Inventory 300 161 250 (15000) 273750 420 300 550 300 000 (30000) 458 250 728 800 LESS: CURRENT LIABILITIES Accounts payable Current tax liability Bank overdraft 44500 54300 9000 88500 151 800 268 500 $598 500 22050 258 750 325 300 403 500 $845250 Working capital TOTAL NET ASSETS The statement of profit or loss and other comprehensive income for the year ended 30 June 2021 for Locale Ltd, prepared for management purposes, is shown below. LOCALE LTD Statement of Profit or loss and Other Comprehensive Income for the year ended 30 June 2021 INCOME Sales revenue Inet) Cost of sales $415500 Less: Discount received GROSS PROFIT Proceeds from sale of plant and equipment $825000 414 375 410625 3750 414 375 90375 7500 57750 4500 45000 EXPENSES Salaries and wages expense Depreciation on buildings Depreciation on plant and equipment Electricity expense Bad debts expense Profit before tax Income tax expense Underprovision for income tax PROFIT FOR THE PERIOD Other comprehensive income: Gain on revaluation of land TOTAL COMPREHENSIVE INCOME FOR THE YEAR 205 125 209250 75000 3750 78 750 130500 22 500 $ 153000 Additional information 1. The land was revalued upwards during the year by $22 500. 2. During the year, a dividend of $33 750 had been paid. 3. Plant and equipment which had originally cost $82 500 and had been depreciated by $15 000 was sold during the year for $71 250. 4. The company pays income tax in four instalments and the first three instalments have been paid. For the year ended 30 June 2020, the ATO issued an amended assessment of $12 750 resulting in an under provision of $3750 being recorded in 2021. Required (a) Prepare a statement of cash flows as per current accounting standards using the direct method. (b) Prepare a note reconciling cash flows from operating activities to profit