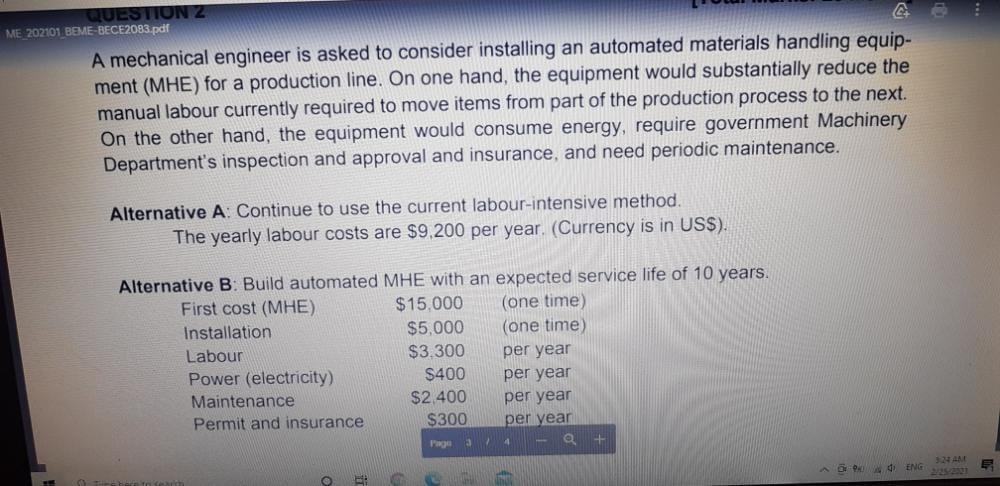

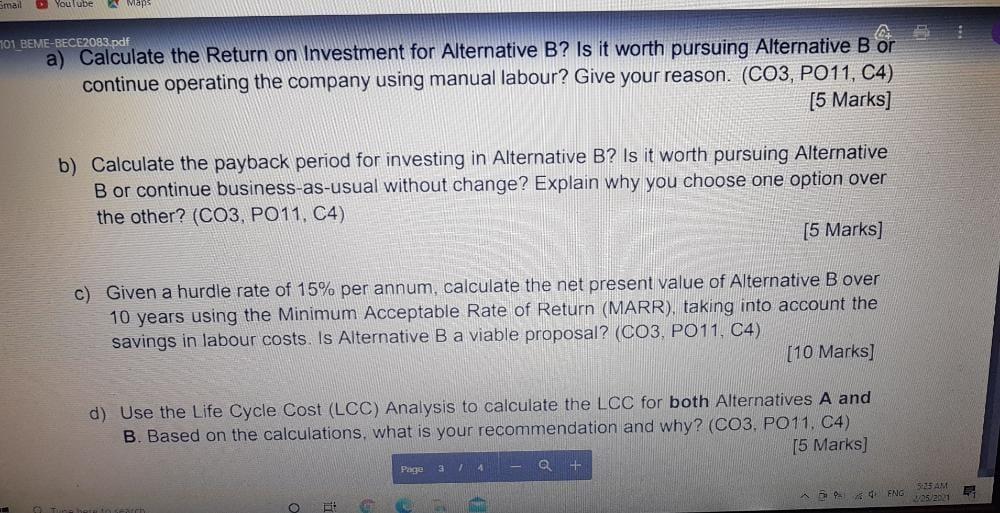

QUESTION 2 ME 202101 BEME-BECE2083.pdf A mechanical engineer is asked to consider installing an automated materials handling equip- ment (MHE) for a production line. On one hand, the equipment would substantially reduce the manual labour currently required to move items from part of the production process to the next. On the other hand, the equipment would consume energy, require government Machinery Department's inspection and approval and insurance, and need periodic maintenance. Alternative A: Continue to use the current labour-intensive method. The yearly labour costs are $9,200 per year. (Currency is in USS). Alternative B: Build automated MHE with an expected service life of 10 years. First cost (MHE) $15.000 (one time) Installation $5,000 (one time) Labour $3.300 per year Power (electricity) $400 per year Maintenance $2.400 per year Permit and insurance $300 per year 3 / 4 E di ENG Smail D Youtube A Maps A 701 BEME-BECE2083.pdf a) Calculate the Return on Investment for Alternative B? Is it worth pursuing Alternative B or continue operating the company using manual labour? Give your reason. (CO3, PO11, C4) [5 Marks] b) Calculate the payback period for investing in Alternative B? Is it worth pursuing Alternative B or continue business-as-usual without change? Explain why you choose one option over the other? (CO3, PO11, C4) [5 Marks] c) Given a hurdle rate of 15% per annum, calculate the net present value of Alternative B over 10 years using the Minimum Acceptable Rate of Return (MARR), taking into account the savings in labour costs. Is Alternative B a viable proposal? (CO3, PO11, C4) [10 Marks] d) Use the Life Cycle Cost (LCC) Analysis to calculate the LCC for both Alternatives A and B. Based on the calculations, what is your recommendation and why? (CO3. PO11, C4) [5 Marks] Page 34 5:15 AM PENG 25/2021 QUESTION 2 ME 202101 BEME-BECE2083.pdf A mechanical engineer is asked to consider installing an automated materials handling equip- ment (MHE) for a production line. On one hand, the equipment would substantially reduce the manual labour currently required to move items from part of the production process to the next. On the other hand, the equipment would consume energy, require government Machinery Department's inspection and approval and insurance, and need periodic maintenance. Alternative A: Continue to use the current labour-intensive method. The yearly labour costs are $9,200 per year. (Currency is in USS). Alternative B: Build automated MHE with an expected service life of 10 years. First cost (MHE) $15.000 (one time) Installation $5,000 (one time) Labour $3.300 per year Power (electricity) $400 per year Maintenance $2.400 per year Permit and insurance $300 per year 3 / 4 E di ENG Smail D Youtube A Maps A 701 BEME-BECE2083.pdf a) Calculate the Return on Investment for Alternative B? Is it worth pursuing Alternative B or continue operating the company using manual labour? Give your reason. (CO3, PO11, C4) [5 Marks] b) Calculate the payback period for investing in Alternative B? Is it worth pursuing Alternative B or continue business-as-usual without change? Explain why you choose one option over the other? (CO3, PO11, C4) [5 Marks] c) Given a hurdle rate of 15% per annum, calculate the net present value of Alternative B over 10 years using the Minimum Acceptable Rate of Return (MARR), taking into account the savings in labour costs. Is Alternative B a viable proposal? (CO3, PO11, C4) [10 Marks] d) Use the Life Cycle Cost (LCC) Analysis to calculate the LCC for both Alternatives A and B. Based on the calculations, what is your recommendation and why? (CO3. PO11, C4) [5 Marks] Page 34 5:15 AM PENG 25/2021